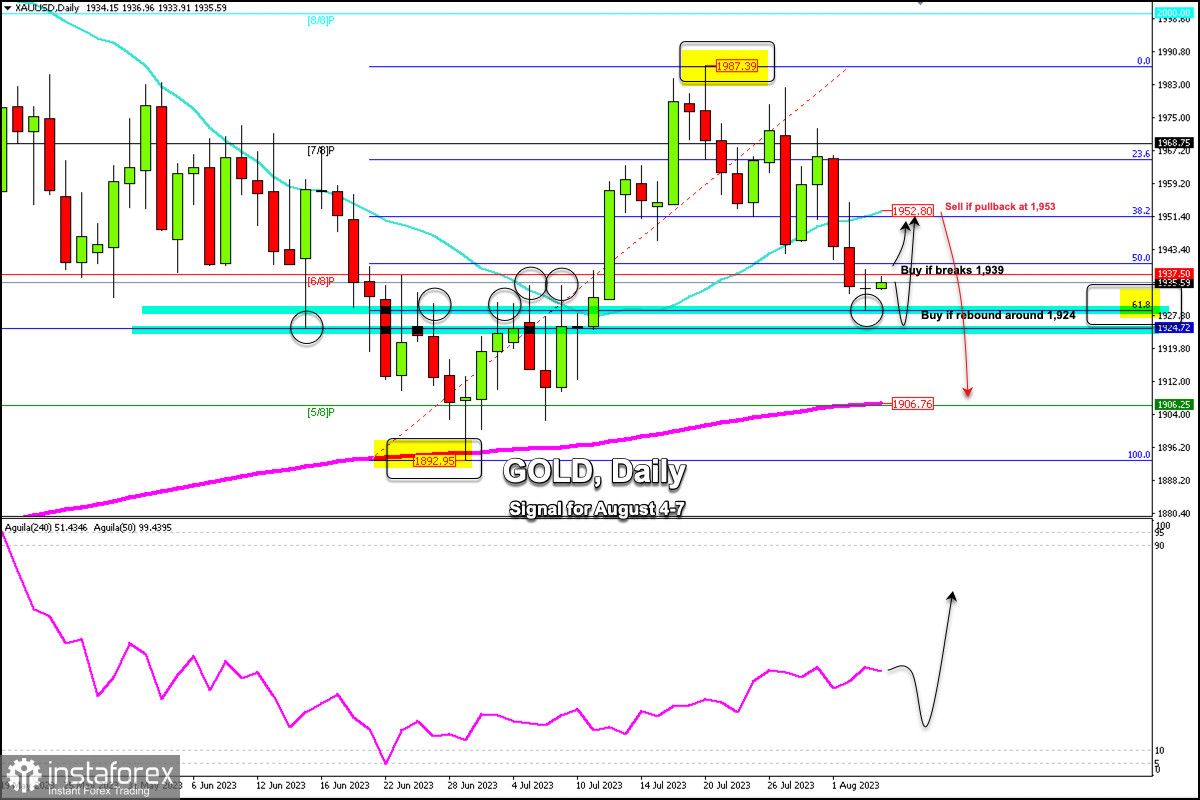

Early in the European session, gold (XAU/USD) is trading at 1,935.59 around the 61.8% Fibonacci retracement and below the 6/8 Murray (1,937). We can see a consolidation which is a sign of a strong movement ahead of the US nonfarm payrolls for July.

Gold has strong support spanning from 1,928 to 1,924. This zone could offer an opportunity for a bounce. Thus, the price could reach the 38.2% Fibonacci level, which coincides with the 21 SMA around 1,952.

In the next few hours, during the American session, the Non-Farm Payroll data will be published. This data is expected to be favorable for the United States. If the data comes out above 205K, we could expect a decline in gold towards the 1,920 area, where the weekly support (W_S1) is found.

If the Non-Farm Payrolls data is negative for the United States, we could expect a rebound above 1,937 (6/8 Murray). In this case, the metal could reach 1,943 and 1,952.

In the medium term, for a recovery, gold should consolidate above 1,953 (21 SMA) on the daily chart. Then, it could open the doors for a bullish rally to 23.6% Fibonacci and up to 7/8 Murray.

On the other hand, the 61.8% Fibonacci level (1,928) offered immediate support for gold. The break of this could accelerate its fall towards 1,920 and up to 1/8 Murray around 1,906 where the 200 EMA converges and is the last bottom of the metal and the defense of the bulls.

According to the daily chart, our trading plan for the next few days is to buy gold above 61.8% Fibonacci (1,928), with the target at 1,952 (21 SMA). Moreover, in case the price rebounds at around 1,920, it will be seen as a signal to buy.