Stock indices continue to rise slowly, indicating that sentiment is quite positive among market participants. Perhaps, the reason is the upcoming key economic data, such as the US GDP for Q4, figures of core durable goods orders, and components of inflation.

Forecasts say US GDP will fall from 3.2% to 2.6%, while core orders will slip by 0.2%. Core PCE is expected to rise by 0.3% m/m, but decrease to 4.4% y/y. If the figures turn out to be weaker than these estimations, the Fed will be forced to pause its rate hikes for at least one quarter in order to assess the impact of the measure on the economy. Such a development would definitely affect risk appetite.

Clear signals of a slowdown in economic and business activity, followed by a reflection of negative labor market, will convince the Fed that inflation will fall to 2%. That will justify the decision to pause the rate hikes as it will boost demand for stocks, not only in the US but also on other regions. Accordingly, dollar will weaken, while gold and oil prices will climb up.

Forecasts for today:

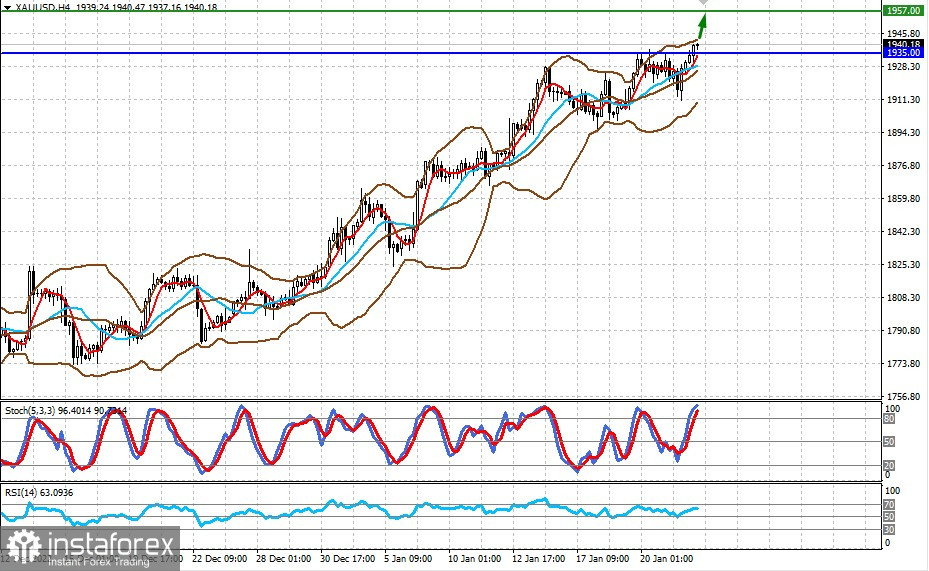

XAU/USD

Gold is trading above 1935.00. Continued positive sentiment will push the metal to 1957.00.

USD/CAD

The pair is trading at the support level of 1.3350 amid expectations of a rate hike by the Bank of Canada this week. A fall and consolidation below this level could push the pair down to 1.3300.