The pound/dollar pair opened a new trading week with low volatility. The pair has been trading near its local highs for several weeks already. Meanwhile, the possibility of the double top formation is becoming lower. However, there are reasons to say that the situation will settle this week.

In our article devoted to the euro/dollar pair, we mentioned that the Fed's and the ECB's key rate decisions are likely to meet the forecasts. Only the rhetoric chosen by Christine Lagarde and Jerome Powell may change. However, the situation with the Bank of England is more difficult. It is still unclear how high the regulator is planning to raise the benchmark rate. The Fed usually announces its plans even if they are altered. Meanwhile, Andrew Bailey several times said that the key rate would rise as much as needed. There were a lot of comments about a recession, budget deficit, and other issues. Thus, there is great doubt that the BoE will be able to raise the interest rate as much as needed.

On Thursday, the BoE may surprise everyone by raising the benchmark rate by only 0.25%. This variant is quite possible since the regulator's officials did not provide any accurate figures in January. It may even rise less than expected. Notably, at the last meeting, two out of nine members of the monetary committee voted against any tightening. This means that over time and with the deterioration of the economic situation, their number may increase. It seems that the British economy miraculously managed to avoid falling in the fourth quarter. However, even such a positive moment absolutely does not mean that a recession will be avoided in 2023.

Moreover, there is a lot of information about the dissatisfaction of the British people with the Bank of England and the actions of the government. Many representatives of ordinary professions are on strike and threatened with layoffs, while their real incomes are falling from month to month. This is clearly reflected in the inflation and salary reports. According to the latest data, wages grew by 6.5% per year and inflation exceeded 10%. Naturally, people with high incomes do not pay much attention to this. Those with lower incomes cannot help but pay attention to this.

In addition, the government believes that the wage growth is excessive, and it may fuel inflation in 2023. Inflation has not even really started to decline yet. However, the government of Rishi Sunak has already raised taxes. Of course, it has not affected the most low-income segments of the population, but in any case, the situation is alarming.

Inflation

Speaking about the upcoming meeting of the Bank of England, we should mention the inflation rate in the UK. Thus, inflation has decreased by 0.6% over the past two months. However, this could hardly be called a considerable drop. By the end of January, inflation may drop by another 0.2%, analysts suppose. The report will be released on February 15, that is two weeks after the meeting. We believe that with such an inflation rate, which is also slowing down very slowly, the Bank of England should raise the interest rate to at least 5-6%. In any case, if the regulator signals its readiness to maintain the current pace of monetary policy tightening, this may boost the British pound. Otherwise, there will be no reason to buy the pound.

