The euro does not believe the "hawkish" rhetoric of the European Central Bank representatives headed by ECB President Christine Lagarde, who are trying to dissuade investors from believing the Bloomberg insider. A day earlier, Bloomberg claimed, citing competent sources in the Governing Council, that the ECB is considering the possibility of slowing down the rate of monetary tightening from +50 bp in February up to +25 bp in March. EURUSD does not know who is more credible and continues to swing from side to side around 1.083.

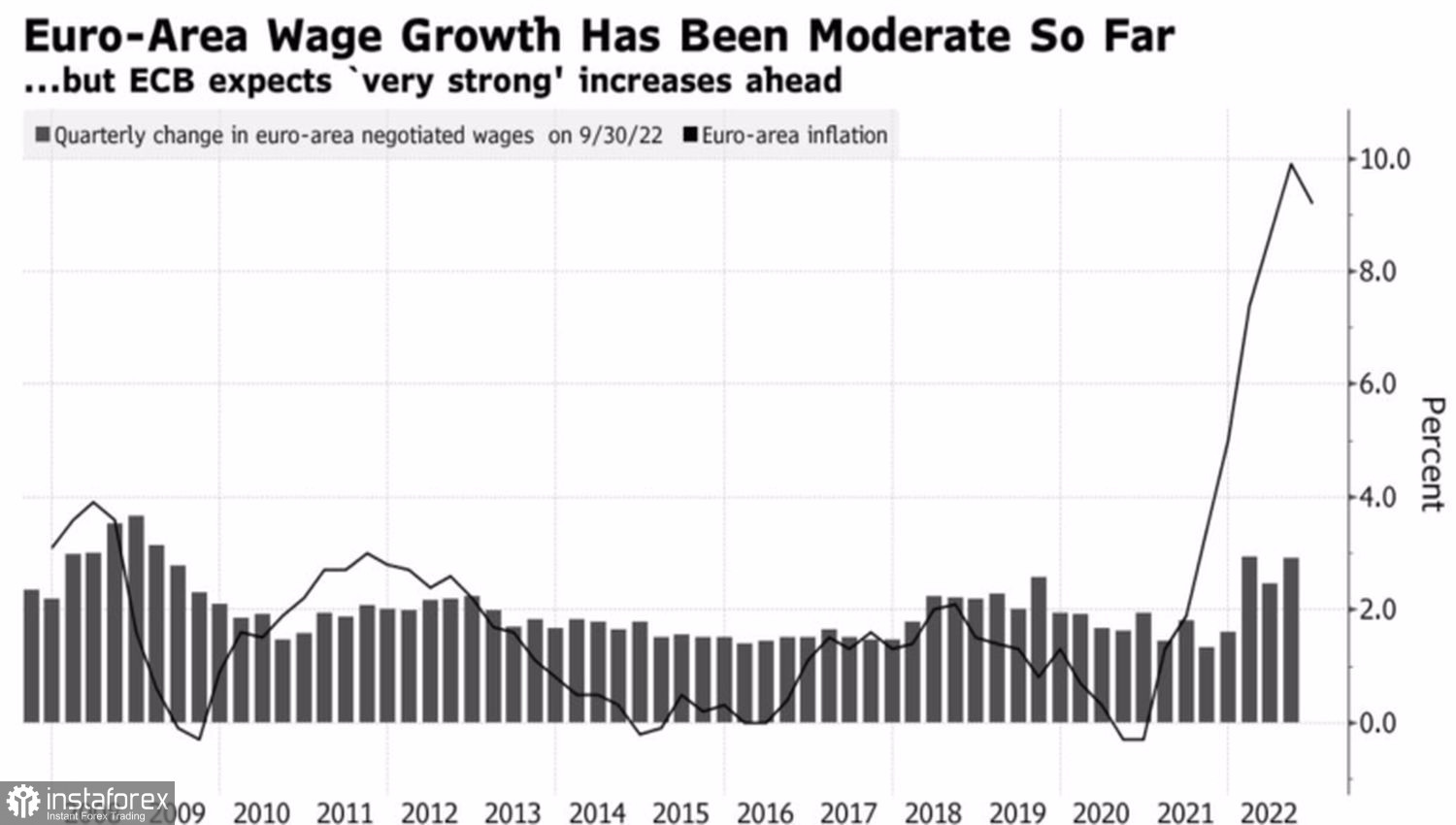

According to Lagarde, the eurozone economy is holding up much better than expected, so don't think that a 50 bp hike in the interest rate is going to be a big deal in February - a one-time event. It's something more. The head of the Bank of the Netherlands, Klaas Knot, argues that the ECB will definitely not stop after raising the cost of borrowing by half a point at the next meeting, and his French counterpart Francois Villaroy de Galo stressed that Lagarde's half-point ECB guidance is still valid.

