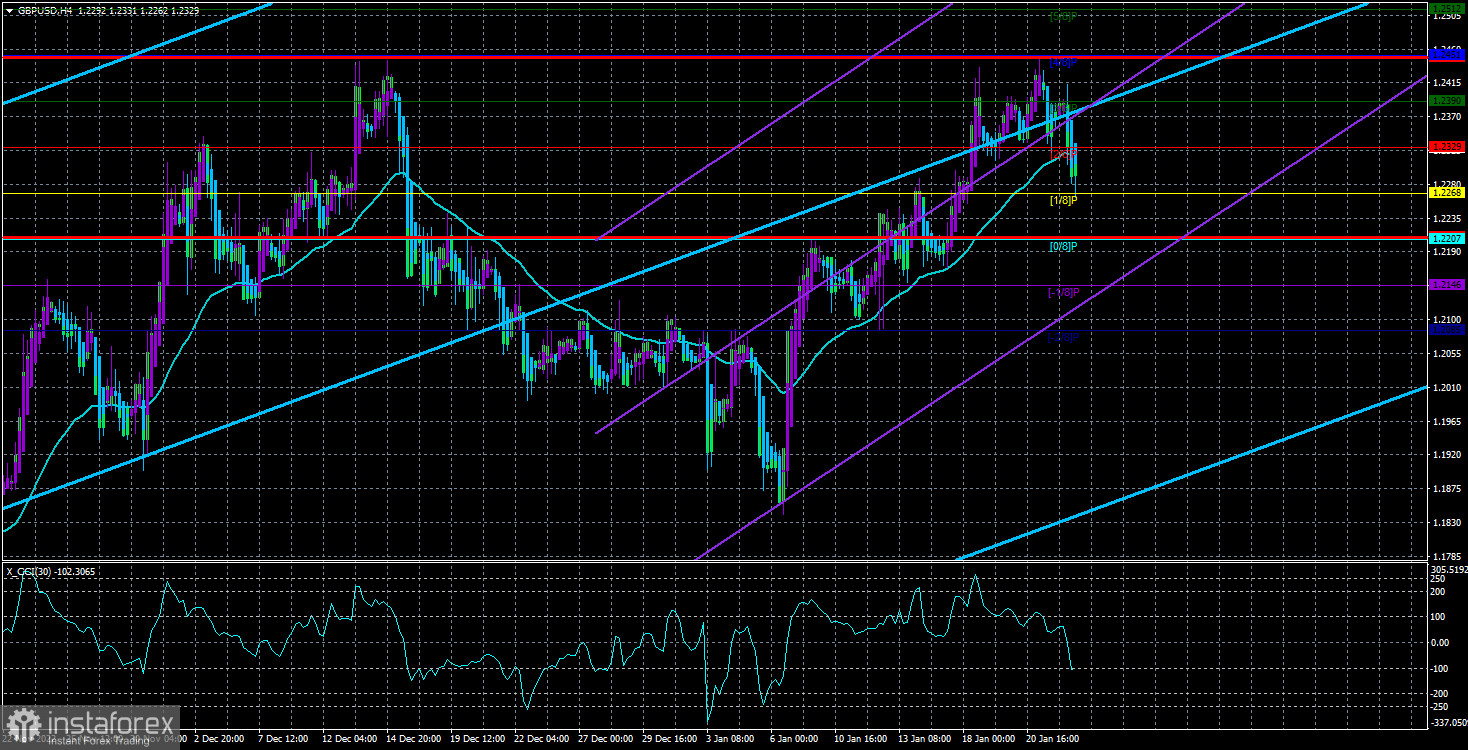

The GBP/USD currency pair started a new round of downward correction on Tuesday, and as a result, by the end of the day, it had fallen below the moving average line. Yesterday, we discussed the pair's inability to go over the level of 1.2451, where the latest rise in the value of the pound came to a stop, as well as the overbought CCI indicator, which frequently signals an impending negative reversal. These two technical elements were what made Tuesday successful. We want to point out right now that numerous reports have been released in the last day, all of which have been about commercial activity in the USA and the UK. However, it is impossible to categorically label these findings either positively or negatively.

UK business activity increased in the manufacturing sector while marginally declining in the services sector. However, neither index rose above the "waterline" of 50.0, indicating that the trend is still downward. Based on this information, how could the pound have been declining all day? Let's take a look at it from the other angle: although the manufacturing and services business activity indices in the US increased, they both continued to be below the "waterline," and by the time they were released, the downward trend had already ended. Here, the numbers don't add up. It turns out that either the market calculated all of these statistics using its logic, or these reports have absolutely nothing to do with what occurred.

Remember that we have been anticipating a significant decline in the value of both the pound and the euro for a very long time. It should not have been the only round of downward movement that we saw between December 14 and January 6. Therefore, we think it will make sense to start moving downward again after recovering to the level of 1.2450. We continue to have serious doubts that the Bank of England will hike the benchmark interest rate "to the bitter end." And if we are correct, there simply isn't any justification for the pound to increase. In just a few months, it has already gained more than 2,000 points, which is roughly half of what it lost during the most recent worldwide decline.

The BA rate is expected to rise higher, according to experts.

