Buyers remain optimistic on expectations of the next ECB interest rate hike and against the backdrop of verbal interventions from its representatives. Speaking at the World Economic Forum in Davos today, ECB President Christine Lagarde said that "inflation expectations are not easing" and "the ECB will continue to raise rates." In her opinion, "inflation is too high," and "the ECB intends to bring it down to 2% in a timely manner." Tomorrow, she will give another speech starting at 10:00 (GMT). Until then, the euro will probably maintain the bullish momentum gained from Lagarde's remarks today.

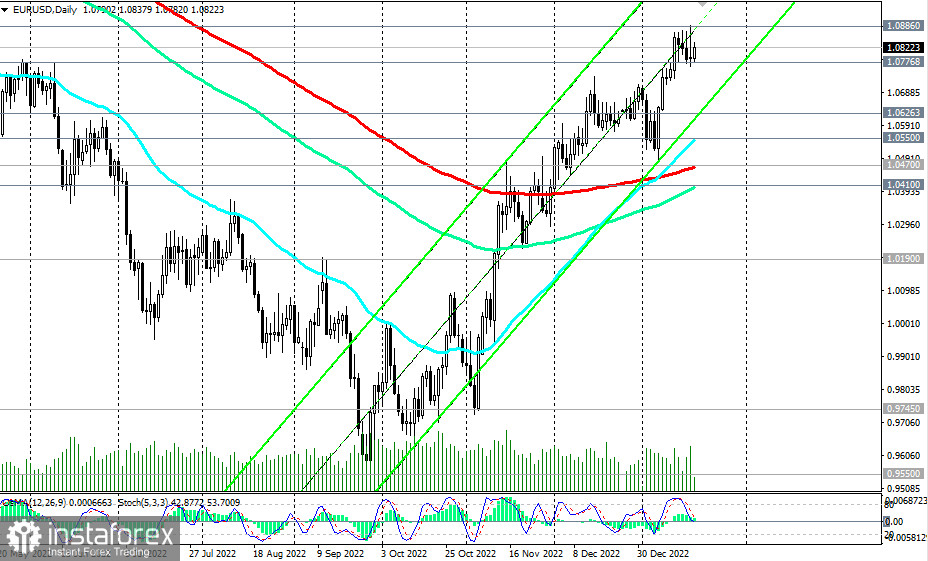

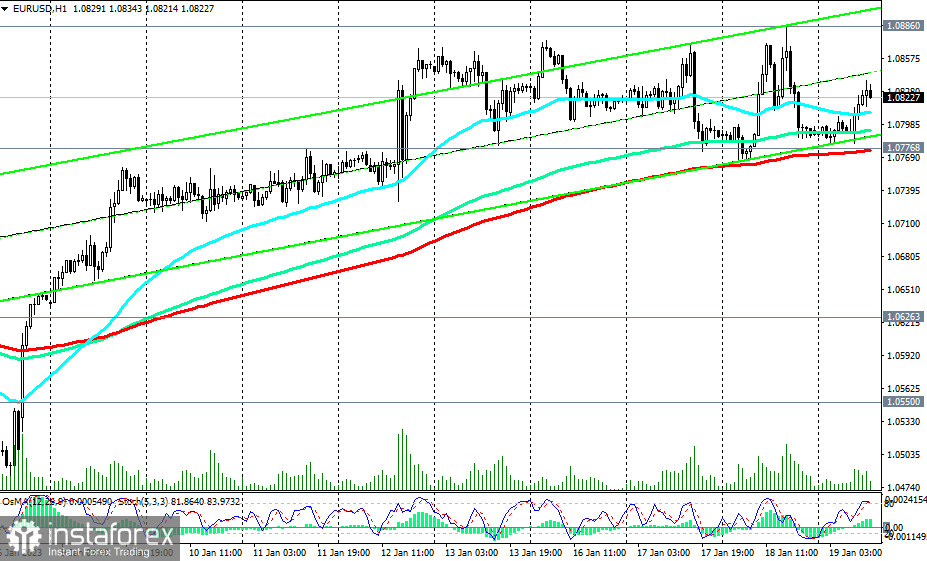

As of writing, EUR/USD was trading near 1.0822, remaining in the zone of the medium-term bull market, above the key support levels 1.0470 (200 EMA on the daily chart), 1.0550 (50 EMA on the weekly chart).

The breakdown of yesterday's local and new 9-month high at 1.0886 will become a signal to increase long positions on EUR/USD, and the pair will head towards key resistance levels 1.1010 (144 EMA on the weekly chart), 1.1130 (200 EMA on the weekly chart), separating the long-term bullish trend of the pair from the bearish one.

Alternatively, after the breakdown of yesterday's and intra-week low at 1.0766 and the 1.0777 support level (200 EMA on the 1-hour chart), EUR/USD will head to the lower border of the upward channel on the daily chart and to the 1.0626 mark, through which the 200-period moving average also passes on the 4-hour chart. Further decline is unlikely; long positions remain preferrable.

Support levels: 1.0766, 1.0777, 1.0700, 1.0626, 1.0550, 1.0500, 1.0470, 1.0410

Resistance levels: 1.0886, 1.0900, 1.1010, 1.1130

Alternative Scenarios

Sell Stop 1.0760. Stop-Loss 1.0875. Take-Profit 1.0700, 1.0626, 1.0550, 1.0500, 1.0470, 1.0410, 1.0370, 1.0190

Buy Stop 1.0875. Stop-Loss 1.0760. Take-Profit 1.0900, 1.1000, 1.1130