The euro reached a new local high and then bounced. However, a slight drop has not changed the market situation. It could be considered a decline before a further increase that could be caused by today's preliminary estimates on the PMI. In the eurozone, the manufacturing PMI may increase to 48.5 points from 47.8 points, whereas the services PMI may grow to 50.8 points from 49.8 points. As a result, the composite PMI may climb to 50.0 points from 49.3 points. This is enough to see a rise in the euro during the European session.

Eurozone Composite PMI

Notably, the US PMI data is likely to be the main driver of the euro. Forecasts are not that positive. The services PMI is expected to advance to 45.0 points from 44.7 points, thus boosting the composite PMI to 45.1 points from 45.0 points. Such a small rise in the composite PMI could be explained by a decline in the manufacturing PMI to 45.0 points from 46.2 points. Since the data from the US could be worse than in Europe, the greenback may continue losing value.

US Composite PMI

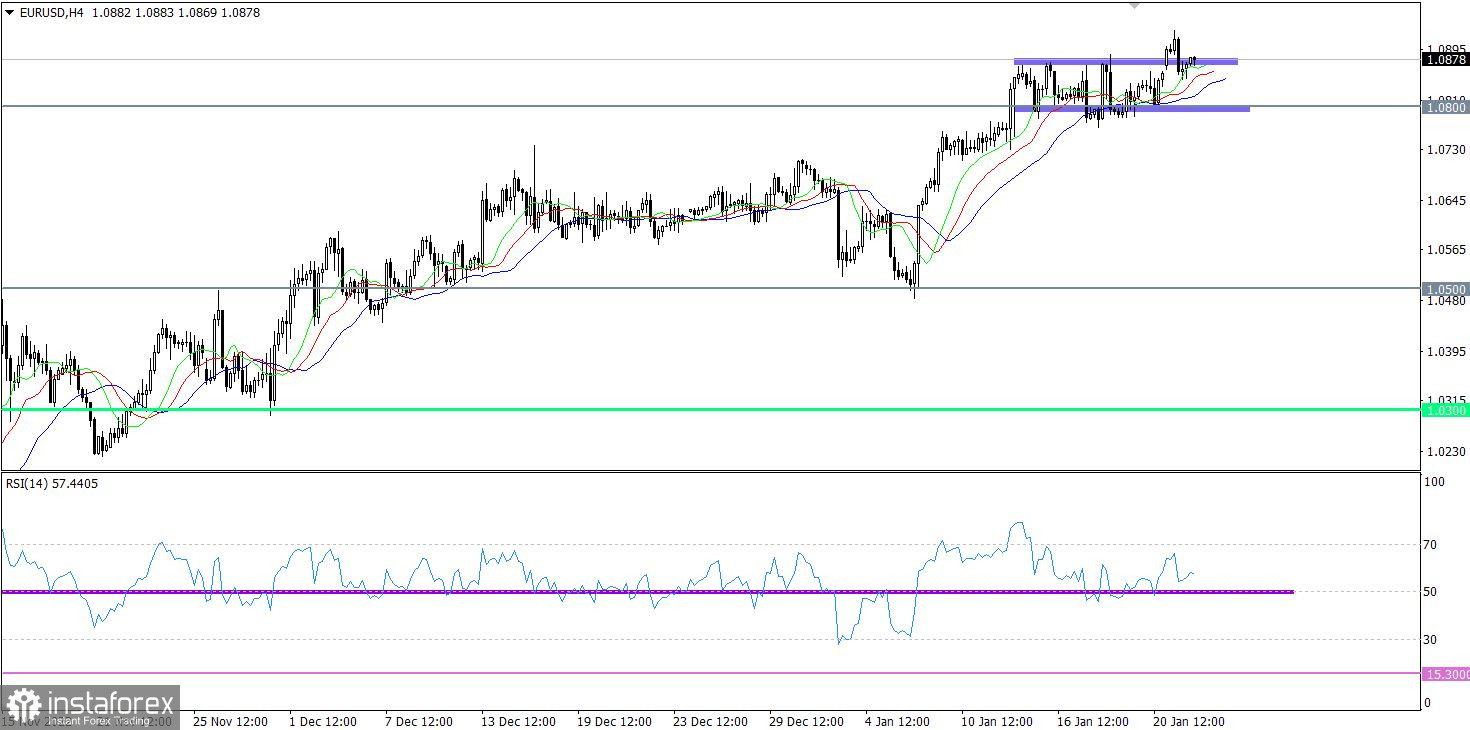

Just after the euro/dollar pair reached a new local high of the uptrend located at 1.0927, it bounced. Although the volume of long positions dropped, the market sentiment remained bullish.

On the four-hour chart, the RSI technical indicator is hovering in the upper area, which corresponds to the upward cycle. On the daily chart, the RSI indicator is at level 66, which points to the strength of the upward movement.

On the four-hour and daily charts, the Alligator's MAs are headed upwards, which proves the dominance of bulls.

Outlook

To resume growing, the quote should climb above 1.0900 on the four-hour chart. In this case, we may see a new rise in the volume of long positions. This, in turn, may push the price to a new local high.

However, the price may go on falling if it fixes below 1.0840. In this case, the pair may slide to 1.0800.

In terms of the complex indicator analysis, we see that technical indicators are pointing to a bounce in the short-term period. In the intraday and mid-term periods, the indicators are reflecting the upward cycle.