You require the following to open long positions on the GBP/USD:

There were no signals for entering the market in the first half of the day. Let's analyze the 5-minute chart to see what happened. The levels I predicted in the morning were not tested because of the market's low volatility. There were no entry points from which to open positions as a result. The technical situation was left unchanged for the rest of the day.

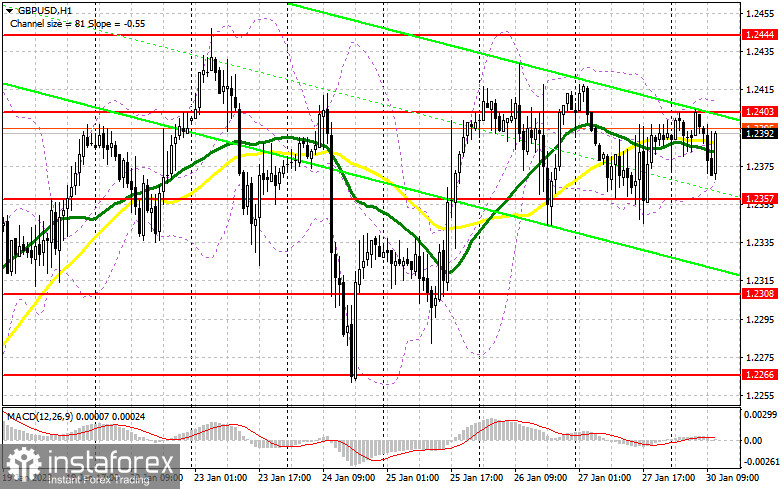

We may continue to anticipate that bulls will try to break through 1.2403 given the lack of news regarding the American economy, but we shouldn't forget to defend the nearest support level at 1.2357. Many traders now underestimate the Bank of England's level of aggression. The government will be forced to break once more and boost payments as a result of the rising cost of living and the ongoing wage rise strikes; this is a clear indication that high prices will remain the norm for some time to come. Additionally, it will force the regulator to keep raising rates. My entire attention is still on the crucial nearest support level of 1.2357. Having missed this mark, it will be possible to firmly wave goodbye to the pound's future growth, at least until the next Federal Reserve System meeting. We can expect bullish momentum to develop and take us back to 1.2404 (a new resistance that emerged after last week) if a false signal forms at 1.2357. The demand for the pound will increase if consolidation occurs above this area since bulls will have another opportunity to update the monthly maximum above 1.2444. A top-down test and an exit above this level will open up growth opportunities above 1.2487, where I lock profits. If the bulls are unable to complete the tasks and miss 1.2357, the situation becomes unmanageable. Increased pressure on GBP/USD will change the market's direction and cause the emergence of a strong downward correction. Starting long positions on a decline and a false breakout close to the minimum of 1.2308 is preferable to rushing into purchases as a result. To achieve a drop of 30-35 points within a day, I will buy GBP/USD right away on the rebound only from 1.2265.

You require the following to open short positions on the GBP/USD:

Bear activity is also still fairly low. The sellers are now concentrating on regaining control of the level of 1.2357, but don't overlook the protection of the new resistance at 1.2403. Only the formation of a false breakout at 1.2403 will signal the opening of short positions in the event of an upward movement against the backdrop of the lack of US data, with the expectation of a new and more active movement down to 1.2357. Bullish sentiment will be undermined by a breakout and reverse test from the bottom up of this range, which would result in a sell signal and a move to 1.2308. The area of 1.2266 will be my farthest target, and that's where I'll set the profit. The bullish trend will advance due to the possibility of GBP/USD growth and the lack of bears at 1.2403 in the afternoon. In this instance, the sole entry point for short positions is a false breakout near the monthly maximum of 1.2444. If there isn't any activity, I'll sell GBP/USD right away at its maximum price of 1.2487, but only if I believe the pair will decline another 30-35 points during the day.

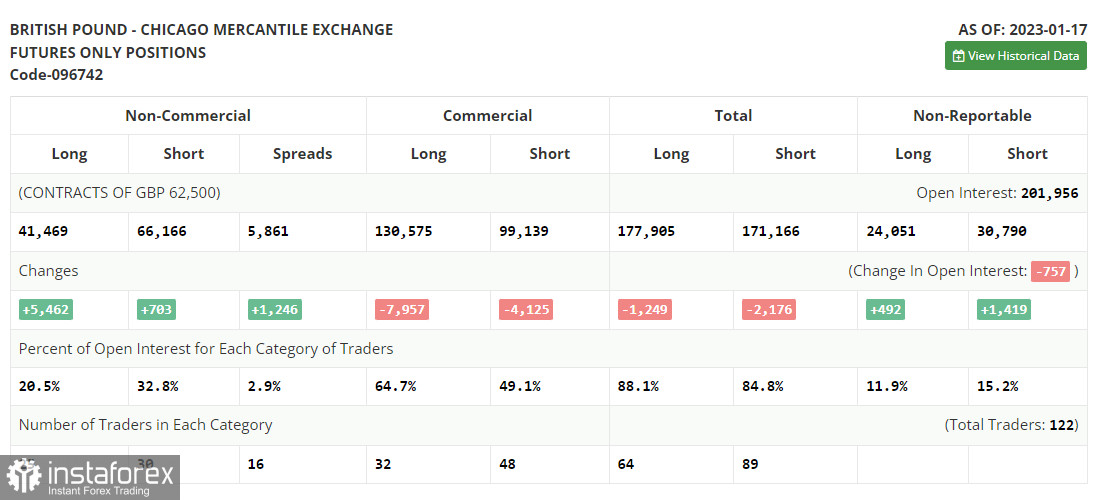

There was an increase in both short and long positions in the COT report (Commitment of Traders) for January 17. It is important to realize that the Federal Reserve System's formerly effective aggressive strategy is no longer working and that the economy slowing down and a sharp drop in retail sales are the first indications of a possible recession by the end of this year. At the same time, the Bank of England in the UK is still dealing with high inflation, although, according to the most recent report, it has fallen. This is not sufficient to somehow change the regulator's opinion. Rates are projected to continue rising quickly, which will help the pound make up for losses it suffered when paired with the US dollar last year. According to the most recent COT report, long non-commercial positions immediately increased by 5,468 to the level of 41,469, while short non-commercial positions increased by 703 to 66,166, resulting in a decrease in the negative value of the non-commercial net position to -24,697 from -29,456 a week earlier. We will continue to closely study the UK's economic data to make inferences about the Bank of England's future policies because such insignificant changes have almost no bearing on the power equation. In contrast to 1.2182, the weekly ending price increased to 1.2290.

Signals from indicators

Moving Averages

Trading occurs in the area of the 30- and 50-day moving averages, which suggests market uncertainty.

Notably, the author considers the time and prices of moving averages on the hourly chart H1 and departs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's upper limit, which is located at 1.2413, will serve as resistance in the event of growth.

An explanation of the indicators

• Moving average (moving average, determines the current trend by smoothing volatility and noise). Period 50. It is marked in yellow on the chart.

• Moving average (moving average, determines the current trend by smoothing volatility and noise). Period 30. It is marked in green on the graph.

• MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands (Bollinger Bands). Period 20

• Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.