Various intriguing economic data are occasionally released in the European Union or the United States, but they no longer significantly affect traders' attitudes. The euro is still increasing for a very good reason, I mean. The ECB's rhetoric on interest rates is the cause of this. The rate will continue to rise, the regulator needs to make a few more substantial advancements, inflation is still quite high, and the fight against it must continue, according to Christine Lagarde's comments from last week. Traders deduced from these statements that the rate will rise by 1.00% during the following two meetings.

Traders are also sure that the Fed will slow the rate of interest rate increases to 0.25% at the upcoming meeting and that it won't raise rates for a while. As a result, the ECB is now acting and speaking in a more "hawkish" manner than the Fed. The value of the euro is rising as a result. And all of the economic information from the United States or the European Union is merely background. For instance, Christine Lagarde will talk once more today. Now, all we can anticipate from her is what we heard last week. Bull traders can therefore continue buying today; however, I have been personally pondering for a long time how much longer this particular factor can support the growth of the euro.

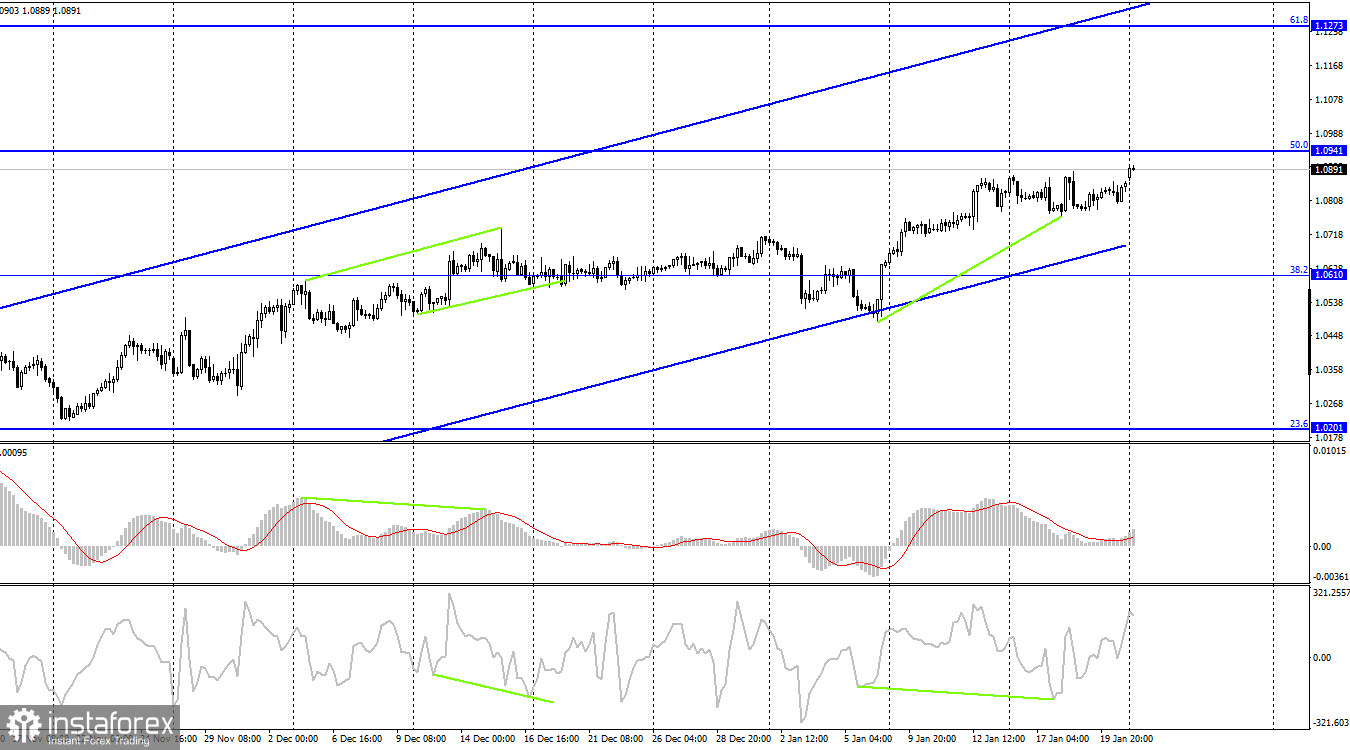

On the 4-hour chart, the pair made a new turn in favor of the euro and is now moving up toward the corrective level of 50.0% (1.0941). The US dollar will benefit from the comeback of prices from this level, and some prices may fall in the direction of the Fibo level of 38.2% (1.0610). Once more, the upward trend corridor describes the traders' attitude as "bullish." I don't anticipate the euro falling significantly before the corridor closes.

