The general news background remains positive and contributes to growth of risk demand. Stock markets started the week in the green zone, global yields are rising. Oil added more than 1% on Monday, this is associated, among other things, with the beginning of the New Year celebrations in China, when the demand for gasoline traditionally grows. Copper, a major commodity for the technology sector, was also slowly but persistently gaining in price and remained close to a 7-month high.

The dollar index has changed a bit, with decent movement only witnessed in some G10 pairs. The market has not yet reacted to the US debt ceiling, considering the situation as a technical one, since such crises often end well.

The main events in the currency market are likely to start on Thursday, the release of important macro data may stimulate Federal Reserve officials to drop hints and make some changes in rate expectations.

NZDUSD

The Reserve Bank of New Zealand's room for maneuver is starting to narrow - a recession is approaching, and inflation is still high. Following a sharp drop in the NZIER Business Confidence index in the 4th quarter, the PMI report also did not add anything positive, in December, activity in the New Zealand manufacturing sector remained below the expansion zone at 47.2p, while growth to 52p was forecast. Investment plans are declining, firms' hiring intentions and overall business activity are declining. The leading indicators look very unconvincing and point to the risk that the economic momentum will decline further and faster than the RBNZ estimates.

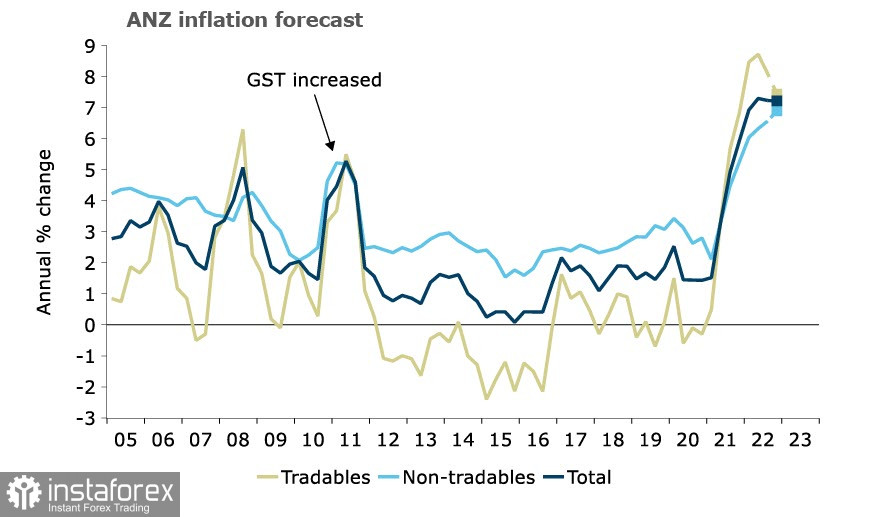

The question of inflation also remains open. Despite some slowdown in price growth in the 4th quarter, we must assume that this slowdown was due to external factors due to stabilization and a slight decrease in commodity prices, but as for the internal components of inflation, it remains at a high level and signs of slowdown not yet observed.

As a result, the RBNZ finds itself in a difficult position. Indicators suggest that the domestic components of inflation continue to get worse, while a recession is coming. Food prices are currently up 11.3% over the same period last year, the strongest annual increase in food prices since 1990.The ANZ Bank predicts that final Q4 data will show inflation at 7.2%.The report will be released today. If there is no deviation from the forecast, kiwi volatility will remain low.

