Euro and pound hit local highs, but then bounced down in preparation for a further rise ahead of the preliminary estimations on EU and UK business activity indices. In the eurozone itself, the manufacturing index is forecast to rise from 47.8 to 48.5 points, while the service index is expected to climb from 49.8 to 50.8 points. The composite index is also projected to turn up from 49.3 to 50.0 points. All this will be enough for euro to gain during the European trading session.

Composite Business Activity Index (Europe):

In the UK, the manufacturing index is projected to rise from 45.3 to 46.0 points, while the service index is expected to climb from 49.9 to 50.0 points. The composite index is also forecast to turn up from 49.0 to 49.6 points.

Composite Business Activity Index (UK):

However, the main driver for the market's movement is still the data from the US, where the outlook is not so positive. According to forecasts, the service index is likely to rise from 44.7 to 45.0 points, while the composite index is likely to turn up from 45.0 to 45.1 points. Such a modest rise is due to the decline in the manufacturing index, from 46.2 to 45.0 points. Dollar will lose ground because these figures are slightly worse than in Europe.

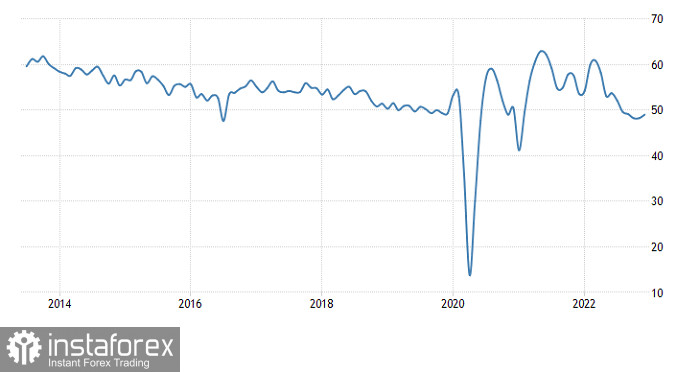

Composite Business Activity Index (United States):

Of course, EUR/USD is still bullish as most traders are still inclined towards long positions. Thus, a return of above 1.0900 could trigger a new upward spiral.

In GBP/USD, buyers need to keep the quote above 1.2450 unless they want the pair to decrease in terms of price. The trend will also shift into bearish if the price stays below 1.2300.