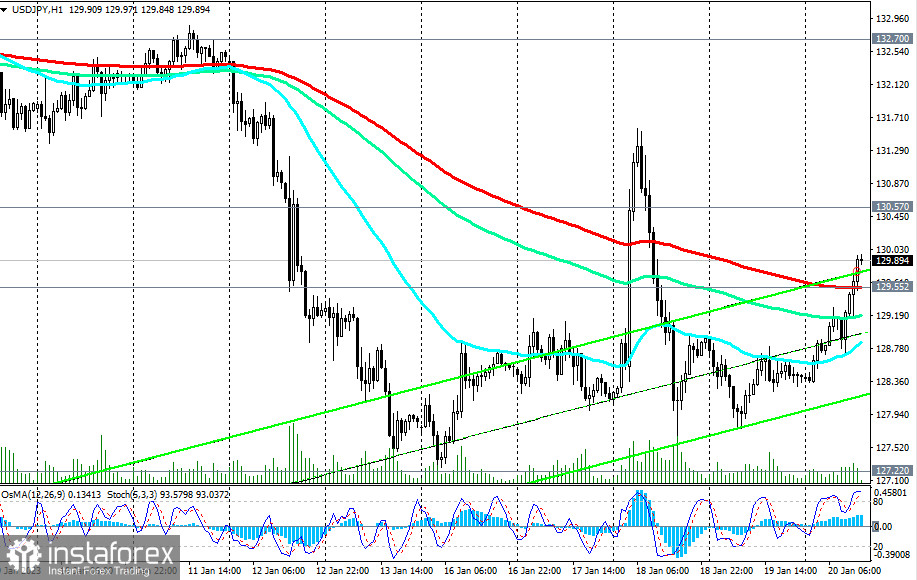

USD/JPY is rising today, recovering from this and last month's biggest losses, trading near the 130.00 mark as of writing.

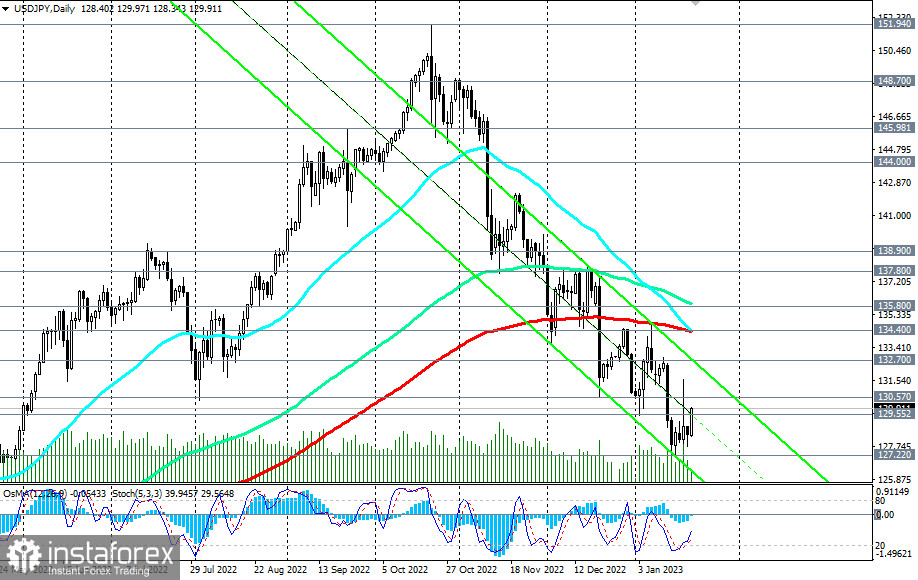

The price broke through the important short-term resistance level 129.55 (200 EMA on the 1-hour chart) and continues to rise towards the nearest important resistance level 132.70 (upper limit of the downward channel on the daily chart and 50 EMA on the weekly chart, 200 EMA on the 4-hour chart).

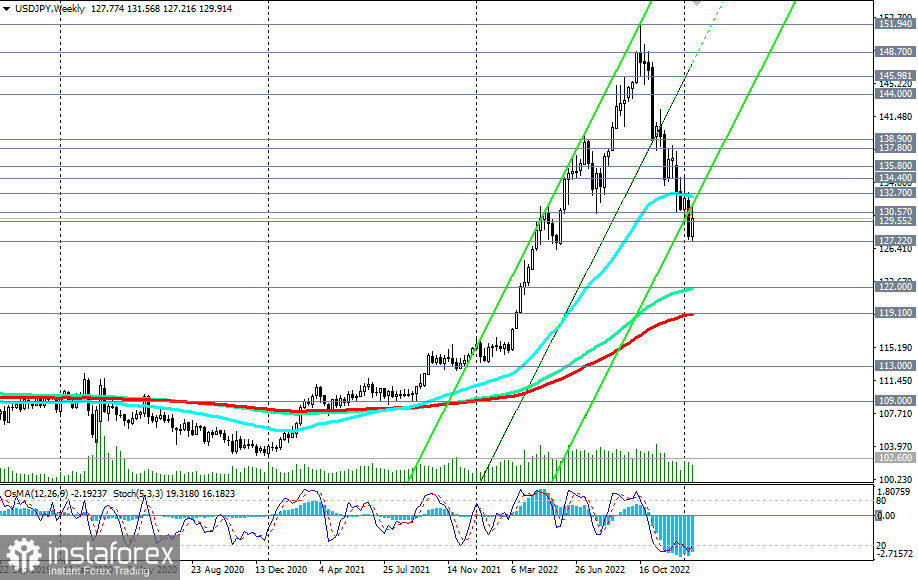

Below this level and the 134.40 key resistance level (200 EMA on the daily chart), the pair remains in the long-term bear market zone.

Therefore, despite the current corrective growth, short positions remain preferable, and a breakdown of the 129.55 support level will be a signal for their resumption. This is the main scenario.

Alternatively, USD/JPY will continue to rise towards 132.70, with an intermediate target at 130.57 (an intraday low after the December meeting of the Bank of Japan). A break of the 134.40 resistance level will return USD/JPY to the global bull market zone.

Support levels: 129.55, 129.00, 128.00, 127.22, 127.00

Resistance levels: 130.57, 131.00, 132.00, 132.70, 134.00, 134.40, 135.80

Trading scenarios

Buy Stop 130.65. Stop Loss 129.50. Take-Profit 131.00, 132.00, 132.70, 134.00, 134.40, 135.80, 137.45, 138.90

Sell Stop 129.50. Stop Loss 130.65. Take-Profit 129.00, 128.00, 127.22, 127.00