Dynamics of European GDP and inflation

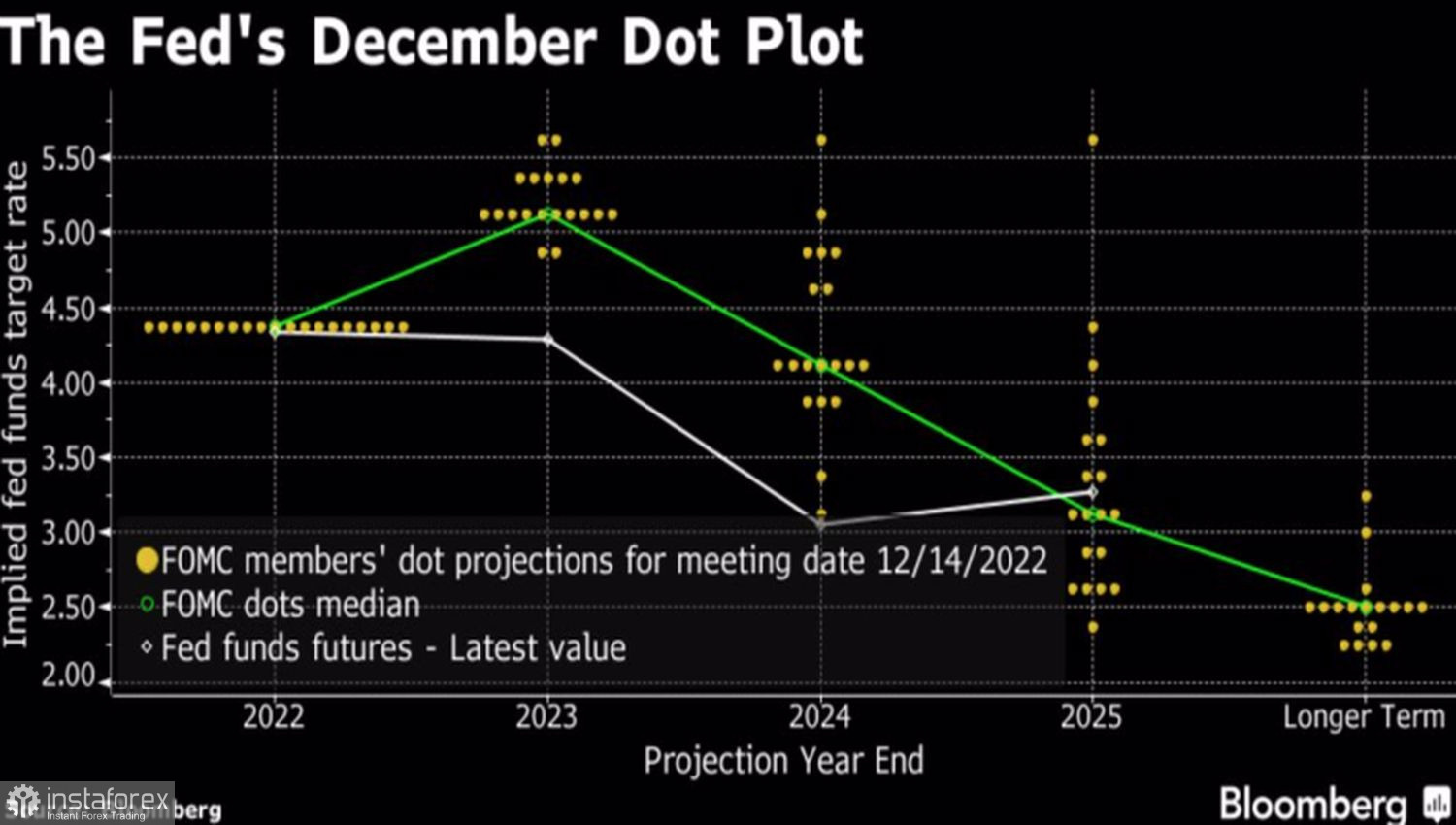

It feels like the central bank representatives are vying with one another to justify themselves. Saying that they were not the ones who leaked information to Bloomberg about the slowdown in the rate of monetary tightening. The market is watching this quietly, having become accustomed to the hawkish rhetoric of Federal Reserve officials. So, St. Louis Fed President James Bullard revealed a secret that when the FOMC was making its forecast, he voted to raise the federal funds rate to 5.25-5.5%. His colleague from Cleveland, Loretta Mester, in response to the disappointing data on retail sales and PPI in the United States, said that the Fed is beginning to see the results it needs. It is about slowing domestic demand, which should eventually return inflation to the 2% target.

