The EUR/USD currency pair began the week as uninteresting as possible. The trading on Monday and Tuesday was essentially the same. Volatility has long lagged behind expectations, and recent movements can only be defined as flat. As a result, there is nothing noteworthy happening right now on the market. Furthermore, figuring out this "nothing intriguing" is quite challenging. What should you do with a pair that is stuck in one spot? If you can still open intraday trades on a lower time frame to earn 10–20 points, what should you do on a 4-hour time frame? Simply observe and wait. By the way, it doesn't take long to wait. The Fed will already make the meeting's first results public tonight. Since reports regarding another slowdown in the rate of a key rate increase have been constantly exaggerated for more than a month, one could claim the market is already familiar with them.

It should be noted that Fed officials do not use rumors or expectations as a guide for action. In other words, although inflation has decreased to 6.5%, the target level is still being missed. How can inflation expectations be calculated using the rate? This week, the Spain consumer price index stopped falling. Many other nations around the world may see a stop to the decline. What if the Fed now reduces its rate to 0.25% and it turns out that inflation is no longer decreasing because the cost of gas and oil has started to rise once more? Will the Fed be protected from such a situation, or will it choose to "go with the flow"? After all, nothing prevents raising the rate for a longer period than initially anticipated. Therefore, it is likely that the rate will increase by 0.25% after all, and the market has long "determined" this outcome "in advance." However, this does not mean that the market will disregard this event.

There are two ways to use the euro currency: logically and illogically.

Let's return to the technique once more. Since November 3, the euro has increased by 1200 points in value. This means in less than three months. We experienced one correction of 250 points during these three months. Do you think it's excessive? The euro currency is significantly overbought, in our opinion. Although it may have outstanding long-term potential and increase over the next one to two years, its current growth rate and regression pattern are, to put it mildly, odd. As a result, we only advocate for the necessity of adapting at this time. And how does this fit into the fundamental background? It's very easy. If the euro has been increasing by significant amounts in recent weeks, the Fed's rate hike will be slowed down for a reason that has already been determined. The 0.5% ECB rate increase has the same factor. As a result, the market has no motivation to purchase euros once more. This means that rather than a lack of response, we may witness a backlash in the form of a decline in the euro/dollar pair.

The ECB's monetary policy will be significant until the euro currency shows at least some correction (we are anticipating a 300–400 point drop). The most widely accepted scenario at present is that the European regulator will raise rates by 1.25% for three sessions, but nobody knows what will happen after that. Lagarde claims that the ECB will continue to raise rates "to the bitter end," but no one is certain of the condition of the European economy in three to four months. The GDP data released yesterday for the fourth quarter of 2017 showed negligible growth of 0.1% q/q. If you compare it to the expectations from a few months ago, this is simply an excellent value. However, the European economy is still slowing down and may soon enter a slight recession. Therefore, in our opinion, the ECB won't suddenly raise rates. It can settle for inflation of 3% to 4% while establishing a more secure, longer-term target to bring it down over the next few years. In this scenario, one of the key reasons for supporting the euro will be gone.

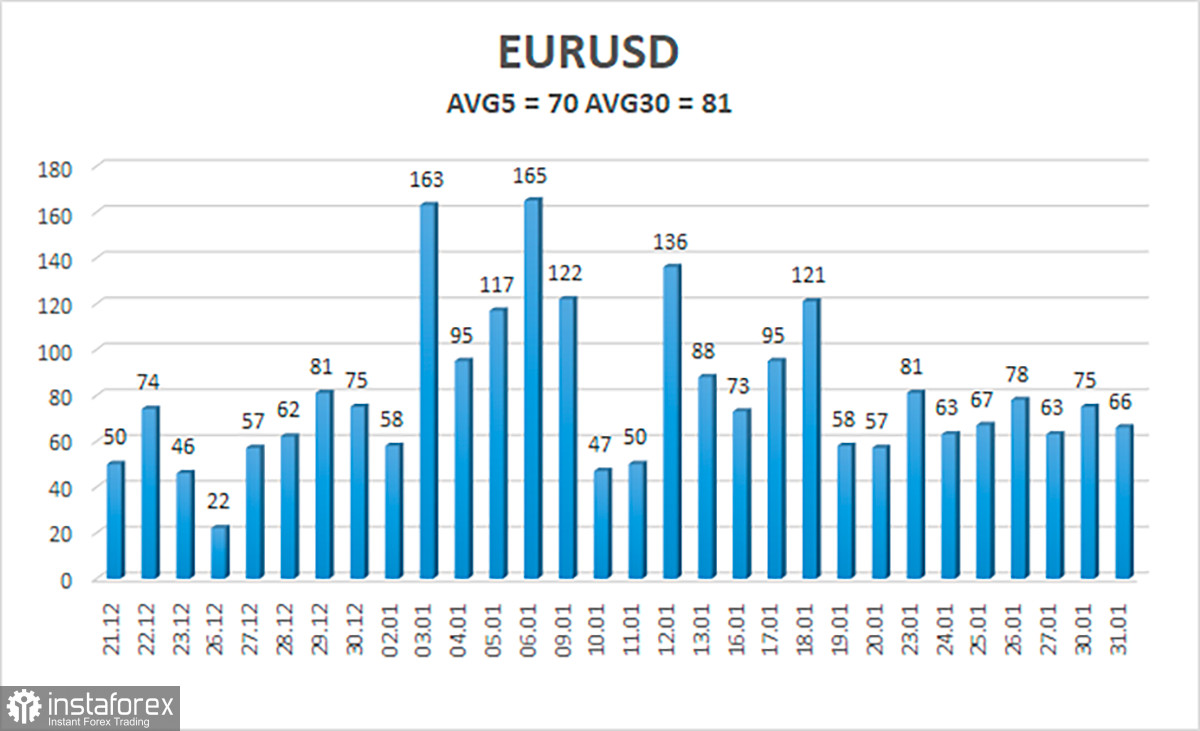

As of February 1, the euro/dollar currency pair's average volatility over the previous five trading days was 70 points, which is considered "normal." So, on Wednesday, we anticipate the pair to move between 1.0789 and 1.0929. A new round of downward movement will be signaled by the Heiken Ashi indicator reversing downward.

Nearest levels of support

S1 – 1.0742

S2 – 10620

S3 – 10498

Nearest levels of resistance

R1 – 1.0864

R2 – 1.0986

Trading Suggestions:

The EUR/USD pair has finally consolidated below the moving average. Until the price is fixed above the moving average, you can maintain short positions with targets of 1.0789 and 1.0742. After the price has secured above the moving average line, you can start trading long with targets of 1.0929 and 1.0986. The flat is still going at this point, which is something to consider.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.