Long positions on GBP/USD:

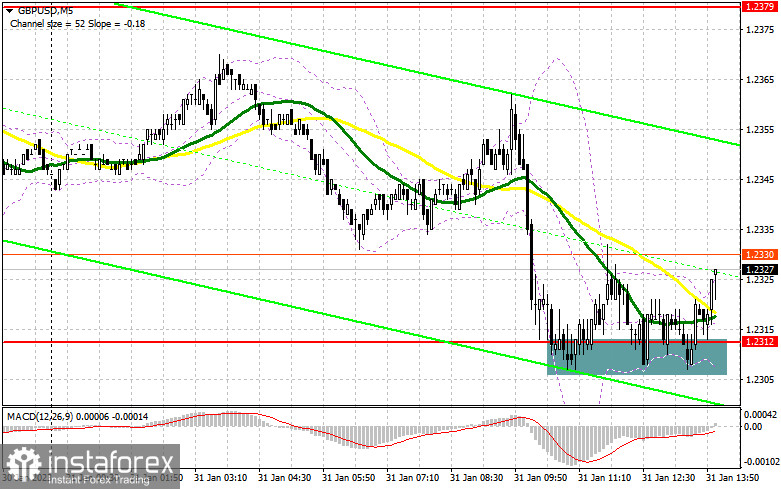

In the first half of the day, there was only one signal to enter the market. Let's have a look at the 5-minute chart and analyze the situation. In the previous forecast, I drew your attention to the level of 1.2312 and recommended opening long positions from it. During the European session, the British pound dropped sharply and formed a false breakout at 1.2312. However, the price soared by 20 pips, and big buyers are unlikely to come back to the market. In the second half of the day, the technical picture changed slightly.

As long as the pair is trading above 1.2312, we might expect a recovery of the pair's quotes. The market may react to the data of the consumer confidence indicator in the US. However, a false breakout at 1.2312 may confirm the presence of big players who bet on the pair's growth in the near future. Especially, after the meeting of the Bank of England, where the regulator will continue to raise interest rates. We can also count on the bullish momentum and coming back to 1.2367 against the background of weak US statistics. If the price settles above this level, we can see a sharp rise in the GBP/USD pair as bulls will have a real chance to hit a new monthly high near 1.2444. If the price moves above this level as well as performs a downward test, it may increase to 1.2487, where traders may lock in profits. If bulls fail to protect 1.2312, the situation will get out of their control. The pressure on the pair is likely to increase, which will reverse the pair's direction. For this reason, it is better not to be in a hurry to buy the British pound. You may open long positions on a decline and a false breakout near the low of 1.2266. One may also buy GBP on a rebound from 1.2172, allowing an intraday correction of 30-35 pips.

Short positions on GBP/USD:

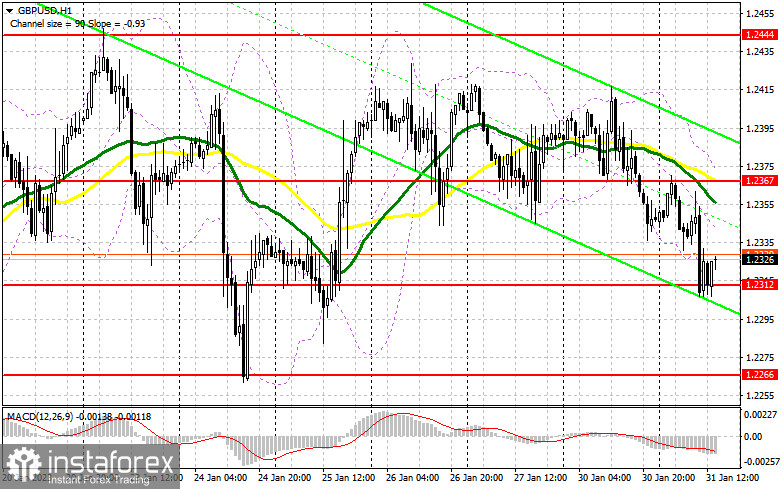

Bears increased their activity in the first half of the day but failed to pierce 1.2312. Most likely, it will happen in the second half of the day, so pay close attention to that level. Now bears are focused on regaining control of 1.2312. At the same time, they should not forget about defending the resistance level of 1.2367. The moving averages are passing above this level. The MAs are supporting bears. This fact also limits the upside potential of the pair. If the price increases after weak US statistics, only a false breakout at 1.2367 may give a signal to open short positions with the target at 1.2312. If this level is broken through and tested from below, bullish sentiment may fade, giving a sell signal towards 1.2266. The next target is located at 1.2172, where traders may book profits. However, if the GBP/USD pair grows and we see weak activity from bears at 1.2367 in the second half of the day, bulls will return to the market and take it under control, keeping a good prospect for the development of a bullish trend. In that case, a false breakout near the monthly high at 1.2444 may form an entry point into short positions. If there is no activity there, it would be better to sell GBP from the high of 1.2487, counting on an intraday downward correction of 30-35 pips.

Signals of indicators:

Moving averages

The pair is trading below the 30- and 50-day moving averages, indicating a further decline in the British pound.

Note: The period and prices of moving averages are considered by the author on hourly chart H1 and differ from the general definition of classical daily moving averages on daily chart D1.

Bollinger Bands

If the pair grows, the upper band of the indicator at 1.2367 will offer resistance.

Description of indicators

- Moving average defines the current trend by smoothing out volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average defines the current trend by smoothing out volatility and noise. Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence) indicator. Fast EMA 12. Slow EMA 26. SMA 9

- Bollinger Bands. Period 20

- Non-commercial traders are speculators, such as individual traders, hedge funds and large institutions, which use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.