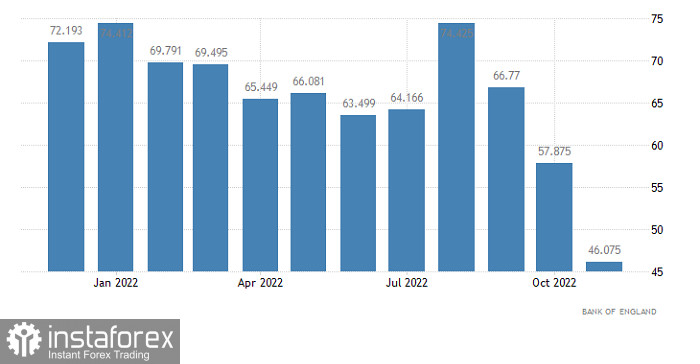

The market remains stagnant. However, yesterday, closer to the opening of the US trade, the pound sterling started falling. The currency was losing value during the whole session. Before that, the British pound approached the upper limit of the range, where it has been trading for more than a week. Unlike the euro, the pound sterling failed to touch the lower limit. However, it may reach it amid data on the UK lending market. Forecasts point to a slowdown in the growth pace, which is a negative factor. In particular, the number of mortgage approvals should total 45,000, whereas, in the previous month, the number of approvals was 46,100. The UK mortgage lending may decline to 4,0 billion from 4.4 billion in the previous month. Mortgage lending has a direct influence on the real estate market, which is very important for the British economy. Construction and real estate transactions account for at least 20% of the British economy. This sector plays the same role as retail sales.

UK Mortgage Approvals

However, during the US trading session, the pound sterling may start rising to the upper limit of the channel. The fact is that the market cannot stand still. It always moves at least within narrow ranges. Ahead of the upcoming meetings of the key central banks, no one wants to take a risk. Once the price touches the lower limit, it will start climbing to the upper one.

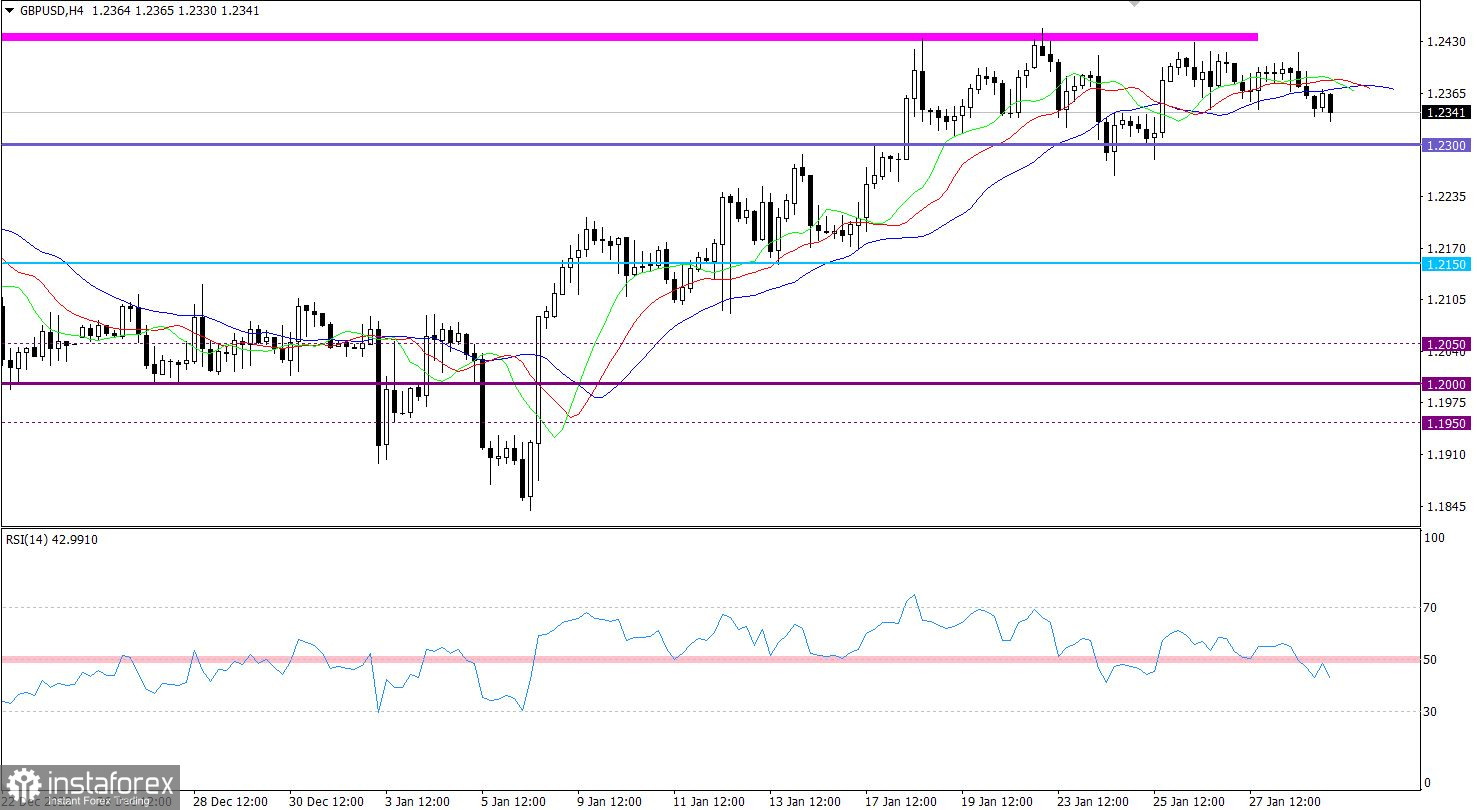

Although the pound sterling opened a new trading week with a decline against the US dollar, the quote is still hovering within the range of 1.2300/1.2440.

On the four-hour chart, the RSI technical indicator is hovering in the lower area of 30/50, which reflects the price's movement to the lower limit of the channel. On the daily chart, the indicator is in the upper area of 50/70, which corresponds to the trend.

On the four-hour chart, the Alligator's MAs intersect each other, thus pointing to stagnation. On the daily chart, the indicator points to the bullish sentiment since MAs are headed upwards.

Outlook

It is quite possible that traders focused on the lower limit of the range since the price is falling. The currency's further movement will depend on its behavior near 1.2300. At the moment, traders choose either a rebound or breakout strategy.

In other words, a downward movement will become possible if the price settles below 1.2300 in the four-hour period. This may lead to a formation of a full-scale correction.

Traders will consider the upward scenario if the price consolidates above 1.2450 on the four-hour chart. This action will point to the prolongation of the upward cycle.

In terms of the complex indicator analysis, we see that in the short-term and intraday periods, the indicator is providing mixed signals because of the flat movement. In the mid-term period, the indicator is moving towards the upward cycle launched in the autumn of 2022.