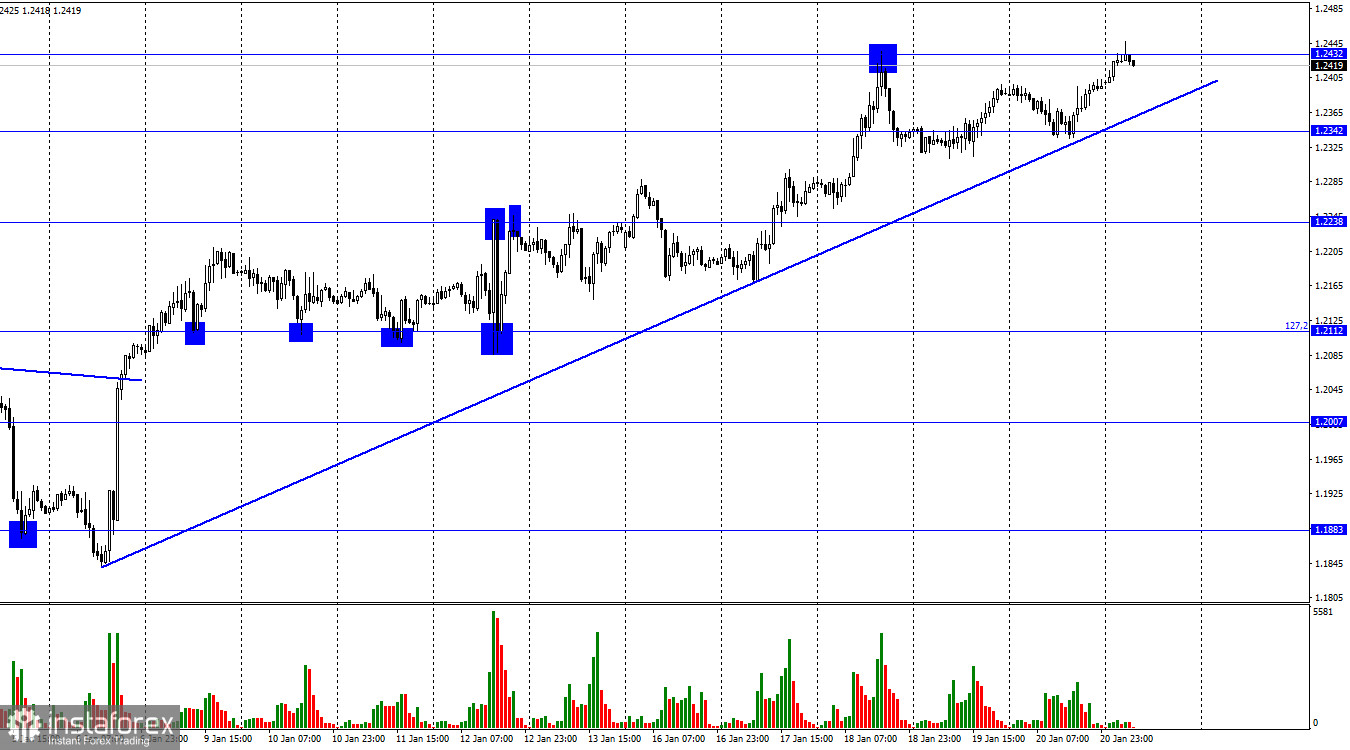

The GBP/USD pair on Friday staged a rebound from the level of 1.2342, a reversal in favor of the euro, and a gain to the level of 1.2432, according to the hourly chart. The US dollar will benefit from the rebound in prices from this level, while the pound will experience some declines. But since the trend line is so near, there is essentially nowhere to fall. If it closes below that level, the US dollar will gain and the price will fall toward the Fibonacci level of 127.2%, or 1.2112.

The same factor driving the euro's current growth also applies to the British pound. I even believe that the euro frequently lifts the pound along with it. The Fed will only increase interest rates by 0.25% in February, compared to the Bank of England's expected increase of 0.50%. This is currently the key cause. Additionally, you can keep a close eye on inflation, the "cause of the cause." The Bank of England will continue to tighten the PEPP, according to traders, as long as UK inflation stays at record levels. Bull traders are strengthened by these anticipations.

