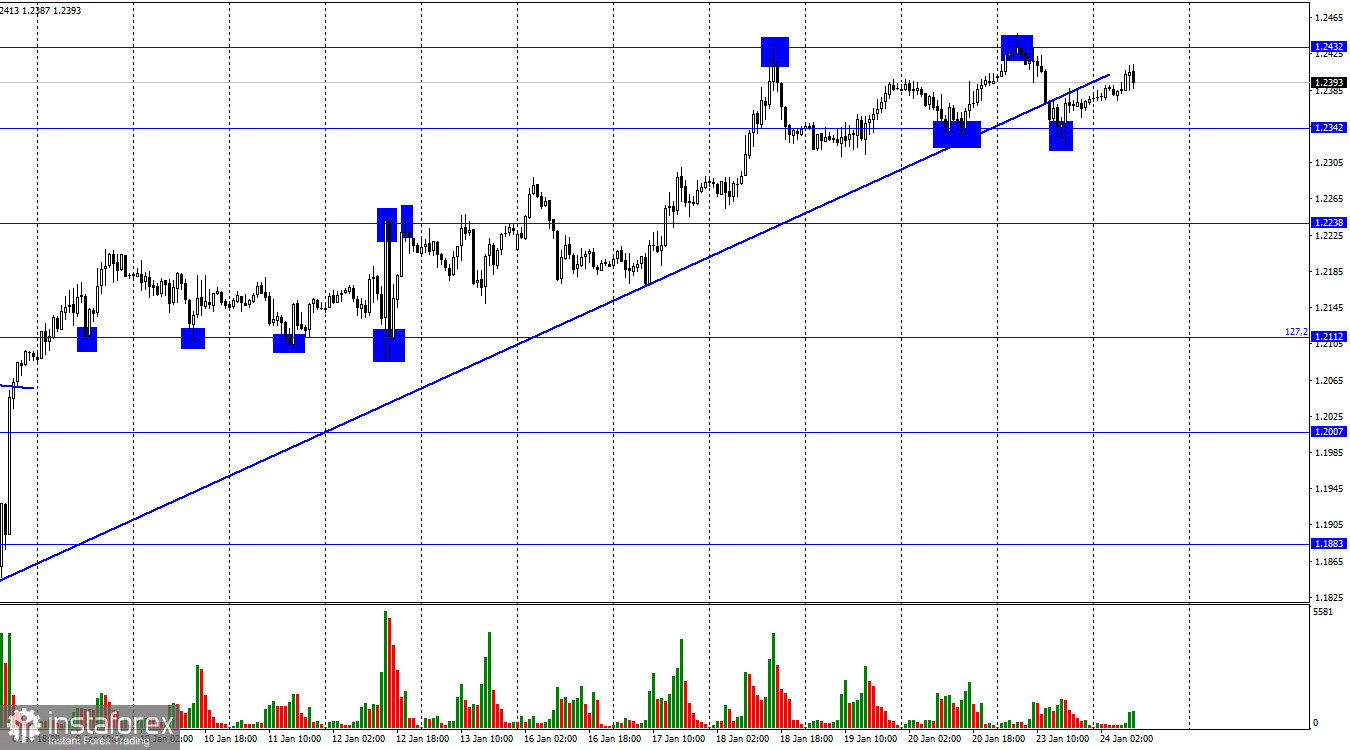

Hi, dear traders! On the 4-hour chart, GBP/USD dropped off 1.2432 and reversed in favor of the US dollar on Monday. Later on, the price rebounded at 1.2432. Thus, the instrument settled below the trend line which indicates a probable decline of the pound sterling in the near future. The price action seems complicated. Let's try to puzzle it out.

In early 2023, market participants were baffled by a few fundamental pieces of news which obscure the whole picture. I've already told you that interest rates of the Federal Reserve, the Bank of England, and the ECB are now the crucial catalyst for market sentiment, albeit there is something else worthy of note. We should not forget about inflation which is heavily dependent on energy prices. They actually went down, thus pushing consumer inflation down. Hence, a lot of traders made a conclusion about the onset of the inflation downtrend. Nowadays, experts and analysts are speculating that low oil and gas prices will not stay at current levels for a long time. In turn, if they rebound, this will propel inflation which will behave differently in various countries. The thing is that we should make a forecast for interest rates in the UK and the US without having accurate information on further oil and gas prices. In my viewpoint, it is the same as trying to predict the future by consulting the crystal ball. In this case, forecasts for interest rates should be revised and updated week after week. The question is what we need such inaccurate forecasts for.

