Dollar almost hit a new yearly low as weak economic data and dovish comments from Fed officials hint at a slowdown in interest rate hikes. According to data, the Bloomberg spot dollar index fell 0.3% on Monday, with euro being one of the top gainers when the indicator approached its lowest level since April last year.

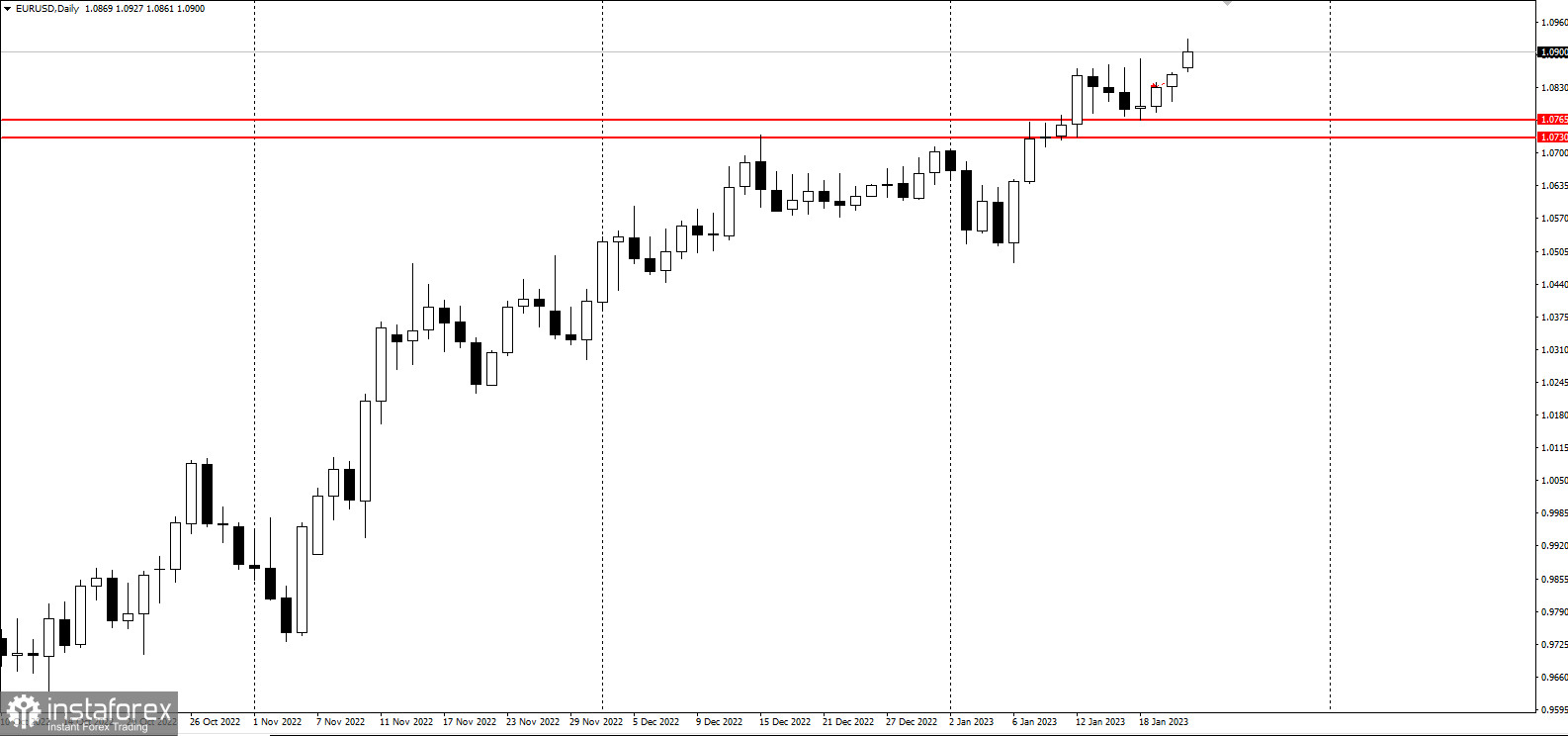

It rose 0.7% to $1.0927 ahead of a number of speeches from ECB officials, including President Christine Lagarde.

Christopher Waller, one of the most hawkish members of the Fed, said he is in favor of a quarter-point rate hike at the next meeting.

Going back to dollar, institutional investors, including pension funds, insurance companies and mutual funds, have increased net short positions to the highest level since June 2021. Ray Attrill, head of currency strategy at the National Australia Bank wrote that "softer US data is putting pressure on the US dollar as the US loses its growth advantage. This week's PMI could add fuel to the fire."

In Europe, Lagarde said that policymakers should not slacken in their fight against inflation even as the jump in consumer prices appears to have peaked.This is because even though overall inflation has fallen, core price growth hit a record high in December.

Euro could rally this week if preliminary PMI data, which is due out on Tuesday, indicates that the eurozone economy is expanding. "We see risks leaning towards a stronger PMI reading than the consensus expects because energy prices continue to fall," strategists at Commonwealth Bank Australia said.