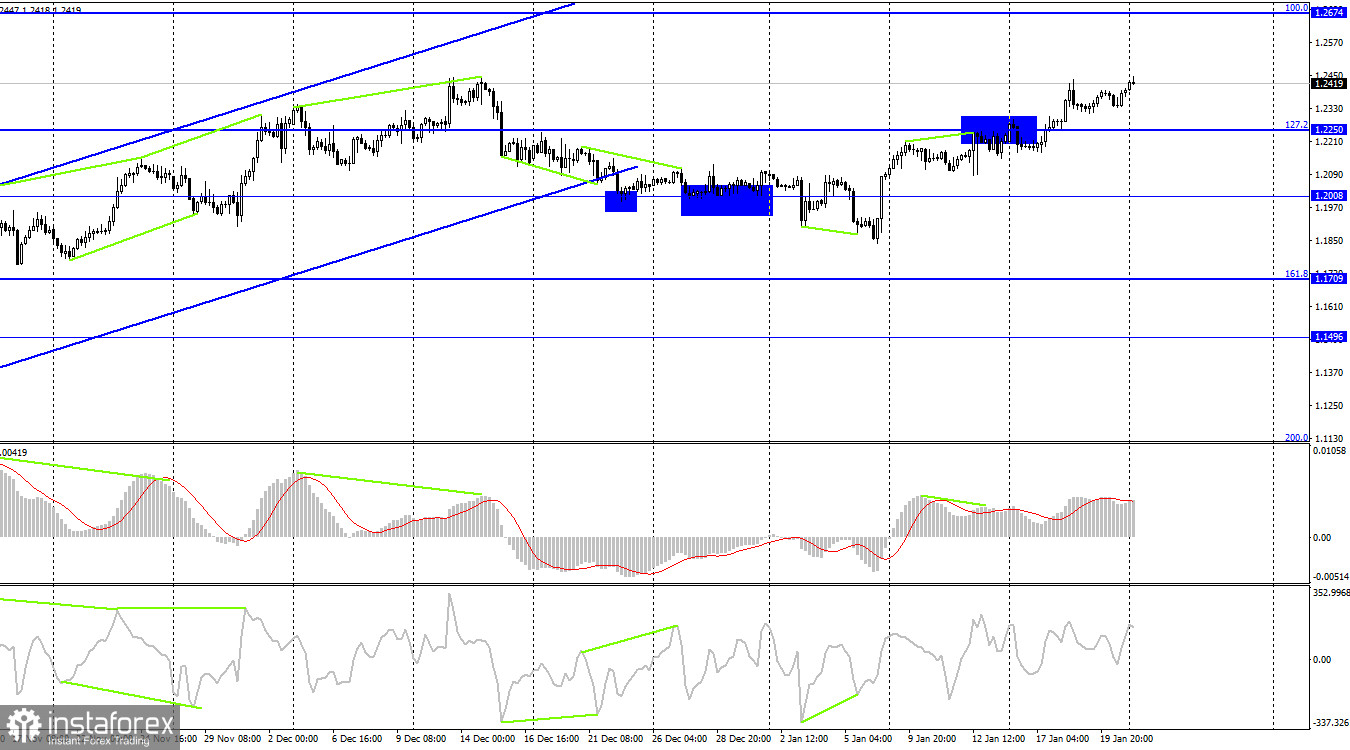

On the 4-hour chart, the pair has maintained above the corrective level of 127.2% (1.2250), allowing us to predict that it will continue to rise toward the next Fibo level of 100.0% (1.2674). The divergence that was "bearish" has been reversed. There are no new divergences in the making. Fixing the exchange rate for the pair at 1.2250 would tempt the market's bears back for a spell and let the dollar rise as high as 1.2008.

