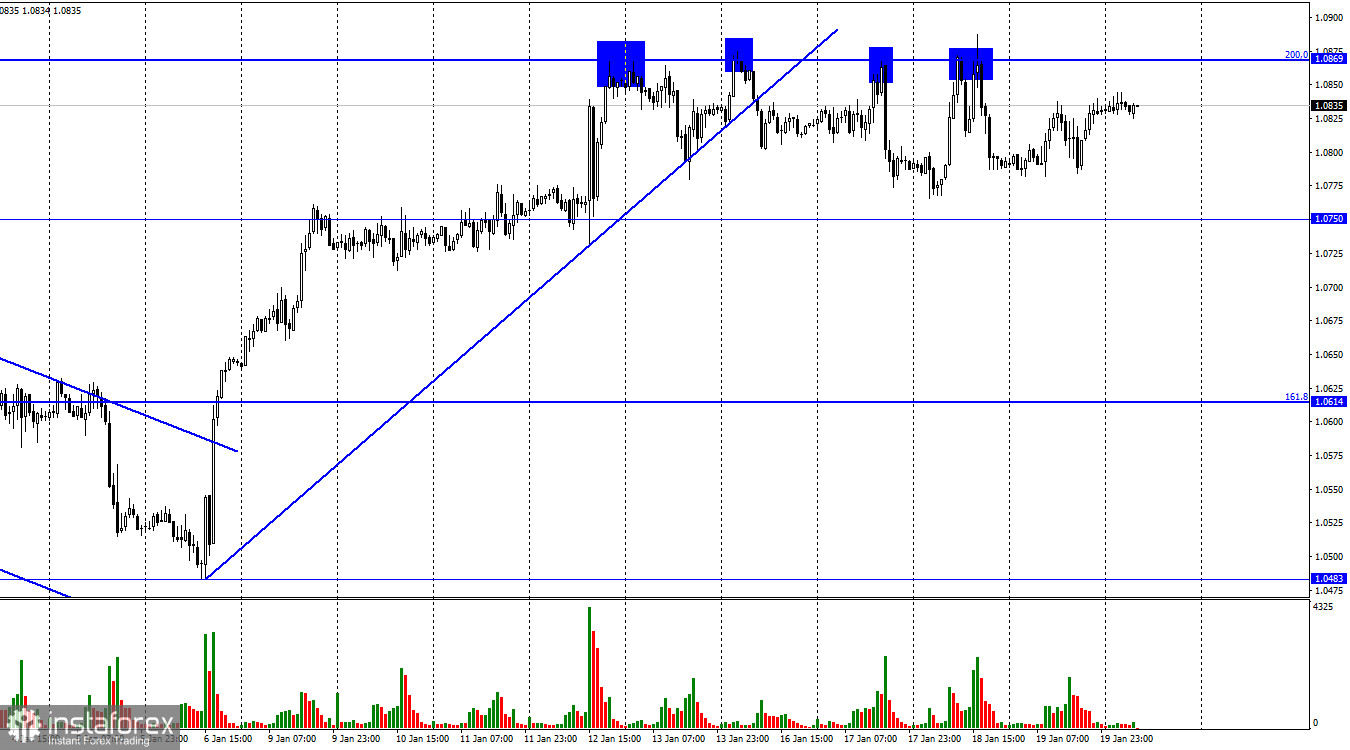

On Thursday, the EUR/USD pair remained in a range of 1.0750 and 1.0869. The quotes have been posted here for a week at this point. There were four attempts to consolidate above the corrective level of 200.0% (1.0860), but they were all unsuccessful. But the bears have never brought the pair down to the level of 1.0750. As a result, we have a horizontal movement and all of its effects.

Yesterday's information background was incredibly thin. I can only cite Christine Lagarde's speech as the ECB president's remarks on the European Union. She stated at the Davos summit that the ECB will keep raising interest rates until they become "restrictive" for the economy, allowing us to anticipate a long-term recovery of inflation to 2%. I'm not sure what the traders inferred from what they heard, but in my judgment, Lagarde's remarks may be characterized as "dovish." Lagarde did not say that the rate would increase before inflation began to go close to 2%. This implies that after another two to three increases, it might stop growing. And with this strategy, inflation can return to the desired level for two to three years.

