When to open long positions on EUR/USD:

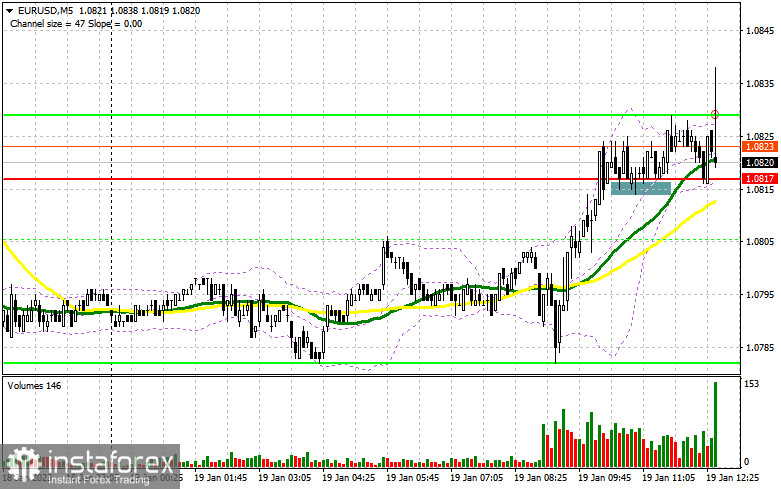

In my morning article, I turned your attention to 1.0817 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and figure out what actually happened. A breakout and consolidation above 1.0817 generated a buy signal with the prospect of a rise to the upper border of the sideways channel. However, a large upward movement did not occur. The pair climbed by only 20 pips.

In the afternoon, I would advise you to wait for the market reaction to the initial jobless claims report and the Philadelphia Fed Manufacturing Index. The euro may drop following these reports. If figures are positive, the US dollar is sure to climb. Thus, the euro/dollar pair will definitely decline. For this reason, if it returns to the 1.0817 level in the afternoon, it is better to act according to the morning scenario. Before going long, one needs to be sure that bulls are able to prospect the support level of 1.0769. Only a false breakout of this level will give a buy signal with the likelihood of a jump to 1.0817. The price tried to settle at this level in the morning. A breakout and a downward retest of this level could occur only amid weak US data and dovish comments from Fed policymakers. A breakout of 1.0817 will create a new buy signal. If so, the pair may rise to 1.0866. Only a breakout of this level will force the bears to close their Stop Loss orders. It will give a new buy signal with the possibility of an increase to 1.0931 where I recommend locking in profits. If EUR/USD declines and bulls show no activity at 1.0769, a larger correction may begin in the afternoon, which will escalate pressure on the pair. Therefore, I would advise you to pay attention to the support level of 1.0728. Only a false breakdown will trigger a new buy signal. You could buy EUR/USD at a bounce from the low of 1.0687 or 1.0653, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

The bears failed to defend the resistance level of 1.0817. They are now trying to regain control of this level. Everything will depend on the US data. However, as I have mentioned above, the speeches of Fed policymakers are also of importance. Hawkish comments may push the pair below 1.0817. A breakout and an upward retest of this level will give a sell signal with the aim of moving down to 1.0769. A decline below this level will cause a deeper correction to 1.0728, which will initiate the bear market. There I recommend locking in profits. If EUR/USD rises during the American session, I would advise you to keep an eye on 1.0866 - the upper border of the sideways channel. The euro has already fallen from this level several times. A false breakout there will provide a new selling opportunity. If the pair does not drop from 1.0866 in the afternoon, it is better to open short positions only from a high of 1.0931. I would also advise you to wait for an unsuccessful consolidation and a false breakout. You could sell EUR/USD at a bounce from a high of 1.0970, keeping in mind a downward intraday correction of 30-35 pips.

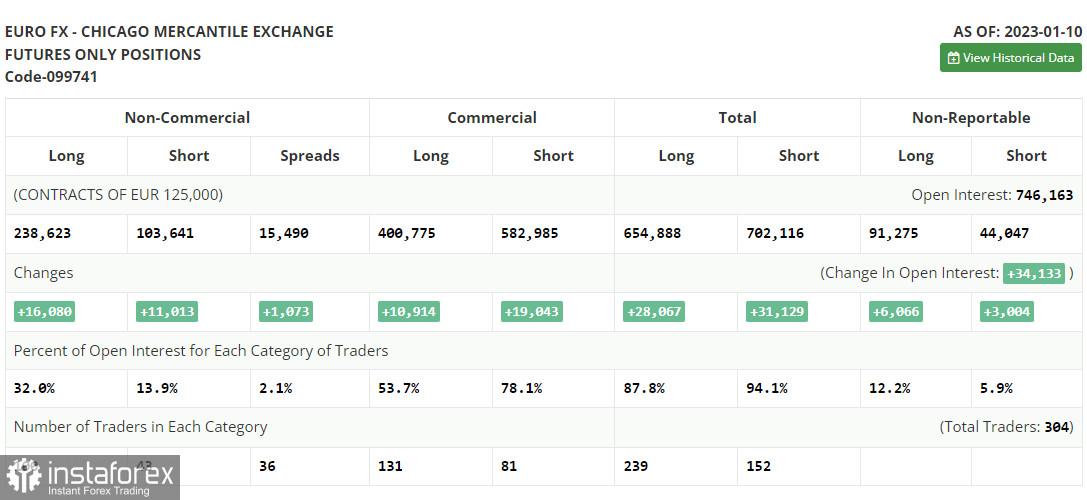

COT report

The COT report (Commitment of Traders) for January 10 logged a sharp increase in both long and short positions. Traders are returning to markets after the New Year holidays. They have also studied the fresh inflation report, showing a decrease in the CPI in December 2022. The Fed could undertake a smaller rate increase at its February meeting and raise the interest rate by only 0.25 basis points. Such a scenario will be extremely bearish for the US dollar. It is likely to drop significantly against the euro. Demand for risky assets is also growing thanks to expectations of a slowdown in monetary tightening. Assets that have fallen in price over the past year are now attractive to investors. Now, it is necessary to focus on the speeches of Fed policymakers and draw certain conclusions about the February meeting results. The COT report revealed that long non-profit positions increased by 16,080 to 238,623, while short non-profit positions jumped by 11,013 to 103,641. At the end of the week, the total non-commercial net position advanced to 134,982 against 129,915. Hence, investors continue to increase long positions on the euro amid expectations of a smaller rate hike. However, the euro needs new drivers for further growth. The weekly closing price rose to 1.0787 against 1.0617.

Indicators' signals:

Trading is carried out slightly above the 30 and 50 daily moving averages. It indicates that the bulls are making efforts to take control.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD moves up, the indicator's upper border at 1.0820 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.