Long-term perspectiv

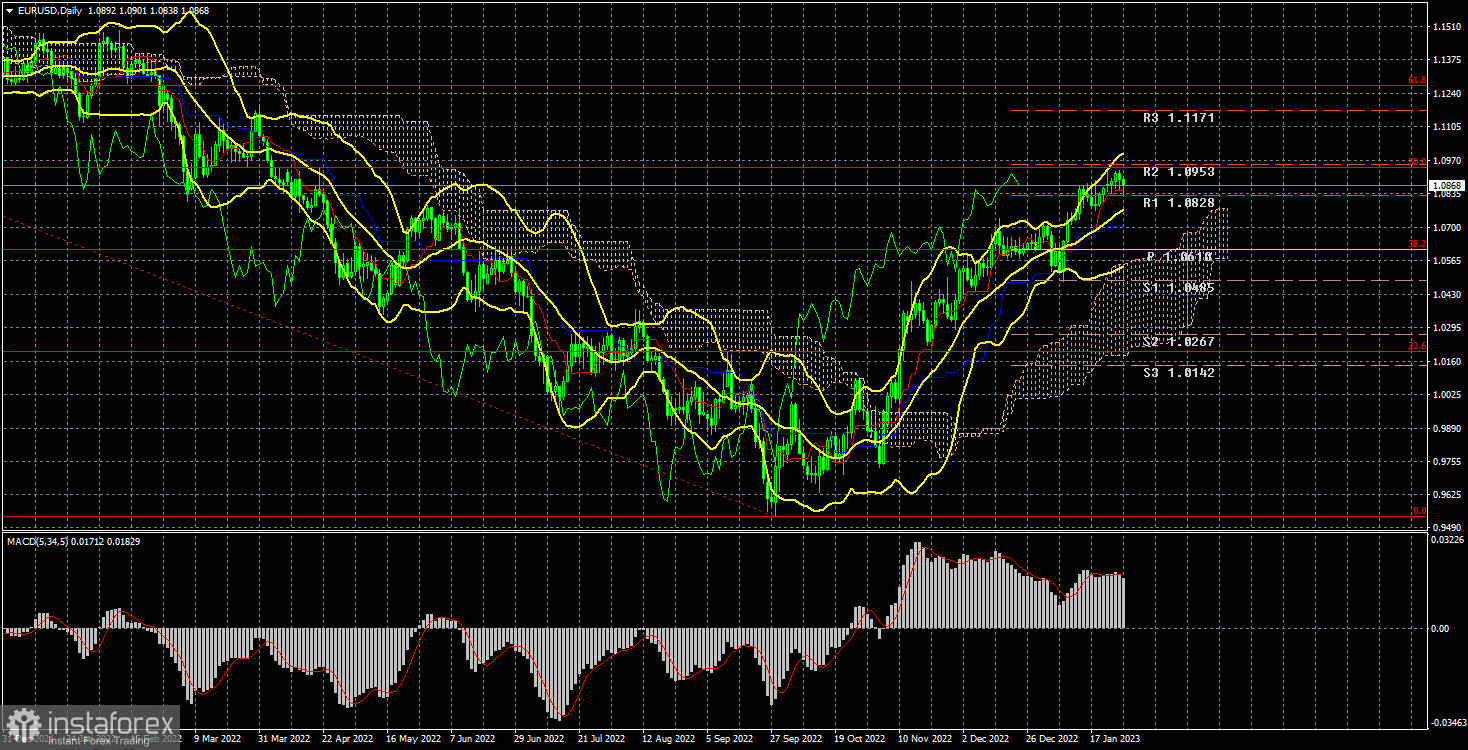

Following a correction to the crucial level, the EUR/USD currency pair resumed its ascent over the current week. Since the present technical disposition is most readily apparent on the 24-hour TF, we mentioned it in our most recent reviews. In other words, the euro has been rising for three months, adding 1200 points during that time, with a maximum correction of 300 points. In writings of all kinds, we have already said that we find such a movement to be illogical and unreasonable. Currently, the euro has already corrected almost 50% of the previous global slump, which developed over nearly two years. Additionally, the euro currency had legitimate reasons for a sharp decline throughout these two years (especially last year). But there aren't as many causes for it to develop anymore. The market continues to focus primarily on those elements that support the euro. If they aren't, it either discovers them or creates them. For instance, this week hardly had any noteworthy events or data. Christine Lagarde did not provide any new information, and the information regarding commercial activities in the US and the EU was also inconsistent. Significant figures on the fourth quarter's GDP and American orders for durable goods were only made public on Thursday. Although both of these reports came in substantially higher than expected, how did Thursday and the rest of the current week pan out? That's true; the euro will continue to increase.

Technically speaking, there is no reason to predict that the pair will tumble right now. In the same way as the price cannot be fixed even below the moving average on the 4-hour TF, there are no trade signals on the 24-hour TF as well. As a result, we continue to anticipate a significant downward correction, but this expectation is still only an educated guess at this point. However, if we consider the sole element that the market is presently considering, the euro can increase for a very long time based on it. Next week, we hope for a change in market participants' attitudes in the other direction.

COT Analysis

The recent COT reports on the euro currency are entirely consistent with market activity. The aforementioned image makes it very evident that from the start of September, the net position of significant players (the second indicator) has been improving. At about the same time, the value of the euro started to increase. Although the net position of non-commercial traders is currently "bullish" and growing virtually weekly, it is the relatively high value of the "net position" that now permits the upward trend's impending end. This is indicated by the first indicator, which frequently occurs before the end of a trend and on which the red and green lines are quite far apart. The number of buy contracts from the "non-commercial" category increased by 9.5 thousand during the reporting week, while the number of short positions