FOMC forecasts for the Federal Funds rate

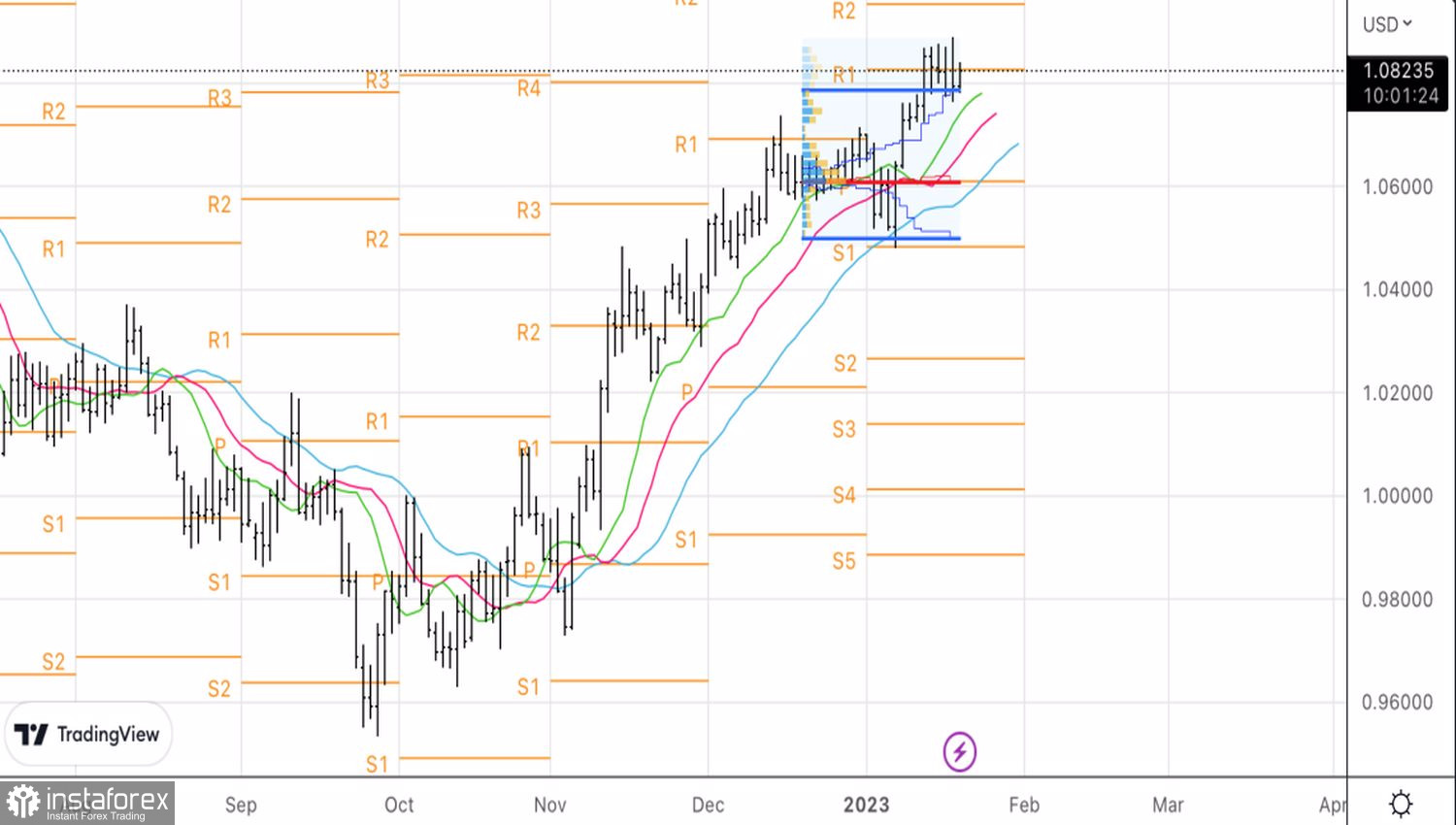

While the ECB and Fed hawks are trying to outcry each other, EURUSD is following in the footsteps of the US stock market. Their upsurge followed by a drop in trading on January 18 took the major currency pair on a roller coaster ride.

Unlike its hazy short-term outlook, the situation in the mid and long-term investment horizon looks much more transparent. We have China to thank for that, which Natixis estimates will account for half the growth of the entire global economy in 2023. This is good news for emerging economies as well as the export-oriented eurozone. According to the forecasts of Bloomberg experts, the GDP of China will accelerate from 3% to 5.1% this year and it will grow by 5% next year.

Technically, it's time for consolidation on the EURUSD daily chart. Bulls and bears are fighting for the upper limit of the fair value range of 1.05-1.0785. It would make sense to use a rebound from this level, as well as the euro's consolidation above $1.083, to open long positions with targets at $1.095 and $1.104.