Report on Commitments of Traders (COT):

During the previous reporting week, traders opened 2,346 short contracts while also closing 10,344 long contracts. The large traders' bullish attitude is still present but has dropped slightly. Currently, 228 thousand of long contracts and 101 thousand of short contracts are all concentrated in the hands of traders. The COT figures show that the European currency is now growing, but I also see that the number of long positions is over 2.5 times greater than the number of short positions. The likelihood of the euro's expansion has been steadily increasing over the past few months, just like the euro itself, but the information background does not always support it. After a protracted "dark time," the situation is now improving for the euro, so its prospects are still good. Until the ECB gradually raises the interest rate by increments of 0.50%, at least.

News calendar for the USA and the European Union:

European Union – ECB President Lagarde will deliver a speech (17:45 UTC).

The European Union and the United States each have one entry for January 23 in their respective economic event calendars. A new performance by Christine Lagarde, probably similar to the ones from the previous week. The knowledge backdrop may not have much of an impact on the traders' attitudes today.

Forecast for EUR/USD and trading advice:

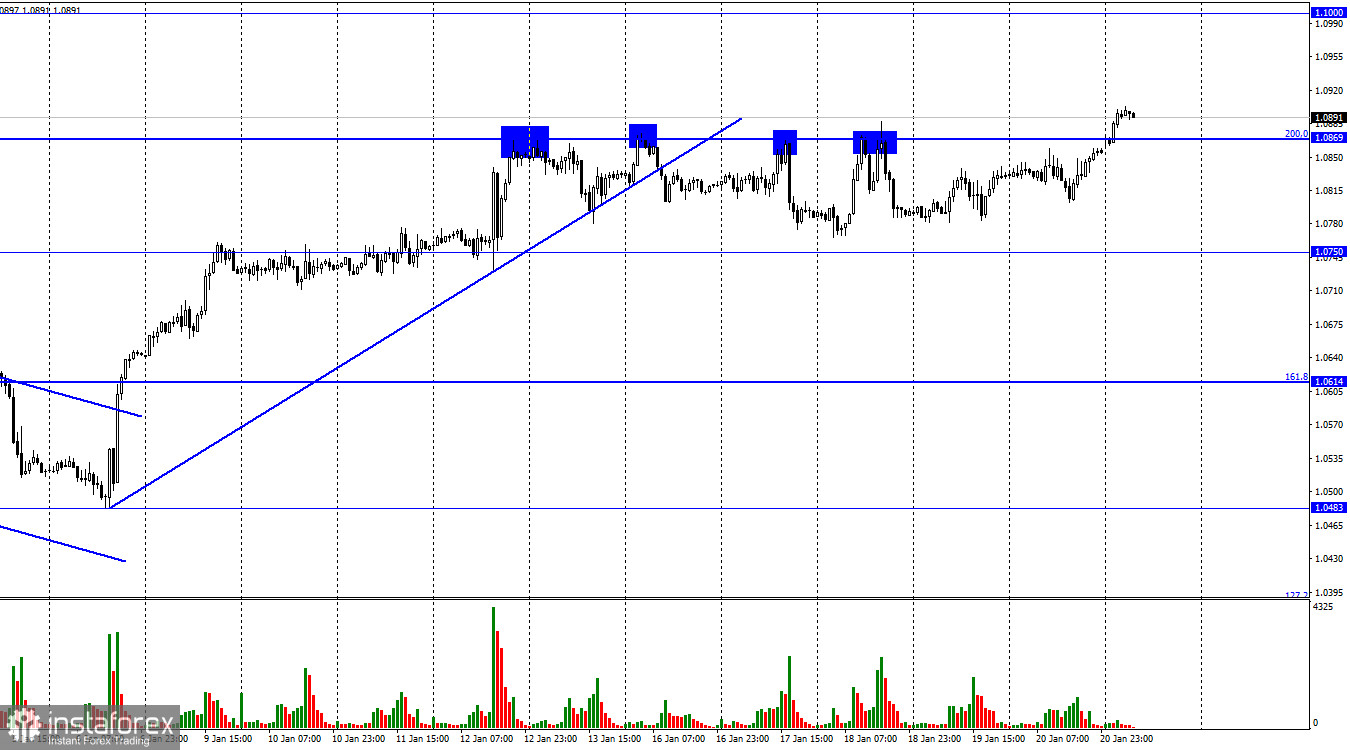

On the hourly chart, sales of the pair with objectives of 1.0750 and 1.0614 are probable when it closes below the level of 1.0869. With goals of 1.0941 and 1.1000, purchases of the euro currency are conceivable when the hourly chart closes above the level of 1.0869.