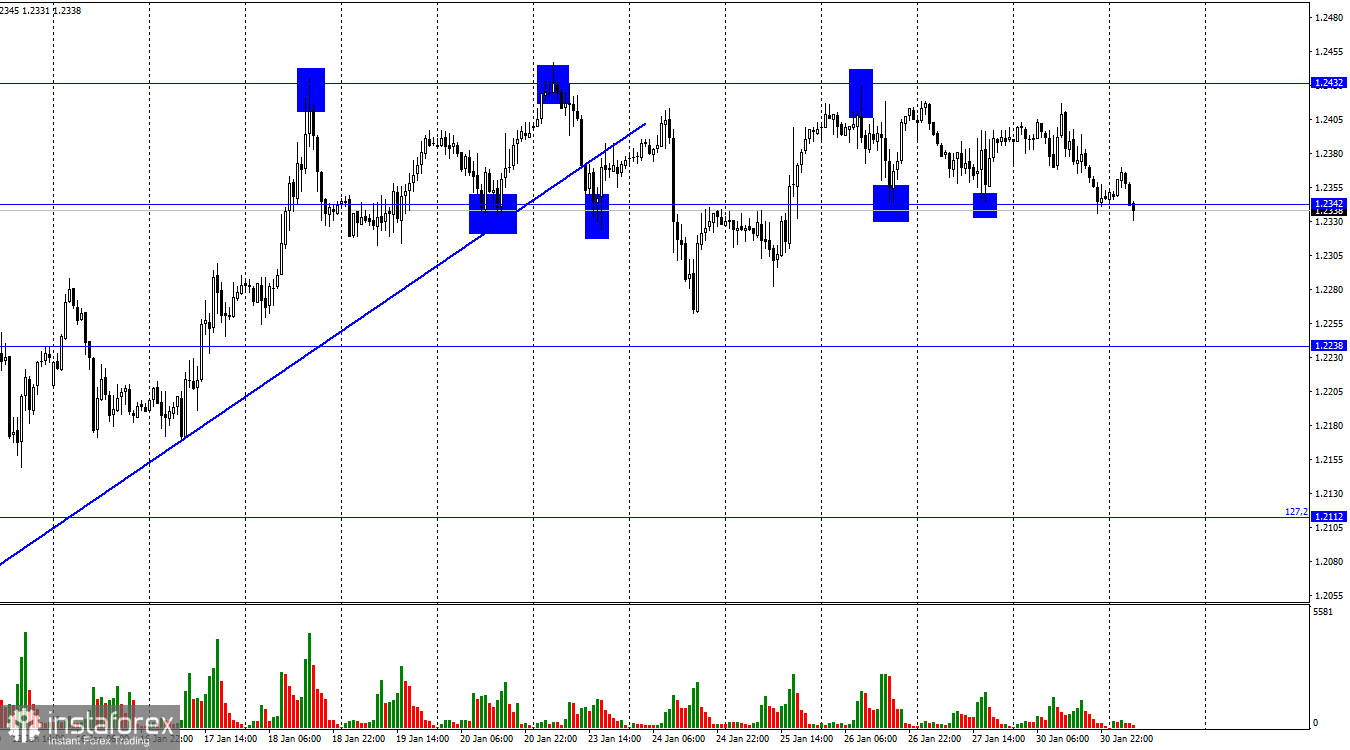

With the exception of two days last week, the pound-dollar pair has been trading between 1.2342 and 1.2432 for two weeks. This is similar the euro-dollar pair. The euro and the British pound reached their highs in the current market conditions but traders are waiting for important central bank meetings on Wednesday and Thursday, as well as for labor market statistics on Friday. The outcome of the meetings and Nonfarm Payrolls report will determine which direction the pair will follow. Notably, bulls may have used up all their potential but some hawkish decisions or announcements from the Bank of England might bring back the confidence lost lately. We have a lot of time until Wednesday evening when the outcomes of the FOMC meeting will be published. The graphical analysis does not allow assuming anything else but a sideways movement. So, the pair may remain in the range of 1.2342 - 1.2432 until tomorrow evening.

