The AUD/USD currency pair updated a 5-month price high during the Asian session on Wednesday. For the first time since August last year, the Aussie tested the 71st figure, reacting to the inflation data. Recall that last Thursday, the AUD/USD pair was under strong pressure amid contradictory Australian jobs report. Then the market again started talking about a possible pause in raising the RBA rate, although the regulator has repeatedly denied such rumors.

However, today's release has dotted the i's, completely leveling some experts' dovish assumptions. Inflation in Australia is still rising, and by leaps and bounds.

In spite of records

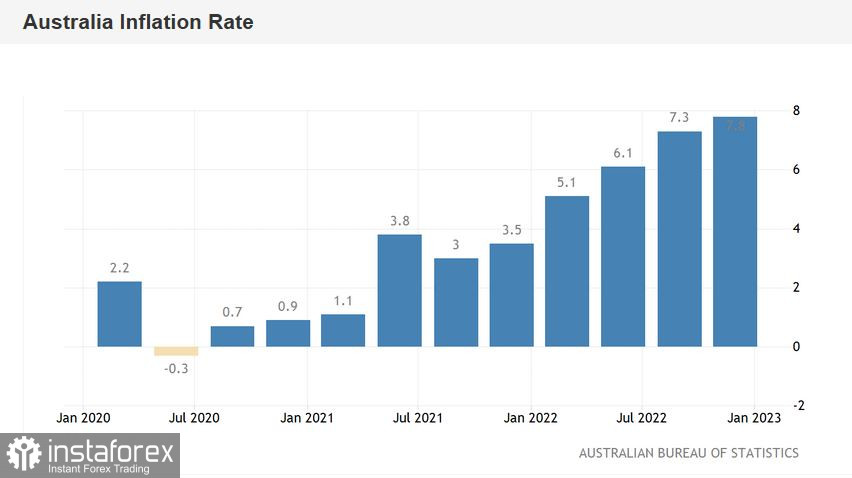

The inflation report really surprised. The monthly CPI jumped to 8.4% in December, compared to a forecast of 7.6%. The index has been rising steadily for the past two months. Note that the Australian statistical services began to publish monthly CPI relatively recently, so in this case it is incorrect to talk about records. But in any case, December's result significantly exceeded forecasts. As for Q4 as a whole, all indicators were also in the "green zone," exceeding experts' expectations. For example, in annual terms, the consumer price index rose to a record high of 7.8% (with the forecast being 7.5%). The indicator continued the upward trend, which it demonstrated throughout 2022. In quarterly terms the CPI was at 1.9%, while most experts forecast a decline to 1.6% (after 1.8% in Q3). Australian core inflation (weighted average CPI) in quarterly terms also exceeded forecasts and stood at 1.7%.

In other words, inflation is at 30-year highs and showing no signs of slowing down. This is a wake-up call for the RBA, which slowed down the pace of interest rate hikes last fall. Some representatives of the Australian regulator stated that the peak of inflation growth is already behind—in their opinion, the overall inflation in 2022 should not exceed 7.7%. As you can see, the CPI in annual terms exceeded this target—prices increased significantly for food, electricity and housing. At the same time, the annual inflation rate is three times higher than the rate of wage growth.

Recall that last Thursday's data on labor market growth in Australia was highly contradictory. On the one hand, the unemployment rate remained at 3.5%. On the other hand, market expectations were more optimistic—experts predicted a drop to 3.4%. However, another component of the report surprised (unpleasantly) the most: the employment growth rate. This indicator fell to -14,600, while the growth forecast was +27,000. But again, there is an important nuance to be considered here: the structure of this component indicates that part-time employment dropped significantly in December (-32,200), whereas the number of full-time employees increased by 17,000. It is well-known that full-time positions imply a higher level of wages and a higher level of social security than part-time jobs. Therefore, it is difficult to predict the RBA's reaction here, given this aspect. In any case, the Australian regulator will first need to respond to the continuing rise in inflation.

RBA outlook

Right now, we can only say with certainty that the Reserve Bank of Australia will continue to raise the interest rate—the issue of a possible pause is finally off the table. But given the record inflation figures, another question arises: will the RBA return to the 50-point rate of tightening monetary policy? After all, Reserve Bank Governor Philip Lowe has repeatedly said that the regulator can adjust its policy "if necessary." Only the market has always interpreted these words not in favor of the Australian dollar. So why can't the central bank also be flexible in the context of increased aggressiveness?

Of course, such a scenario looks unlikely today: many RBA members are overly concerned about the risks of side effects. But, judging by the dynamics of the Australian dollar, the relevant rumors will push the Aussie up in the near future. Buyers of AUD/USD have received an important trump card in the form of an inflation report, which has already allowed them to update the 5-month price high.

Conclusions

Now the upward prospects of AUD/USD will depend on the behavior of the U.S. dollar. The Aussie made an upward push, but another puzzle in the form of a weakening U.S. dollar is needed for an upward trend to develop. If the U.S. economic growth data (Thursday, January 26) and the core PCE index (Friday, January 27) disappoint the dollar bulls, the next price barrier on the horizon will be at 0.7200. At this price point, the upper boundary of the Kumo cloud coincides with the top line of the Bollinger Bands indicator on the W1 time frame.