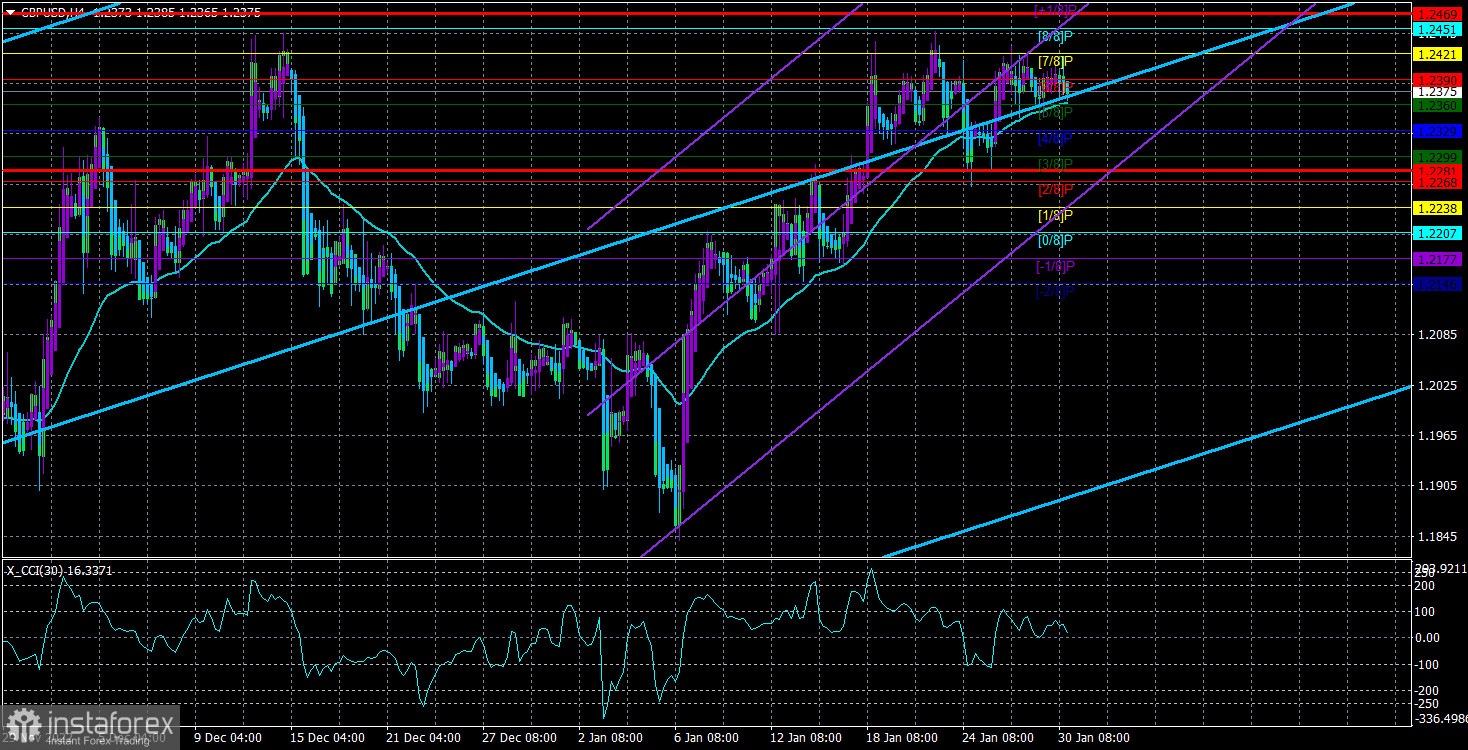

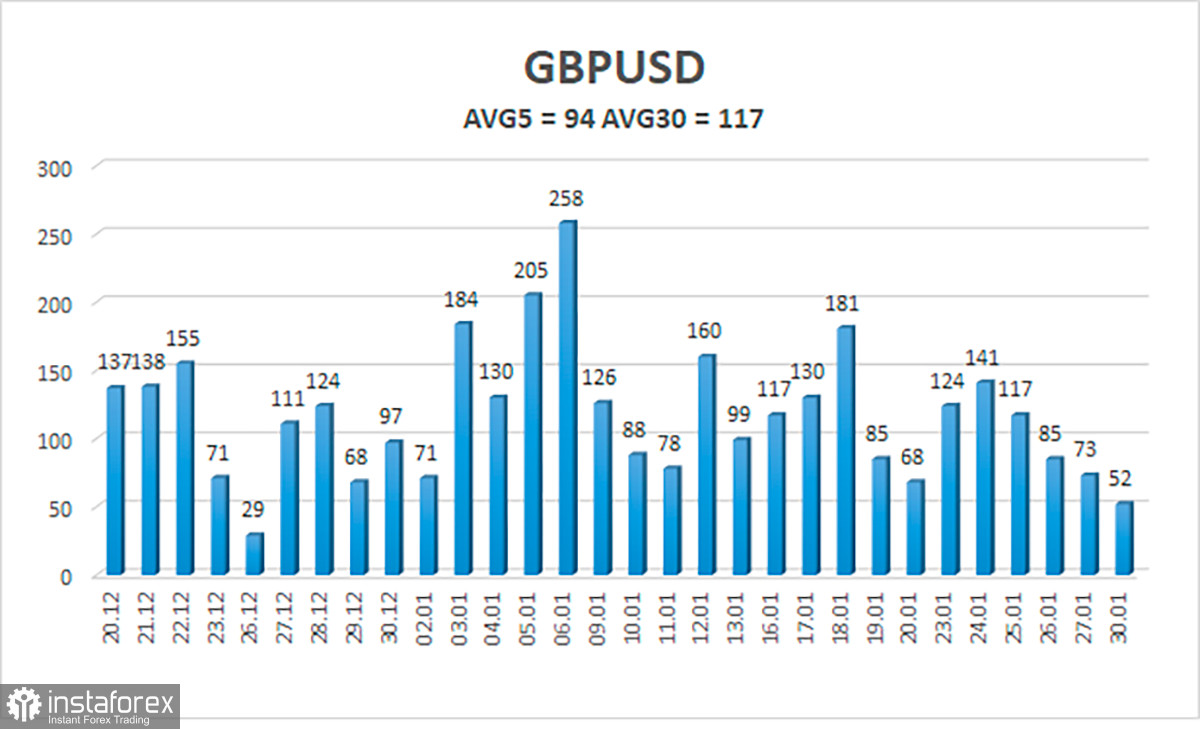

In the last five days, the average volatility of the pound/dollar pair totaled 94 pips. It is an average reading for the trading instrument. On Tuesday, the pair is expected to hover within the channel limited by such levels as 1.2281 and 1.2469. If the Heikin-Ashi indicator upwardly reverses, this will signal a new attempt to launch an uptrend.

The nearest support levels:

S1 – 1.2390

S2 – 1.2329

S3 – 1.2268

The nearest resistance levels:

R1 – 1.2451

R2 – 1.2512

R3 – 1.2573

Trading recommendations:

On the four-hour chart, the pound/dollar pair is still above the MA. That is why now, traders may consider long positions with the targets at 1.2451 and 1.2469. However, the current flat movement makes traders be cautious. It is possible to go short below the MA with the targets at 1.2281 and 1.2268.

What we see on the chart:

Linear regression channels help determine the current trend. If both are headed in the same direction, the trend is strong now.

A moving average (settings 20.0, smoothed) determines a short-term trend and trading direction.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator: its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal will take place soon.