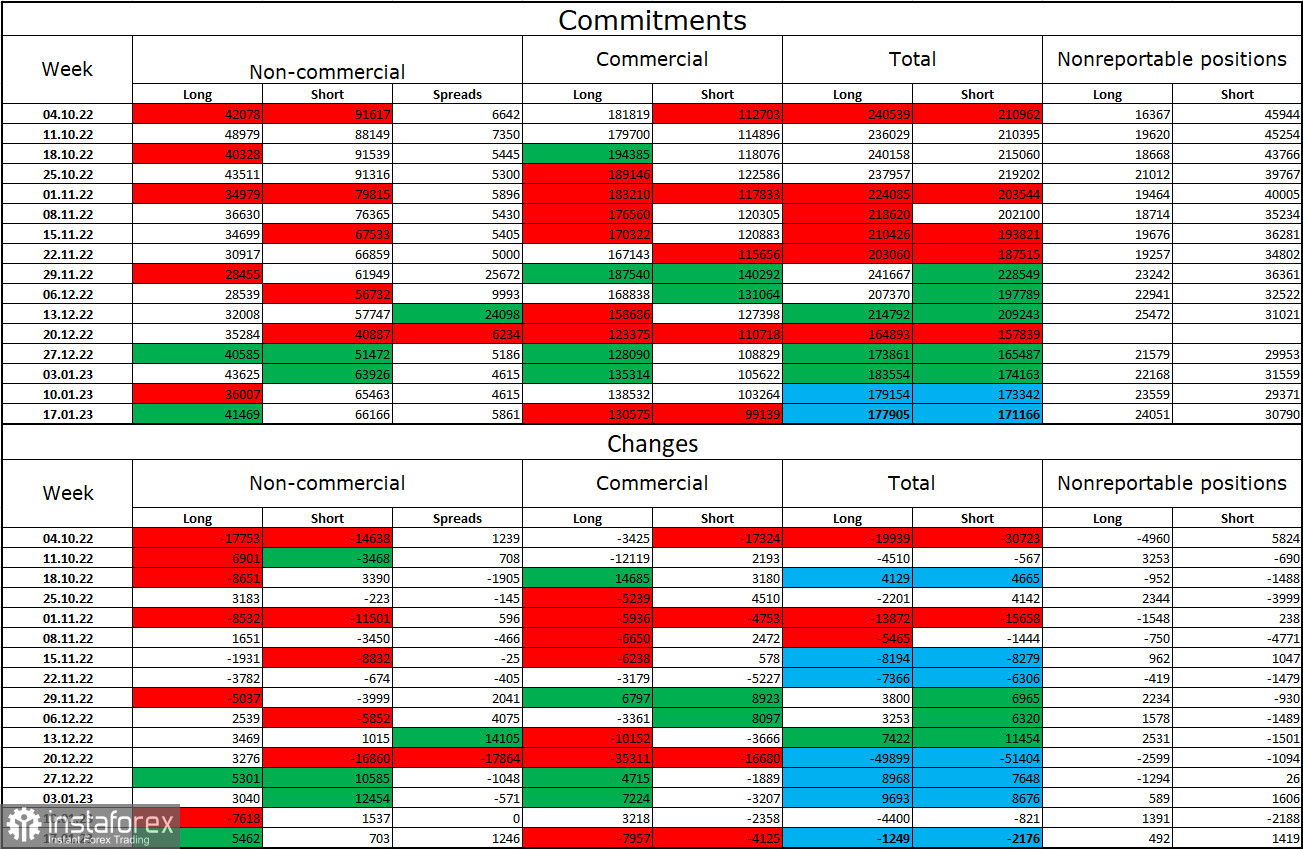

Report on Commitments of Traders (COT):

The "non-commercial" group of traders has been trading in a less "bearish" manner than they were a week ago. Speculators now hold 5,462 more long contracts than short contracts, a difference of 703 units. The big players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. The situation has shifted in favor of the British pound over the last few months, but today the number of long and short positions in the hands of speculators has nearly doubled once more. As a result, the outlook for the pound has once again declined, although the British pound is increasing slowly and may be following the euro. There was a departure outside the three-month ascending corridor on the 4-hour chart, which may have stopped the pound's development at this point.

The following is the UK and US news calendar:

The US and UK's schedules of economic events are both empty on Monday. The rest of the day won't see any impact from the information background on traders' attitudes.

Forecast for GBP/USD and trading advice:

With goals of 1.2238 and 1.2112, sales of the British are conceivable if quotes are fixed beneath the trend line on the hourly chart. On the hourly chart, I suggested buying with a target price of 1.2432 when the price closed above the level of 1.2342. This objective has been completed. When the price closes above 1.2432 with a target of 1.2591 or when it reverses from the trend line with the same objective, new purchases are available.