Many has already said a lot about the possible increase of the interest rates of the Bank of England or the Fed. Now we just need to wait for the official results, after which we can draw conclusions on the reaction of traders. Today, the economic calendar has no important etries, so it will be difficult for the pair to leave the range mentioned above.

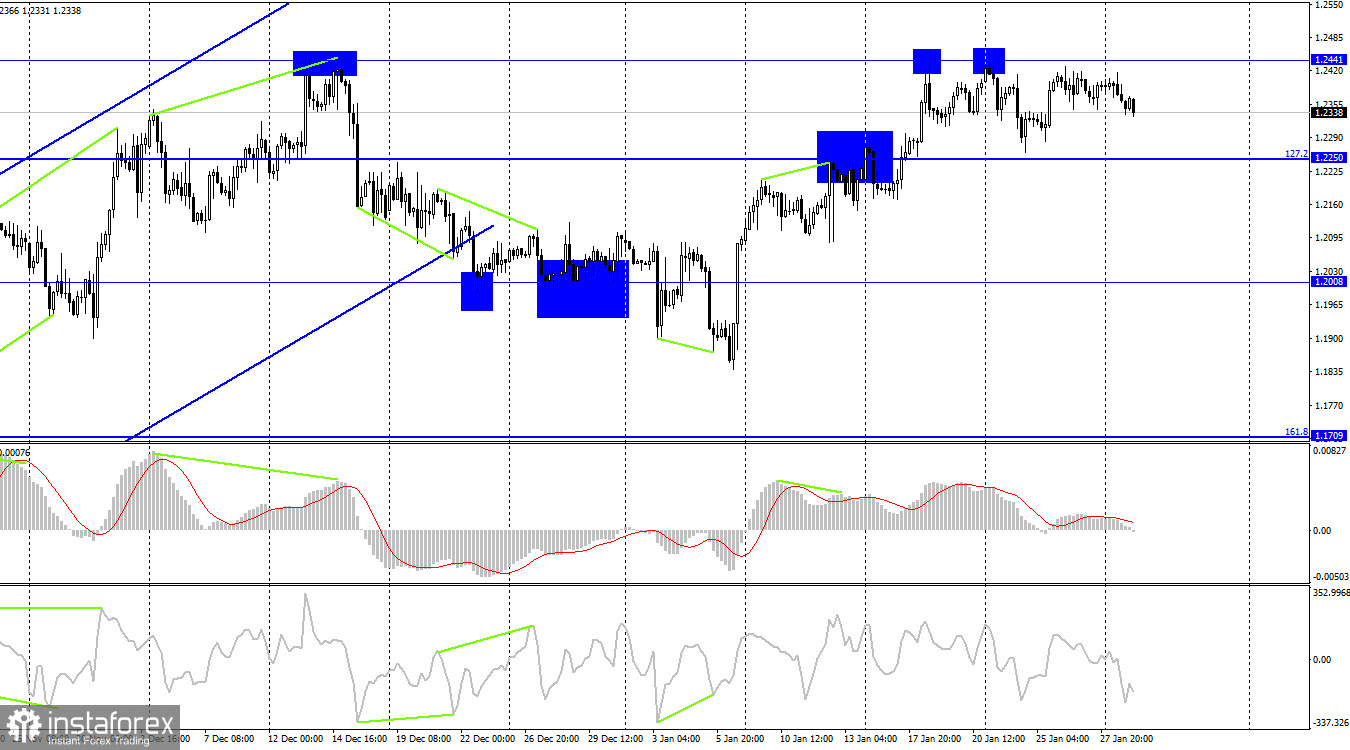

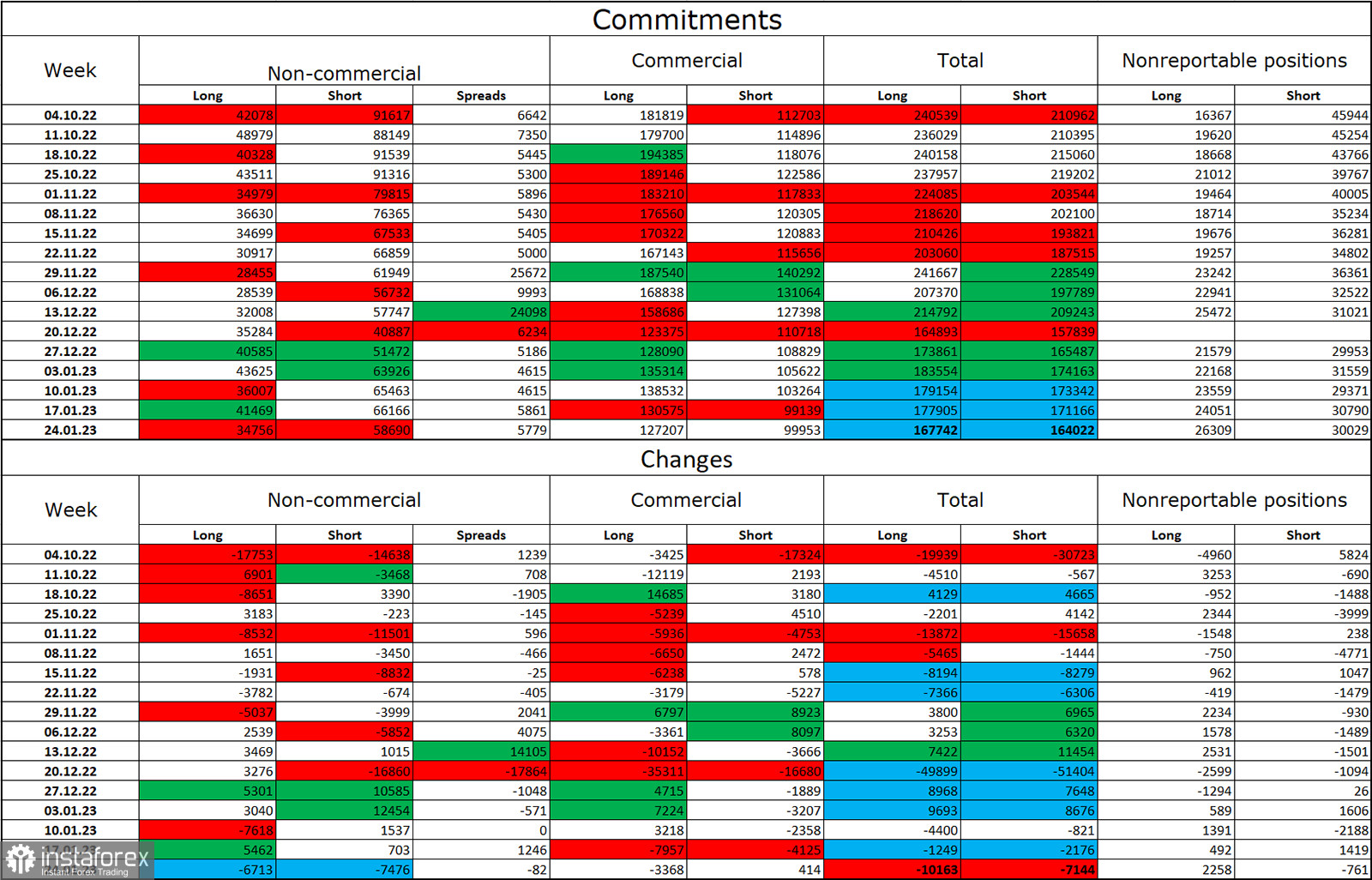

Last week, the sentiment of non-commercial traders became less bearish than the week before. The number of long-contracts owned by speculators decreased by 6,713, and the number of short ones dropped by 7,476. The sentiment of big players remains bearish, and the number of short contracts still exceeds the number of long ones. During the last several months, the situation was changing in favor of the British pound, but now the difference between the number of long and Short contracts is almost doubled again. Thus, the prospects of GBP worsened again but the British currency is unlikely to fall, following the path of the euro. On the 4-hour chart, the price moved below the three-month upward channel, and this may prevent the British pound from growing.

US and UK economic calendar:

On Tuesday, the US and UK economic calendars do not contain any important reports. The information background is unlikely to influence the market today.

GBP/USD forecast and recommendations for traders:

You may sell the British pound if the price settles below the level of 1.2342 with the target of 1.2238 on the hourly chart. If the price rebounds from the level of 1.2342, you may consider opening longs with the target of 1.2432.