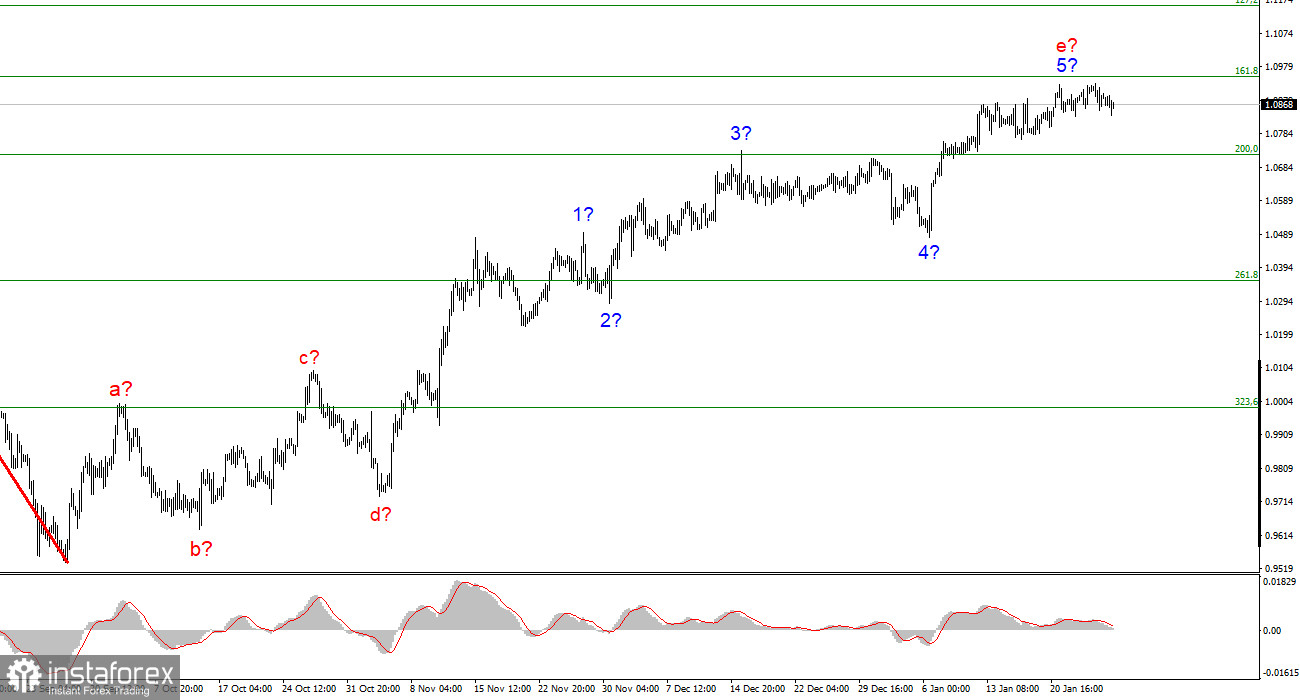

The wave analysis for the euro/dollar pair on the 4-hour chart has not yet changed and is still complex. The upward section of the trend has taken on a pronounced corrective form (although its size is more suitable for the impulse section) and is too extended. We have obtained the wave pattern a-b-c-d-e, in which wave e has a much more complex form than the first four waves. Since the peak of wave e is substantially higher than the peak of wave C, if the wave analysis is accurate, development on this pattern may be nearly finished. I'm still expecting the pair to fall because we're expected to develop at least three waves in this scenario. The demand for the euro either increased or remained consistently high throughout the first few weeks of 2023, and the pair was only able to deviate marginally from previously established levels during this time. Failure to surpass the 1.0953 level, which corresponds to the Fibonacci ratio of 161.8%, will be interpreted as a sign that the market is prepared to lower demand for the pair. Unfortunately, there is still a delay in developing the trend correction section.

The euro has not moved from its current position.

The euro/dollar pair fell by 25 basis points with a small amplitude on Friday. Recently, the amplitude has been considerably decreased, and its direction has changed to horizontal. As a result, the market indicates that it will not take risks before the ECB and Fed meetings. I'm waiting for a decline because I think it should start at some point. I believe that the market has already recovered from the ECB rate increase of 50 basis points, and everyone anticipates a Fed rate cut of 25 basis points, which has also been factored into the pricing for a long time. As a result, the present week is changing from one that may be intriguing and significant to one that is pretty common. Naturally, I'm anticipating a response to meetings or reports on inflation and payrolls, but it appears that the market won't base its decision on them.

The news background will be almost nonexistent on Monday. Only in Germany will a report on the GDP for the fourth quarter be released, which is expected to show no growth. The market is more interested in the European GDP report, which will be announced later this week. Therefore, it may not be as crucial as it first appears. It is difficult to anticipate a significant increase in the value of the euro given that European GDP growth is likewise predicted to be zero. I want to point out that the market is as prepared as it can be for central bank meetings. Members of the board of directors of the Fed as well as Christine Lagarde and other ECB members communicated often in January. It will be quite challenging for them to surprise market participants because they all openly discussed the monetary policy changes that would occur in early February. Based on the aforementioned factors, I do not believe that the euro should be raised this week, but the currency's devaluation also has no certain chance.

Conclusions in general

I draw the conclusion that the formation of an upward trend is nearing its completion based on the analysis. As a result, given that the MACD is signaling "down," it is now possible to consider sales with targets close to the predicted level of 1.0350, or 261.8% by Fibonacci. The potential for complicating and extending the upward section of the trend remains quite strong, as does the likelihood of this happening. The market will be ready to complete the wave e when an attempt to break through the 1.0950 level fails.

The wave analysis of the downward trend section notably becomes more complicated and lengthens at the higher wave amplitude. The a-b-c-d-e pattern is most likely represented by the five upward waves we observed. After the development of this section is complete, work on a downward trend section can start.