M5 chart of GBP/USD

On Thursday, GBP/USD was absolutely flat for the most part, but by the end of the day it managed to edge up. There were no interesting events or reports in the UK yesterday. On the other hand, there were several speeches of Federal Reserve representatives in the US, of which more than 10 were scheduled for this week. However, all of them are saying the same thing: rates will continue to rise, but in time it may be advisable to slow down the pace of rate hikes and then to refuse to do it at all. Moreover, the market believes that a new slowdown in the pace of monetary tightening will occur at the next meeting in February. Despite the fact that the Bank of England might also slow down its rate hike in February, the pound is still in high demand. I still believe that it would be more justified if the pound falls. There were no important reports in the US yesterday, only minor ones.

Thursday's trading signals did not even make sense, since the pair was flat for most of the day along with low volatility. During this time, traders could open one or two positions, but it soon became clear that there would be no movements on Thursday, so all the positions should have been closed and you should have left the market. And positions could be closed with no profit because the price practically did not move.

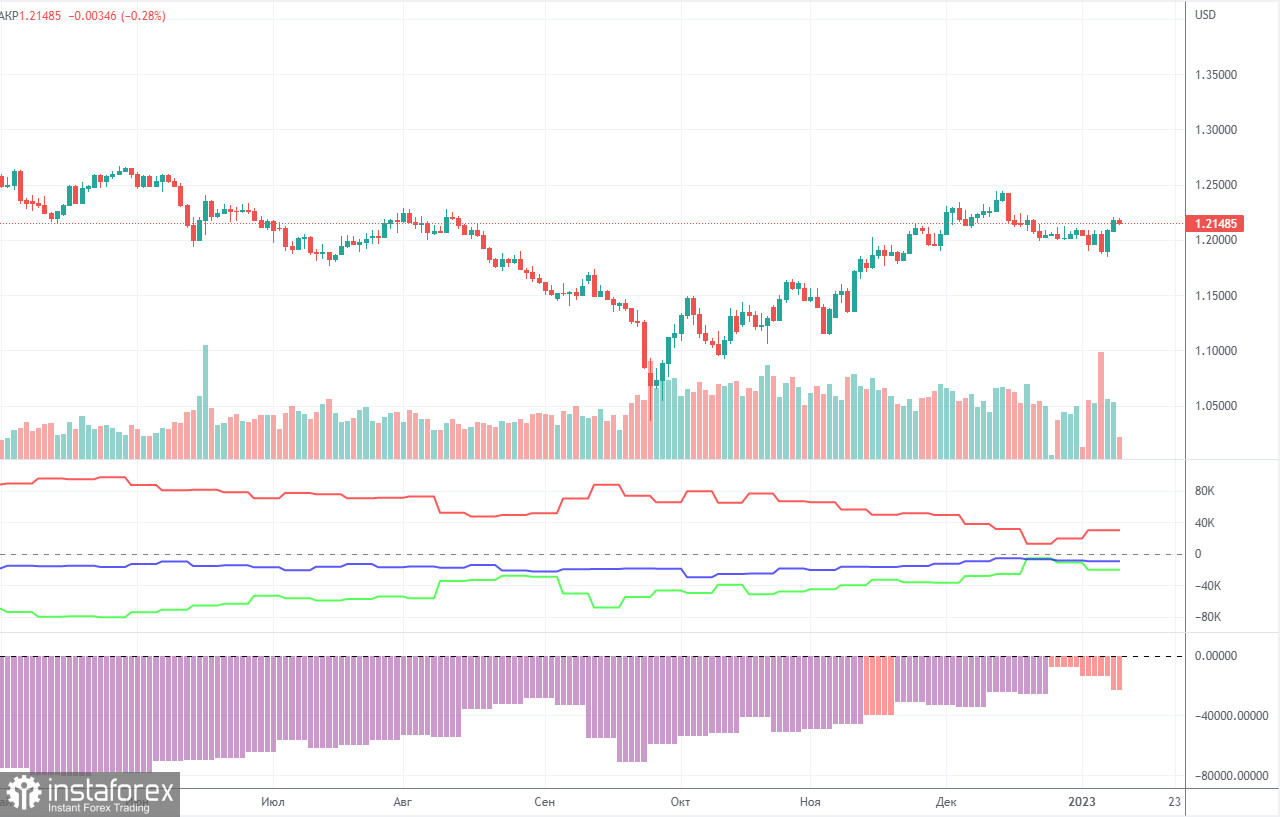

COT report

The latest COT report showed an increase in bearish sentiment. During the given period, non-commercial traders closed 7,600 long positions and opened as many as 1,500 short positions. Thus, the net position fell by about 9,100. This figure has been on the rise for several months, and the sentiment may become bullish in the near future, but it hasn't yet. Although the pound has grown against the dollar for the last few months, from a fundamental perspective, it is difficult to answer why it keeps rising. On the other hand, it could fall in the near future (in the mid-term prospect) because it still needs a correction. In general, in recent months the COT reports correspond to the pound's movements so there shouldn't be any questions. Since the net position is not even bullish yet, traders may continue to buy the pair over the next few months. Non-commercial traders now hold 36,000 long positions and 65,500 short ones. I remain skeptical about the pound's long term growth, though there are technical reasons for it. At the same time, fundamental and geopolitical factors signal that the currency is unlikely to strengthen significantly.

H1 chart of GBP/USD

On the one-hour chart, GBP/USD is in an uptrend and continues to be above the Ichimoku indicator lines. Thus, we can count on a continuation of the pound's unreasonable growth for technical reasons. There are no sell signals right now, and volatility also fell at the end of the week since there are no important events. Today there was a report on the UK retail sales which fell by 1% against the forecast of +0.3-0.5%. Thus, the pound was slightly under pressure in the morning, but it is unlikely that GBP will fall the whole day due to this fact. Again, a decline would be more logical. On January 20, the pair may trade at the following levels: 1.2106, 1.2185, 1.2259, 1.2342, 1.2429-1.2458, 1.2589, 1.2659. The Senkou Span B (1.2063) and Kijun Sen (1.2301) lines may also generate signals. Pullbacks and breakouts through these lines may produce signals as well. A Stop Loss order should be set at the breakeven point after the price passes 20 pips in the right direction. Ichimoku indicator lines may move during the day, which should be taken into account when determining trading signals. In addition, the chart does illustrate support and resistance levels, which could be used to lock in profits. The Fed will give several more speeches on Friday, but it is unlikely that they will tell the market anything fundamentally important. All previous statements of the members of the Monetary Committee did not have a strong impact on the pair's movement.

What we see on the trading charts:

Price levels of support and resistance are thick red lines, near which the movement may end. They do not provide trading signals.

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, moved to the one-hour chart from the 4-hour one. They are strong lines.

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT charts reflects the net position size of each category of traders.

Indicator 2 on the COT charts reflects the net position size for the non-commercial group.