The key interest rate in the UK already stands at 3.5% and inflation has slowed down its annual rate. If oil and gas prices pick up steam, inflation will gain momentum. The Bank of England cannot raise interest rates to 6% or higher. If so, inflation will hardly be brought down to 2% in the nearest couple of years. Personally, I define the current information environment as completely obscure because the two crucial factors are impossible to predict for sure.

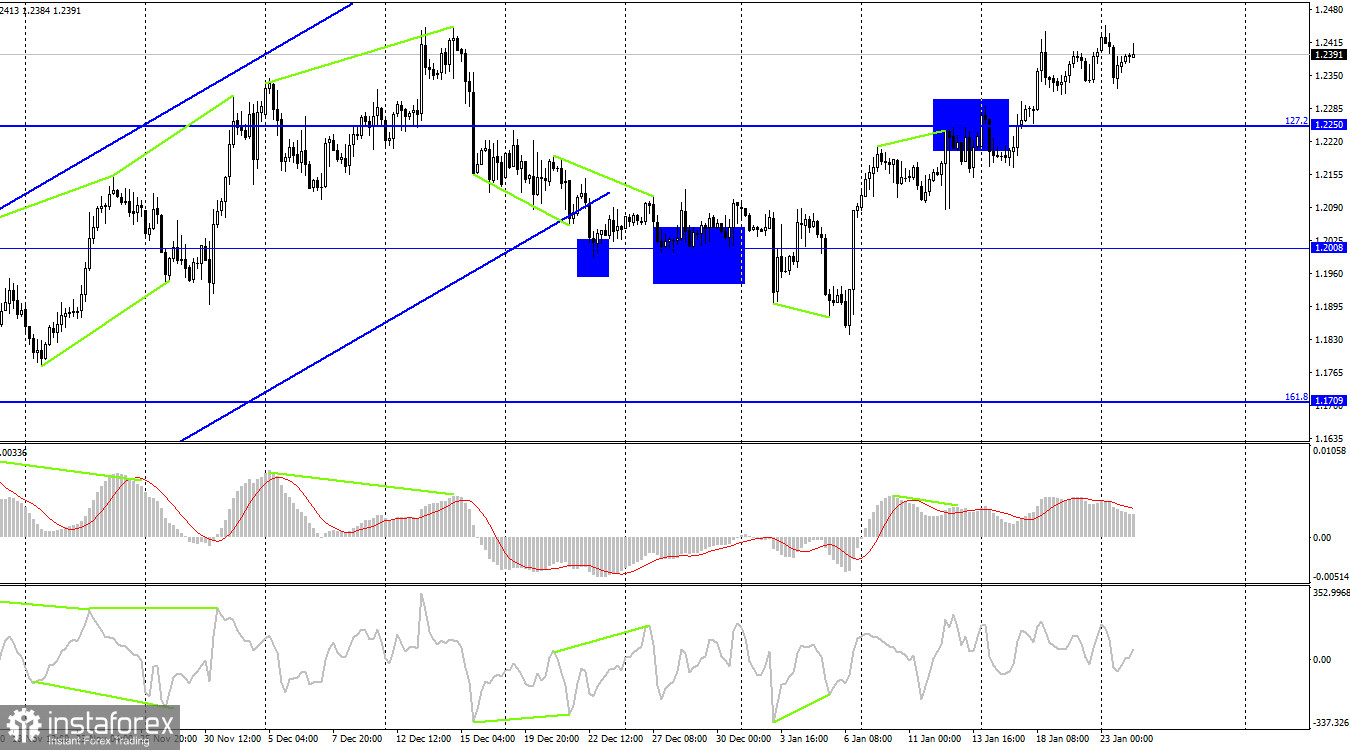

In the 4-hour time frame, GBP/USD settled above 1.2250, the 127.2% Fibonacci correction. This enables us to reckon a further growth toward 1.2674, the next 100.0% Fibonacci level. No new emerging divergences are brewing up today. If the instrument settles below 1.2250, the bears might enter the market for a while. So, the US dollar will be able to strengthen to 1.2008.

