The EUR/USD currency pair finished the week exactly as it had begun. Another ineffective attempt to correct, a further drop in the moving average, which has been closely related to the price for a long time with little volatility and complete disregard for macroeconomic data. It has been abundantly evident in recent weeks that the euro is only gradually rising. Although it was obvious that there were no growth-related factors (they had long since been exhausted, resolved, and taken into account), the market persisted in pushing the euro higher throughout this time. Two weeks ago, the CCI indicator moved into the overbought zone. Everyone may agree that, in general, the European currency has expanded too quickly, too much, and in direct opposition to its macroeconomic and fundamental basis. Since it has been correcting for a while, the market is genuinely anticipating the central bank meetings, which are slated to take place next week. And we're not sure what traders are anticipating. The choices the ECB and Fed will make have been known for at least two weeks. The most recent inflation report made it abundantly clear what to anticipate from the Fed. Nearly all of the members of the monetary committee at the ECB agreed that the rate would rise by 0.5% for two more sessions. Only Jerome Powell's performance has the power to spark interest. Given that she has performed five or six times in the past two weeks, Christine Lagarde's appearance is improbable.

So, the euro currency approaches the meetings of the ECB and the Fed in a great mood and at local highs. Remember that the pair has already corrected by 50% from the previous decline, which lasted for two years, at the current moment. While we have nothing against the euro's expansion, we think it should be pushed farther over time. Now, all we see is inertia: despite everyone knowing that the euro cannot increase in value, they all continue to buy it. As a result, from a technical perspective, you must buy because there is not a single trade signal available for purchase. The long-awaited slide will finally begin if the price drops by 50% on Monday below the moving average.

Meetings, GDP, unemployment, and commercial activity.

Due to three central bank meetings, the vast majority of traders are anticipating the coming week. However, only in the European Union will there be such a variety of news releases that a pair may "fly" all week. Let's begin sequentially. On Tuesday, the first GDP report for the fourth quarter will be released. The growth rate is expected to decline to 0%, however recent figures on the US and UK's GDP showed that they were higher than expected. Whether or not the recession has begun in the EU is the crucial question. This determines how the ECB will feel about the economy after its next two sessions. The manufacturing sector business activity index, the unemployment rate, and January inflation were released on Wednesday. The biggest factor will undoubtedly be the consumer price index, which experts predict will decline to 8.7-9.1% y/y. The more inflation falls, the faster the European currency will stop growing.

The ECB will meet on Thursday and resolve to increase all interest rates by 0.5%. Following the meeting, there will be a press conference and two remarks by Christine Lagarde. Since traders have already calculated the rate rise, as we have previously stated, there won't be much to respond to in this situation, and Christine Lagarde is unlikely to say anything novel. Certainly, the statements about being prepared to combat rising inflation and dedication to a tough monetary approach will be repeated. The service sector's January business activity index was released on Friday. In conclusion, a very intriguing week is in store for us, even without American events and data. Unfortunately, as is frequently the case, the market's response might not be as strong as what you were hoping for. We do not rule out the possibility that there won't be any extremely strong movements. The pair must also decide on their future course of action, and we think that it should be downhill. This is a crucial decision. We must nevertheless caution you that it is not worthwhile to sell if there are no related signals. Given the strong fundamental backdrop expected next week, there may be numerous indications, therefore you should proceed with caution while analyzing each one.

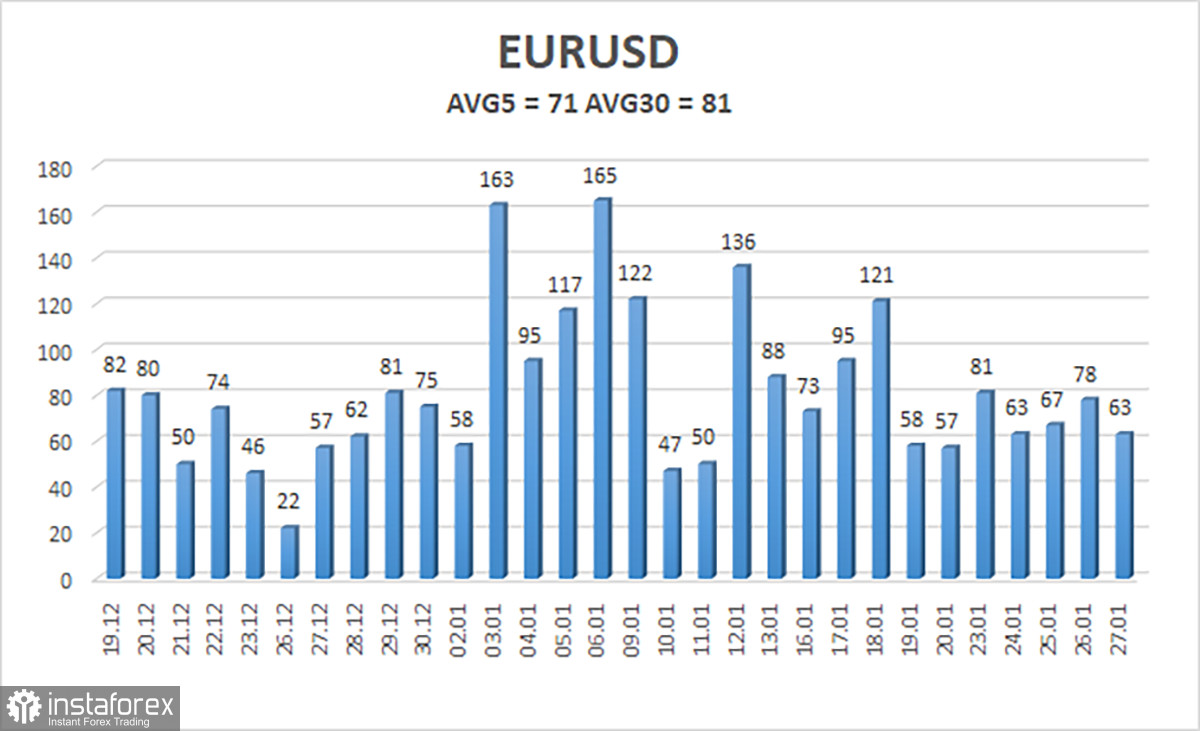

As of January 30, the euro/dollar currency pair's average volatility over the previous five trading days was 71 points, which is considered to be "normal." So, on Monday, we anticipate the pair to fluctuate between 1.0797 and 1.0939. The Heiken Ashi indicator's upward turn will signal a potential continuation of the upward momentum.

Nearest levels of support

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest levels of resistance

R1 – 1.0986

Trading Suggestions:

The EUR/USD pair is still moving upward. In the case of a price recovery from the moving average or when the Heiken Ashi indicator reverses higher at this time, long positions with targets of 1.0939 and 1.0986 might be taken into consideration. With goals of 1.0797 and 1.0742, short bets can be opened after the price is locked beneath the moving average line.

Explanations for the illustrations:

Channels for linear regression - allow us to identify the present trend. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.