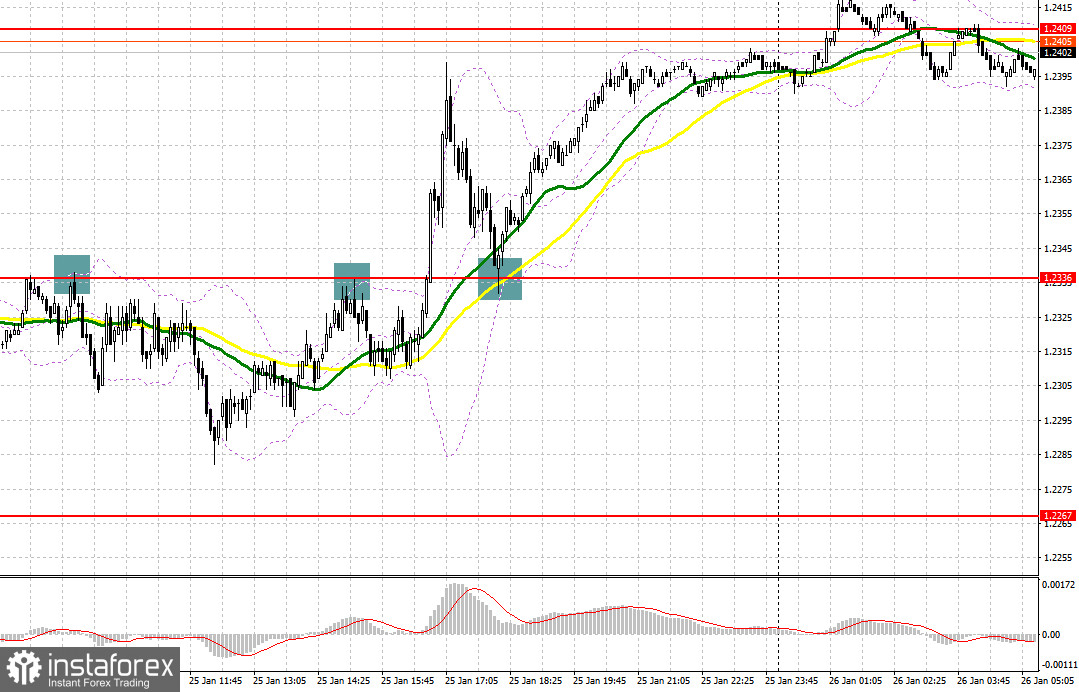

Yesterday, traders received several signals to enter the market. Let us take a look at the 5-minute chart to clear up the market situation. A rise and a false breakout of 1.2336 provided traders with a good sell signal, which led to a 50-pip drop. The second signal led just to a 20-pip decline. After that, the pair broke 1.2336. A downward test of this area gave a good buy signal. As a result, the pair climbed by more than 60 pips.

Conditions for opening long positions on GBP/USD:

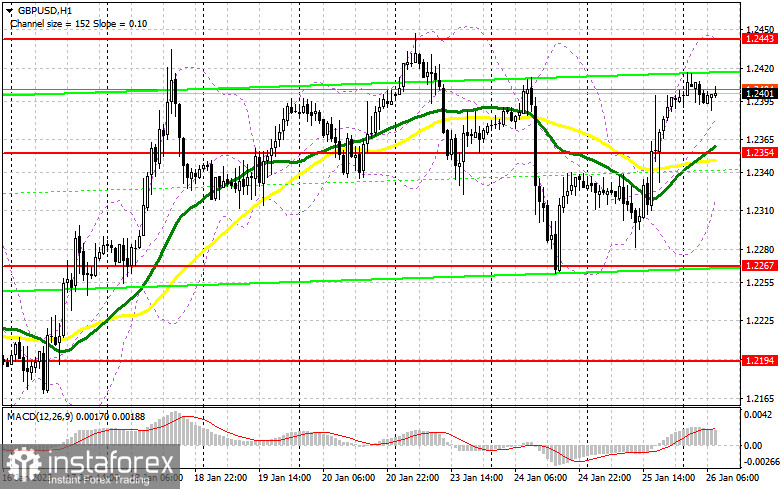

Today, the UK will disclose only its labor productivity data that will hardly affect the market sentiment. The pound sterling is likely to continue hovering within the sideways channel, trying to touch its upper limit. Only in the second part of the day, it will become clear whether the price will consolidate on the limit or not. This will be determined by the US GDP data. It will be wise to go long after a decline to 1.2354, the middle limit of the channel where there are bullish MAs. A false breakout of this level will allow the pair to move to 1.2443. If the price settles at this level and downwardly tests it, the pound sterling may jump to 1.2497. If it climbs above this level, it may surge to 1.2553, where it is recommended to lock in profits. If bulls fail to protect 1.2354, pressure on the pound/dollar pair will increase, thus causing a downward correction. That is why traders should be cautious when opening long positions. It is better to open long orders after a decline and a false breakout of the low of 1.2267. It is also possible to go long just after a bounce off 1.2194, expecting a rise of 30-35 pips within the day.