decreased by 2,000. The net position consequently climbed by 7.5 thousand contracts. For non-commercial traders, there are currently 134 thousand more buy contracts than sell contracts. What remains to be seen is how much longer the major players will boost their long positions. Moreover, a downward correction should have started long ago from a technical perspective. We think this process can't go on for another two or three months. You need to "discharge" a bit, or alter, even based on the net position indicator. Sales are 52 thousand more if you look at the overall indications of open longs and shorts for all trading categories (732k vs. 680k).

Analysis of important events

This week, Tuesday and Thursday saw the release of all the significant data. A new set of Christine Lagarde's speeches was the only one that failed to provide the market with any fresh information. The ECB chief continued to reiterate that the regulator is prepared to tighten monetary policy to reduce inflation in the future. Along with these remarks, business activity indices were also released; across the European Union, at least one of the two indices rose back over 50. Although both indices in the US stayed below 50 in January compared to February, they did increase. The fact that the data on US economic growth and long-term goods orders reported on Thursday were objectively much better than expected did not, however, result in a significant appreciation of the US dollar. As a result, we may say once more that the market interprets any events and communications in any way it sees fit.

Trading plan for the week of January 30-February 3:

1) In the 24-hour period, the pair is placed above all of the Ichimoku indicator's lines, giving it a good possibility of continuing to rise. This is the trading strategy for the week of January 30-February 3: There is a strong likelihood that the pair will rebound from its current significant level of 1.0939 (50.0% Fibonacci), which has been hit at this time. If it is defeated, purchases with the targets of 1.1171 and 1.1270 will be permitted.

2) The sales of the euro/dollar pair are no longer significant. You should now wait for the price to return below the important Ichimoku indicator lines before thinking about shorting. There are currently no circumstances in which the US dollar can reverse the current trend. Although the euro is significantly overbought, market participants still have a strong urge to buy. But in the modern world, anything might happen at any time.

Explanations of the illustrations:

Price levels of support and resistance (resistance and support), Fibonacci levels – levels that are targeted when opening purchases or sales. Take Profit levels can be placed near them;

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5);

Indicator 1 on the COT charts is the net position size of each category of traders;

Indicator 2 on the COT charts is the net position size for the "Non-commercial" group.