According to experts consulted by The Financial Times, the British regulator will probably keep raising the rate. There is no doubt in our minds, but how quickly will he complete it? Recall that there have been persistent reports about a further slowing in the UK's monetary policy tightening pace in recent weeks. Forecasts are more conservative due to worries over the British economy, although the UK's current inflation rate points to an increase of at least 2.0–2.5%. However, according to analysts, what matters most right now is BA's commitment to keeping the rate rising; they don't care how much higher it will go or how long it will take. They point out that the 0.1% increase in November's British GDP was a welcome surprise. Some even assert that because of this signal, we may infer that the British economy won't enter a recession in the fourth quarter, as practically predicted before by Rishi Sunak and Andrew Bailey. In addition, there have been 27,000 new jobs added, salaries are increasing at a record rate, and inflation is still at its highest point in 40 years. Everything would seem to be in favor of raising the rate by 0.5% further.

And if the Bank of England does not disappoint next week, the pound may continue to rise. However, we want to remind you that the rise of the pound in recent weeks and months may have been influenced by high market expectations for interest rates. Most likely, the market has already resolved this issue. Despite the Fed's continued rate increases, the dollar has not increased since the US inflation rate first began to decline. Although only slightly, inflation in Britain has already started to slow down twice. However, if we apply the fairness principle, the pound should have already stopped gaining value if this support factor was the only one available to it. We also caution against drawing quick judgments about the UK recession, as it is highly unlikely that it can be stopped. And it won't be judged until the middle of this year, at the earliest.

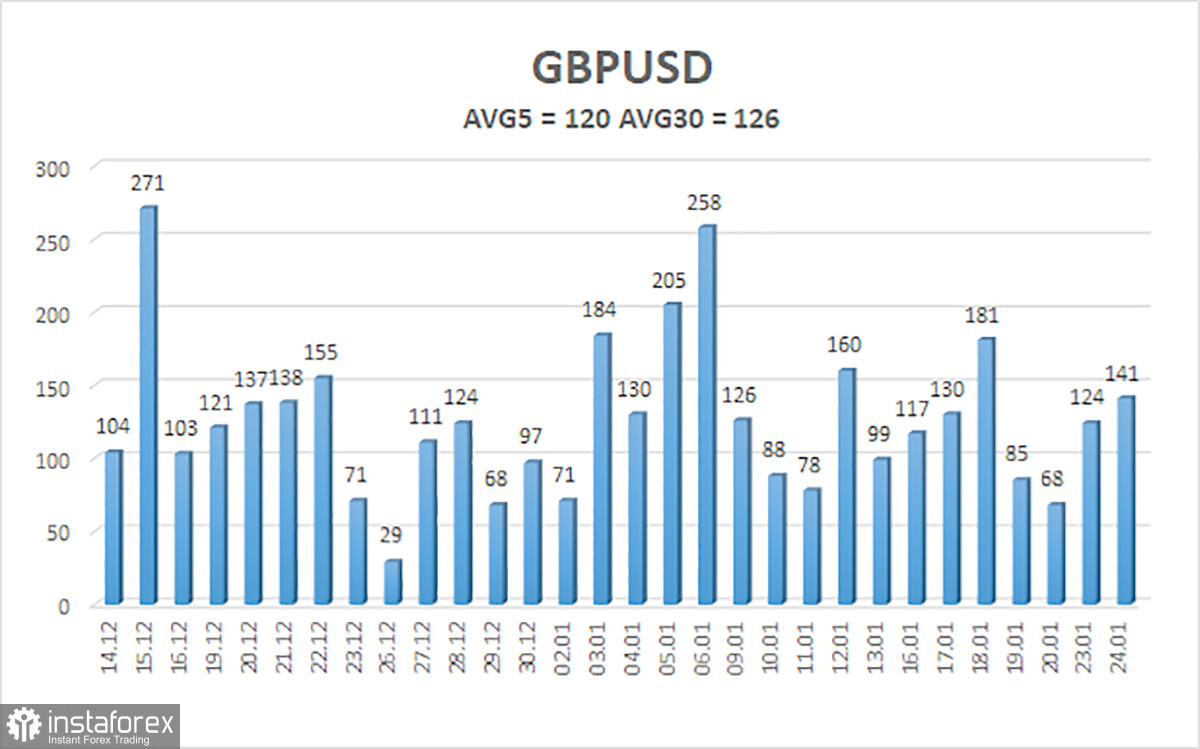

Over the previous five trading days, the GBP/USD pair has averaged 120 points of volatility. This figure is "high" for the dollar/pound exchange rate. Thus, we anticipate movement inside the channel on Wednesday, January 25, with movement being constrained by levels of 1.2209 and 1.2449. A potential continuation of the upward movement will be indicated by an upward turn of the Heiken Ashi indicator.

Nearest levels of support

S1 – 1.2268

S2 – 1.2207

S3 – 1.2146

Nearest levels of resistance

R1 – 1.2329

R2 – 1.2390

R3 – 1.2451

Trading Suggestions:

In the 4-hour timeframe, a significant correction in the GBP/USD pair began. Therefore, until the price is anchored above the moving average, it is possible to hold short positions with goals of 1.2268 and 1.2207. If the price is stable above the moving average line, you can start trading long with goals of 1.2390 and 1.2449.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

The short-term trend and the direction in which you should trade at this time are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.