Conditions for opening short positions on GBP/USD:

Yesterday, bears fail to protect an important level of 1.2354. Now, they will do their best to regain control over the level. Otherwise, the bullish trend will continue. Now, sellers should primarily protect the resistance level of 1.2443, which also acts as this month's high. If the price jumps in the first part of the day, a false breakout of 1.2443 will be enough to form a sell signal with the target at 1.2354. A breakout and an upward test of this area will affect the bullish trend, forming a sell signal with the target at 1.2267. If the price tests this level, this could be considered an attempt to form a downtrend. The farthest target is located at 1.2194, where it is recommended to lock in profits. If the pound/dollar pair increases and bears fail to protect 1.2443, bulls will gain control over the market. In this case, only a false breakout of 1.2497 will give a short signal. If bears fail to be active at this level, the asset could be sold from the high of 1.2553 with the target located 30-35 pips lower.

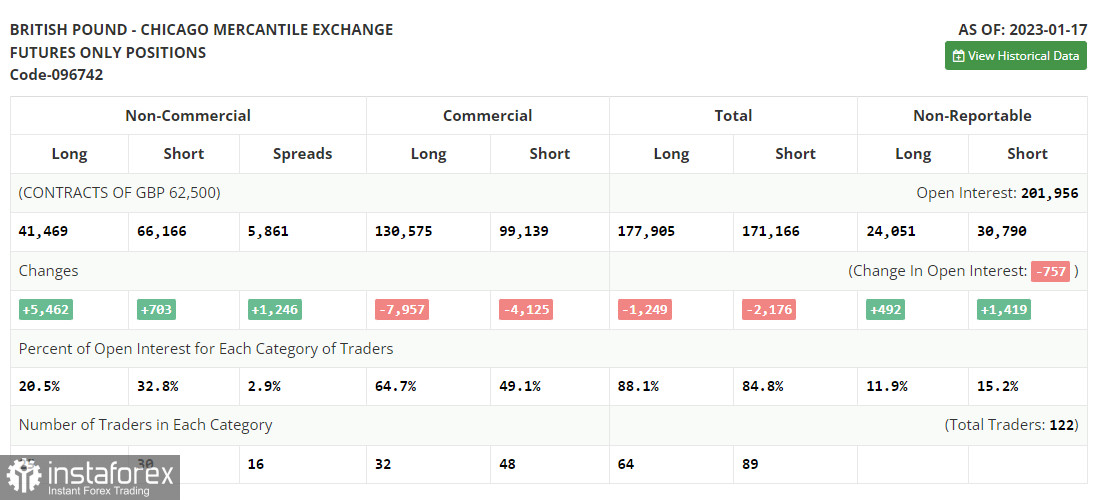

COT report

According to the COT report from January 17, the number of both long and short positions increased. It is important to understand that the Fed's aggressive policy is no longer as effective as it used to be. A slowdown in economic growth and a decrease in retail sales are the first signals of a looming recession in the US. At the same time, the Bank of England keeps combating inflation. Although inflation is a bit lower, it is still not enough for the regulator to alter its monetary stance. Therefore, aggressive tightening is likely to go on. This may allow the pound sterling to recoup previous losses. The recent COT report unveiled that the number of short non-commercial positions increased by 703 to 66,166, while the number of long non-commercial positions surged by 5,4628 to 41,469. Consequently, the non-commercial net position came in at -24,697 versus -29,456 a week ago. These are insignificant changes. Therefore, they are unlikely to affect the market sentiment. That is why traders should monitor macroeconomic reports from the UK as they may drop a hint about the plan of the BoE. The weekly closing price increased to 1.2290 from 1.2182.

Signals of indicators:

Moving Averages

Trading is performed slightly above 30- and 50-day moving averages, which points to bulls' attempt to continue the uptrend.

Note: The author considers the period and prices of moving averages on the one-hour chart which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair increases, the resistance level will be formed by the upper limit of the indicator located at 1.2336. In case of a decline, the lower limit of the indicator located at 1.2270 will act as support.

Description of indicators

Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

Moving average (a moving average determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

Bollinger Bands. The period is 20.

Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

Long non-commercial positions are the total number of long positions opened by non-commercial traders.

Short non-commercial positions are the total number of short positions opened by non-commercial traders.

The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.