Economists disagree on the potential final value of the rate, which is currently 2.5%. Some people think it can be up to 3.25%, while others think it can be up to 3.75%. Whatever the situation, a figure of around 5% is impossible. The Fed will increase its rate to this point, and possibly much higher in the meantime. Accordingly, the difference in rates between the ECB and the Fed will be visible for a considerable period. As the ECB doesn't appear ready to approach the Fed rate, I believe the European currency is beginning to lose its advantage. I anticipate the euro will decline before the rate of the pair is fixed above the level of 1.0869.

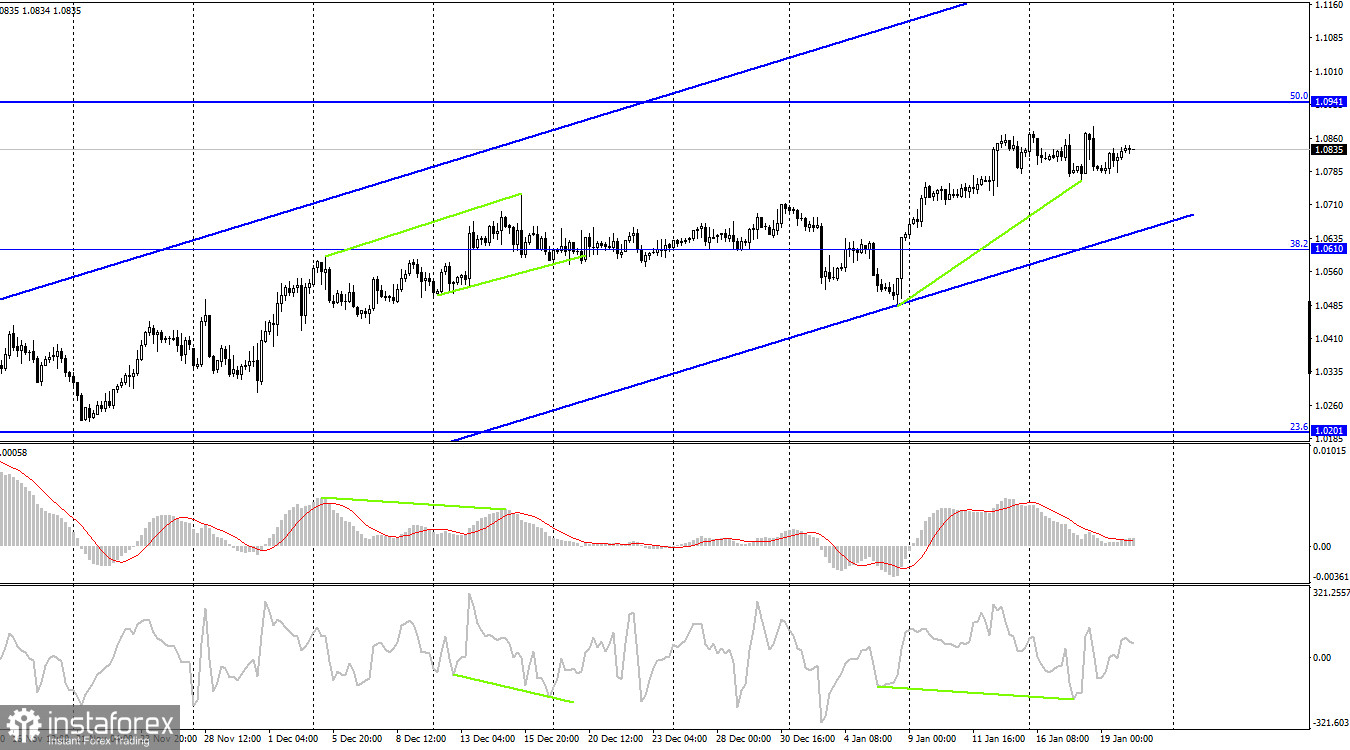

On the 4-hour chart, the pair made a new turn in favor of the euro and is now moving up toward the corrective level of 50.0% (1.0941). The US dollar will benefit from the quotes rising from this level, while some will fall in the direction of the Fibo level of 38.2% (1.0610). Once more, the upward trend corridor describes the traders' attitude as "bullish." I don't anticipate the euro falling significantly before the corridor closes.