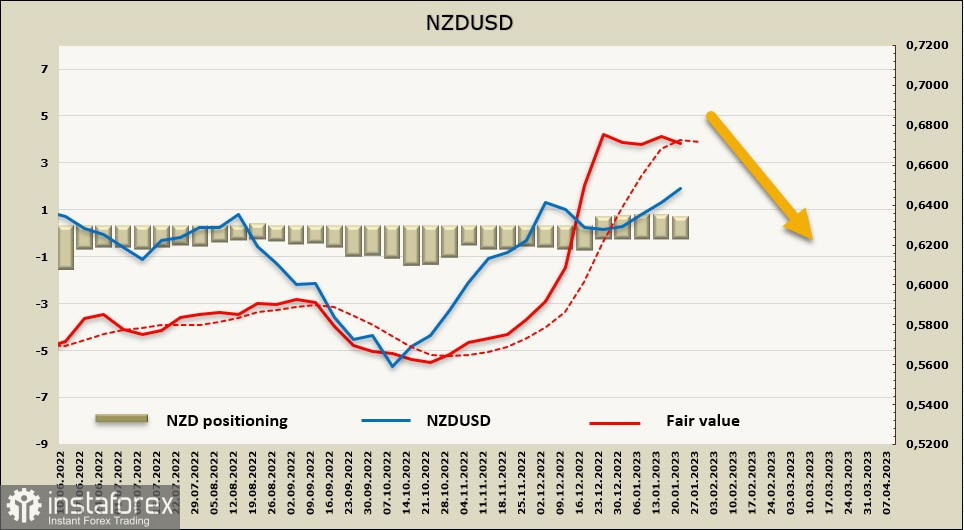

The outlook for the RBNZ rate is still unchanged at 75p in February and peaks at 5.75% by May. These expectations are already priced in, so any indication that the RBNZ might lower the rate will encourage the NZDUSD to turn down, and this turn of events cannot be ruled out.

The net long position on the NZD decreased by 79 million to 389 million during the reporting week, positioning is neutral with a minimal bullish bias, the estimated price has lost momentum and is making an attempt to turn down.

Apparently, a corrective decline is brewing in the NZDUSD pair. The kiwi cannot yet confirm the bullish momentum and test the strength of the local high at 0.6570. The main scenario is another attempt to consolidate above 0.6507 with a transition to a sideways range, consolidation below 0.6570, then a corrective decline. The chances of a successful test of the 0.6570 resistance have become noticeably smaller.

AUDUSD

The Australian economy also shows clear signs of slowing down. PMIs for December came out worse than expected, manufacturing 49.8p, services 48.3p, both in the contraction zone, the NAB business conditions index fell eight points to 12 in December, confidence was slightly up, but stayed in negative territory. But even the negative dynamic does not give much cause for concern yet as indices are still above their long-term average, largely due to the strong growth in the first half of 2022.

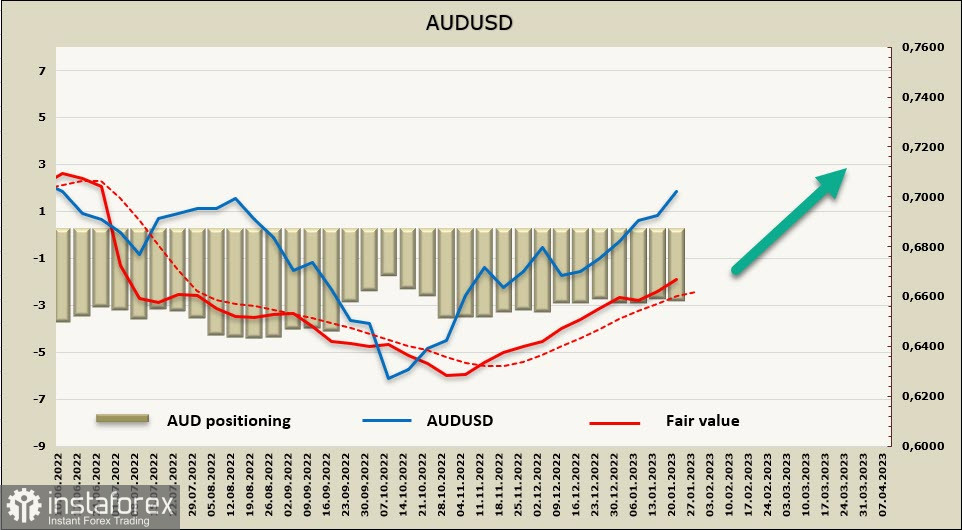

The Q4 inflation report will be released Wednesday morning and is expected to continue to rise, not just overall inflation but also core inflation (from 6.1% to 6.5%). Expectations are in favor of rising aussie demand as rising inflation is a guarantee that the Reserve Bank of Australia will not revise its rate plans.

The aussie's positioning is unchanged, with the net short position rising by 28 million to -2.349 billion over the week, but the settlement price continues to rise, which gives reason to expect that the aussie may strengthen further.

The target for AUDUSD remains the same - resistance area at 0.7100/40. The momentum has not been fully worked out yet, so chances of reaching the target look high.