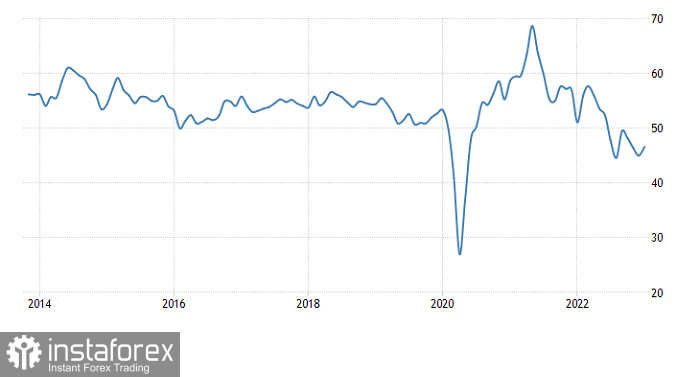

Overall, the pound has lost its traction yesterday, which given the preliminary estimates of PMIs in both the UK and the United States, is not that surprising. GBP ended up posting small daily losses after the data from the UK showed that S&P Global Services PMI fell to 48 in early January when it should have risen from 49.9 points to 50.0 points. The Manufacturing PMI, on the other hand, improved modestly to 46.7 from 45.3 in the same period, which was much better than the forecasted 46.0 points. But just at the expense of the Services PMI, the UK Composite PMI fell to 47.8 in January of 2023 from 49 in December, missing market expectations of 49.6.

UK PMI Composite:

On the other hand, the US PMIs came out significantly better than forecasts. The services activity PMI increased from 44.7 points to 46.6 points, though the growth to 45.0 points was expected. On the manufacturing side, instead of decreasing from 46.2 points to 45.0 points, the PMI came in at 46.8 points. As a result, the PMI Composite rose from 45.0 points to 46.6 points, whereas it had been expected to rise only to 45.1 points.

US PMI Composite:

The only surprise is that the pound started to rise when the US data was released. But apparently, this is due to its already sharp decline, which began literally with the opening of trading. So it is nothing but a technical rebound. Of course, another factor is the fall in US Treasury yields. And it's rather significant. In other words, investors are still waiting for the Federal Reserve to show signs of easing rate hikes. In general, there is a growing confidence in the market that next week's rate hike will be the last in the current cycle, and the U.S. central bank will begin to prepare the market for a subsequent interest rate cut. This is a crucial factor that will have a significant impact on the dollar. Moreover, the macroeconomic calendar is totally empty today, so investors will have to rely on other factors. Such as expectations of the Fed's actions.

GBPUSD showed speculative activity in the market. The price fell below the 1.2300, and then rolled back.

On the four-hour chart, the RSI technical indicator had already crossed the 50 line from top to bottom. This means an increase in short positions on the pound.

Moving averages on the H4 Alligator are intersected with each other which means a slowdown in the bullish cycle or sideways trading. On the daily chart, moving averages are directed upward.

Outlook

Keeping the price below the 1.2300 mark is necessary for a transition from a pullback stage to a full-fledged correction. Otherwise, we can't rule out going back to moving around 1.2300/1.2440.

Complex indicator analysis suggests mixed signals for the short-term due to a pullback followed by a state of being stagnant. In the intraday period, the indicators are focused on the recent breakthrough of the 1.2300 level. In the mid-term period, the indicators are reflecting the upward cycle from the autumn of 2022.