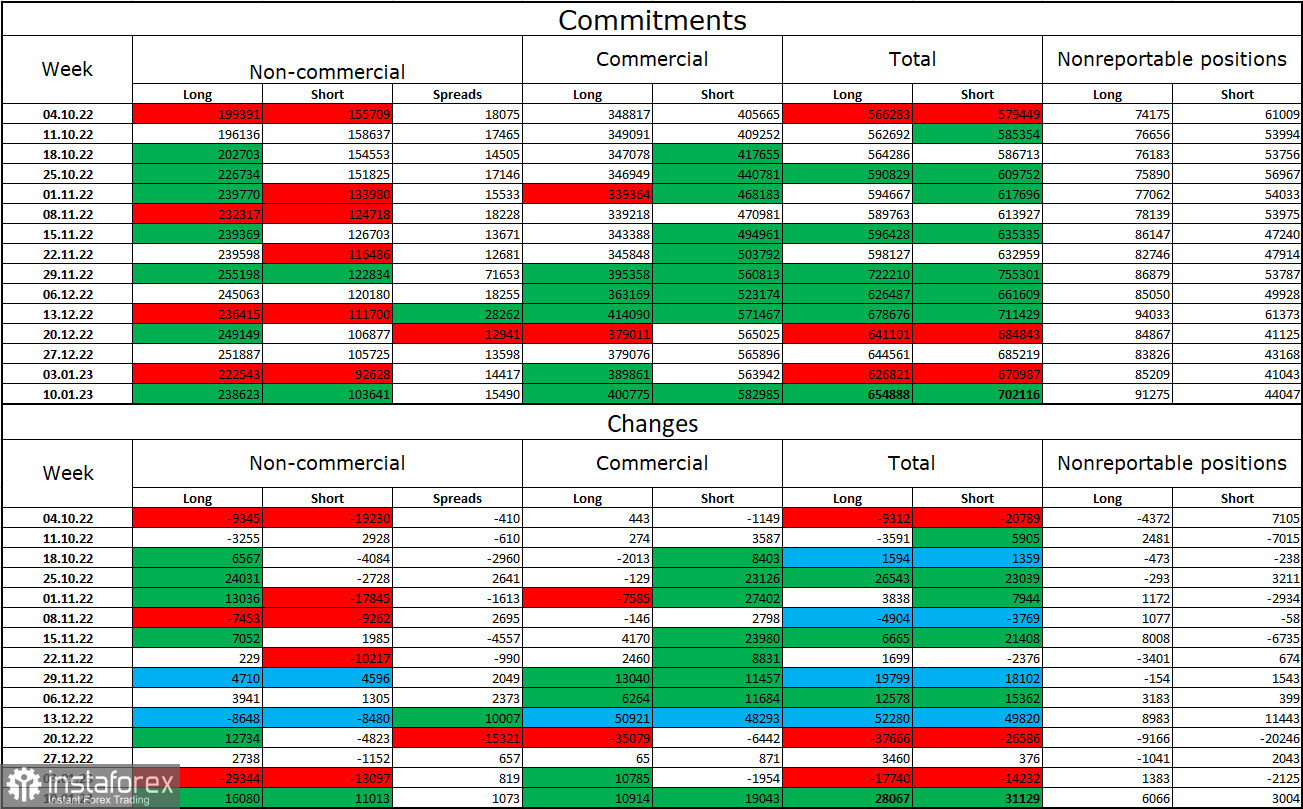

Report on Commitments of Traders (COT):

Speculators opened 11,013 short contracts and 16,080 long contracts over the previous reporting week. Large traders' attitude is still "bullish" and getting stronger once more. Speculators now have 239 thousand long contracts, while just 104 thousand short contracts are concentrated in their hands. The COT figures show that the European currency is now growing, but I also see that the number of long positions is 2.5 times larger than the number of short positions. The likelihood of the euro currency's expansion has been increasing over the past few weeks, much like the euro itself, but the information background does not always support it. After a protracted "dark time," the situation is now improving for the euro, so its prospects are still good. Going beyond the ascending corridor on the 4-hour chart, however, would signal a strengthening of "bearish" positions soon.

News calendar for the USA and the European Union:

EU – ECB President Lagarde will deliver a speech (10:00 UTC).

The European Union and the United States both have one entry for January 20 on their respective economic events calendars. Christine Lagarde's latest Davos address. The knowledge backdrop may not have much of an impact on the traders' attitudes today.

Forecast for EUR/USD and trading advice:

On the hourly chart, sales of the pair are probable if it recovers from the level of 1.0869 with goals of 1.0750 and 1.0614. With goals of 1.0941 and 1.1000, purchases of the euro currency are conceivable when the hourly chart closes above the level of 1.0869. For initial purchases, the rebound from 1.0750 is also favorable.