The focus of traders today is the publication at 13:30 (GMT) of the block of the most important macro data for the United States.

Economists suggest that U.S. GDP in Q4 fell to 2.8% from Q3's 3.2%, while jobless claims rose last week. Among other data is the durable goods orders, which is estimated to be mixed.

Nevertheless, if today's U.S. macro data also turns out to be positive and if it exceeds the forecasted values, then it is worth waiting for the dollar to strengthen.

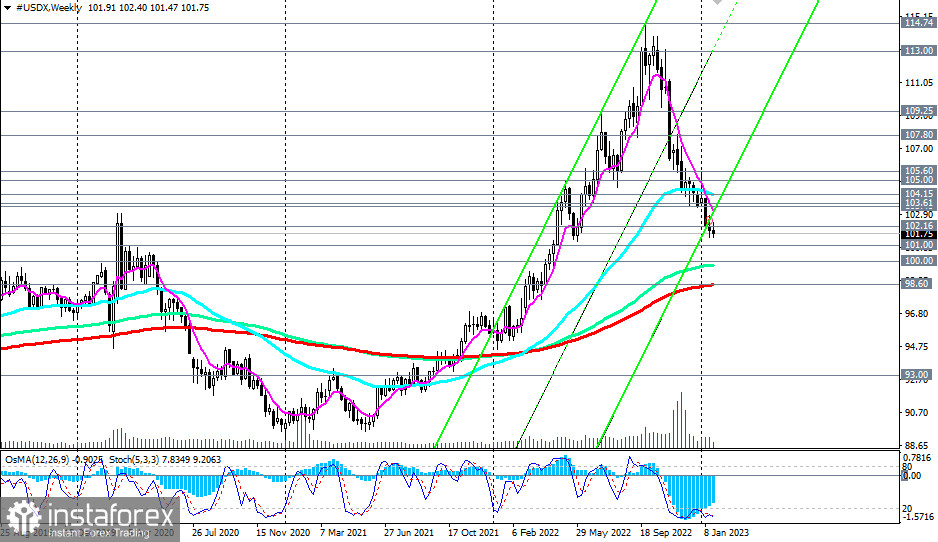

While market participants expect a further slowdown in the Fed's monetary policy tightening, the dollar remains under pressure, trading in the medium-term bear market zone, below the key resistance levels 104.15 (50 EMA on the weekly chart), 105.00 (200 EMA on the daily chart).

Today, DXY (CFD #USDX in MT4 trading terminal) still strengthened, slightly moving away from last week's local 9-month low of 101.26.

However, the DXY remains in a downward trend, making short positions preferable.

In case of further decline, the targets will be the key support levels 100.00, 98.60 (200 EMA on the weekly chart). The break of the 93.00 support level (200 EMA on the monthly chart) will indicate the breaking of the global bullish trend of DXY.

In an alternative scenario, DXY will resume growth, returning to the bull market zone, above the 105.00 resistance level. The first signal of the implementation of this scenario will be a breakout of the resistance levels 102.16 (200 EMA on the 1-hour chart), 103.00.

The breakout of the 105.60 resistance level (144 EMA on the daily chart) will confirm the scenario of the resumption of growth in DXY.

Support levels: 101.00, 100.00, 98.60, 93.00

Resistance levels: 102.16, 103.00, 103.40, 103.61, 104.00, 104.15, 105.00, 105.60, 106.00, 107.80, 109.25

Trading scenarios

Dollar Index CFD #USDX: Sell Stop 101.40. Stop Loss 102.20. Take Profit 101.00, 100.00, 98.60, 93.00

Buy Stop 102.20. Stop-Loss 101.40. Take-Profit 103.00, 103.40, 103.61, 104.00, 104.15, 105.00, 105.60, 106.00, 107.80, 109.25