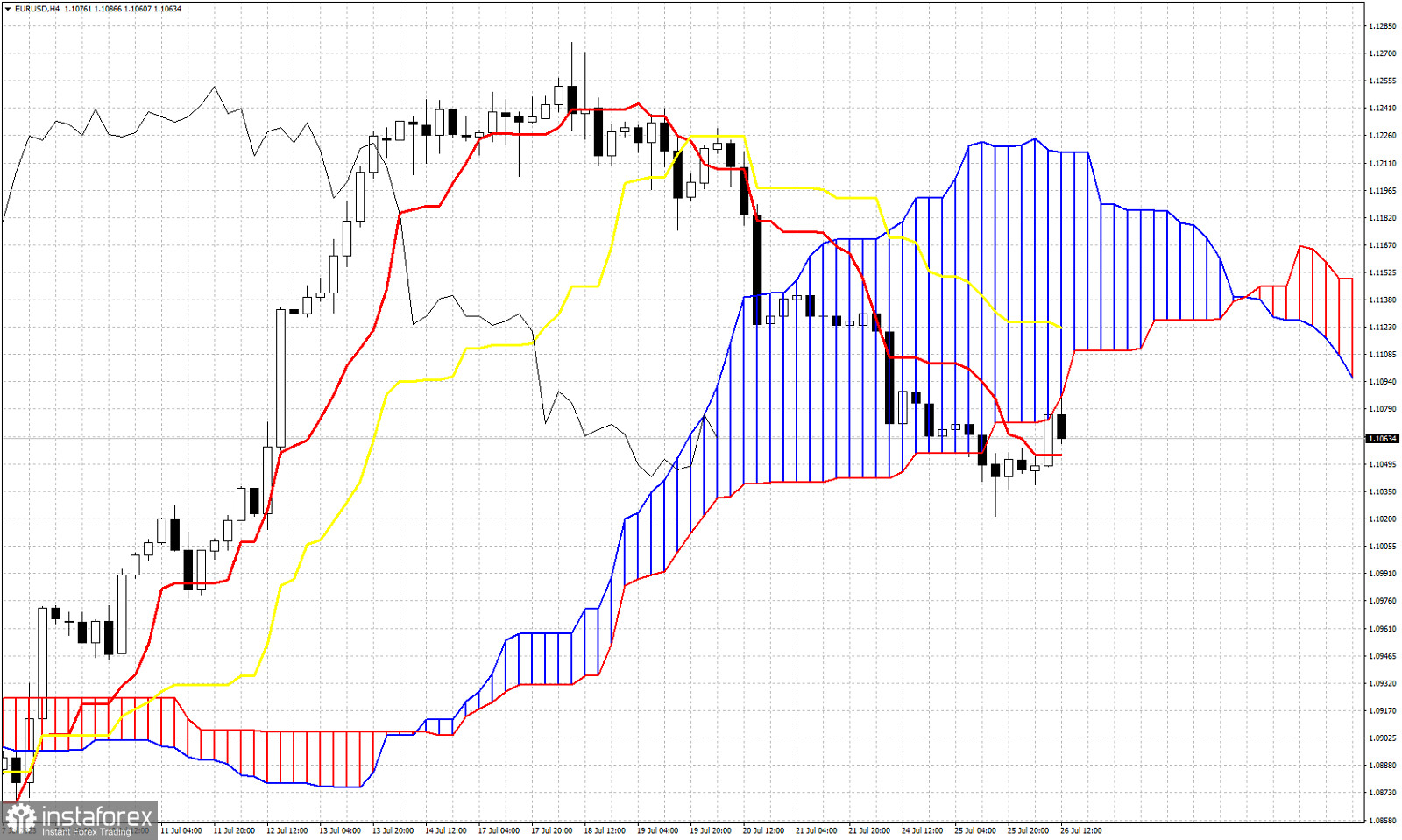

EURUSD is trading around 1.1061 after bouncing towards 1.1086 earlier today. Price challenged the lower cloud boundary that is now support and got rejected. Price remains below the cloud thus trend remains bearish. Volatility is expected to rise over the next couple of sessions until the end of the week as traders anxiously expect the announcements of the major central banks (US, EU, Japan). According to the Ichimoku cloud indicator support is found at 1.1054 by the tenkan-sen (Red line indicator). The kijun-sen (yellow line indicator) provides resistance at 1.1122. The Chikou span (black line indicator) remains below the candlestick pattern (bearish). Price has more upside to bounce as the lower cloud boundary has a positive slope for the time being. As long as we trade below the cloud trend is bearish. Breaking above the kijun-sen will be a first important step towards trend change.