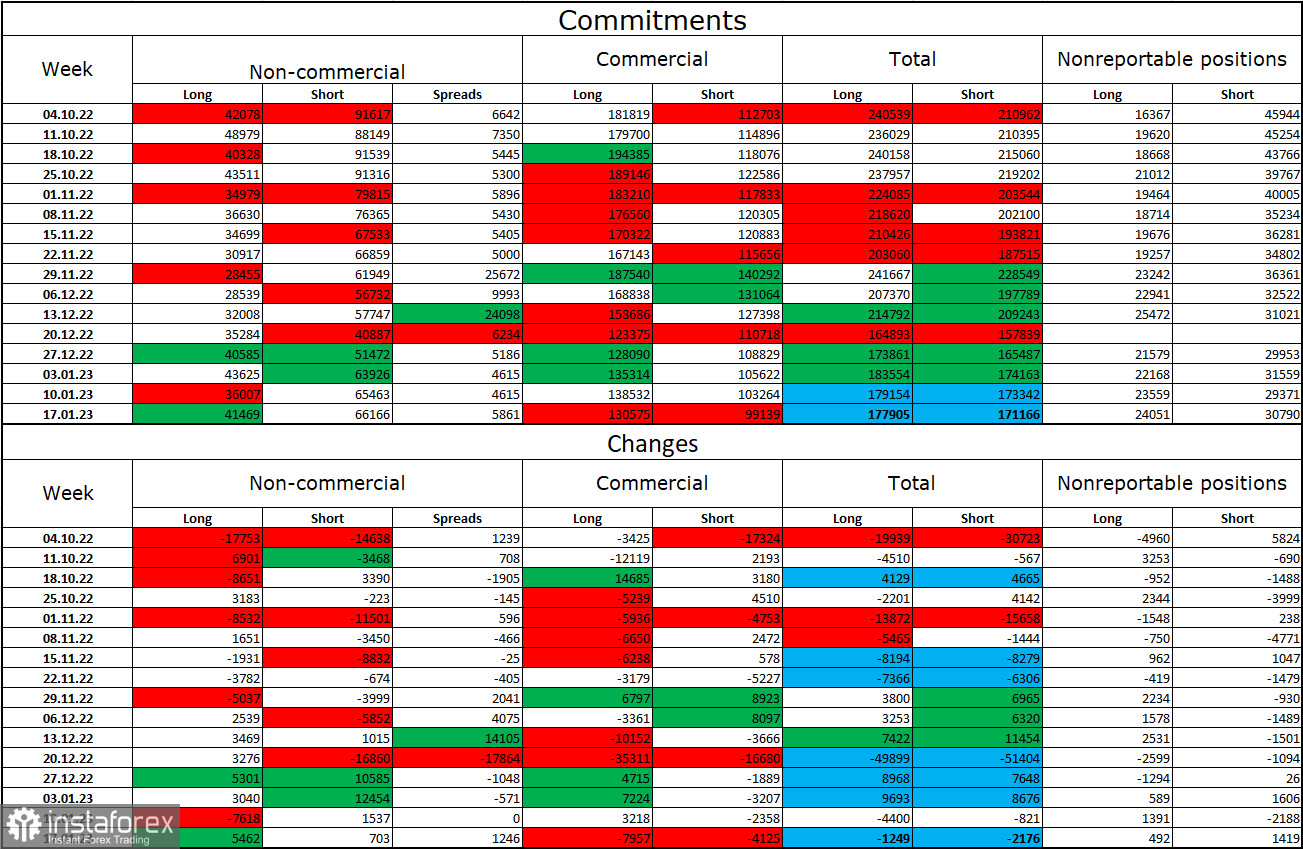

Commitments of Traders (COT):

The sentiment of the non-commercial category has become less bearish over the past week than a week earlier. The number of long contracts held by speculators increased by 5,462, whereas the number of short contracts - by 703. The general sentiment of major market players remains the same - bearish and the number of short contracts still exceeds the number of long contracts. Over the past few months, the situation has improved with the British pound. However, now the difference between the number of long and short ones in the hands of speculators is again almost twofold. Thus, the prospects for the pound have worsened again, but the sterling itself is steadily growing, possibly in sync with the euro. On the 4-hour chart, GBP/USD went out beyond a three-month upward corridor. This might prevent the sterling from growing.

Economic calendar for US and UK

UK: manufacturing PMI at 09-30 UTC

UK: composite PMI by Markit at 09-30 UTC

UK: services PMI at 09-30 UTC

US: manufacturing PMI at 14-45 UTC

US: composite PMI at 14-45 UTC

US: services PMI at 14-45 UTC

The economic calendar for the UK and the US contains a series of similar economic data. The information background will make little impact on market sentiment for the rest of the day.

Outlook for GBP/USD and trading ideas

We could go short on GBP/USD in case the price settles below 1.2342 in the 1-hour timeframe with targets at 1.2238 and 1.2112. Besides, sell positions could be opened at a drop off 1.2432 with a target at 1.2342. Alternatively, we could buy the currency pair during a rebound at 1.2342 with a target at 1.2432 or in case the price closes above 1.2432 on the 1-hour chart.