Risk appetite surged after the Federal Reserve announced a 25 bp increase at its monetary policy meeting. Jerome Powell also followed up with a statement that there may be at least two more similar hikes, which is more dovish than their stance last December.

Most likely, the Bank of England and the European Central Bank will do a similar move, but the amount of increase should be fifty basis points. This will narrow the gap between the level of interest rates in the US and Europe.

However, current conditions in both UK and Europe calls for a slowdown, if not a decrease, in the growth of interest rates. The two central banks may also announce a change in their rate hike cycles, which will cause a sharp reversal and thus enhance strengthening of the dollar.

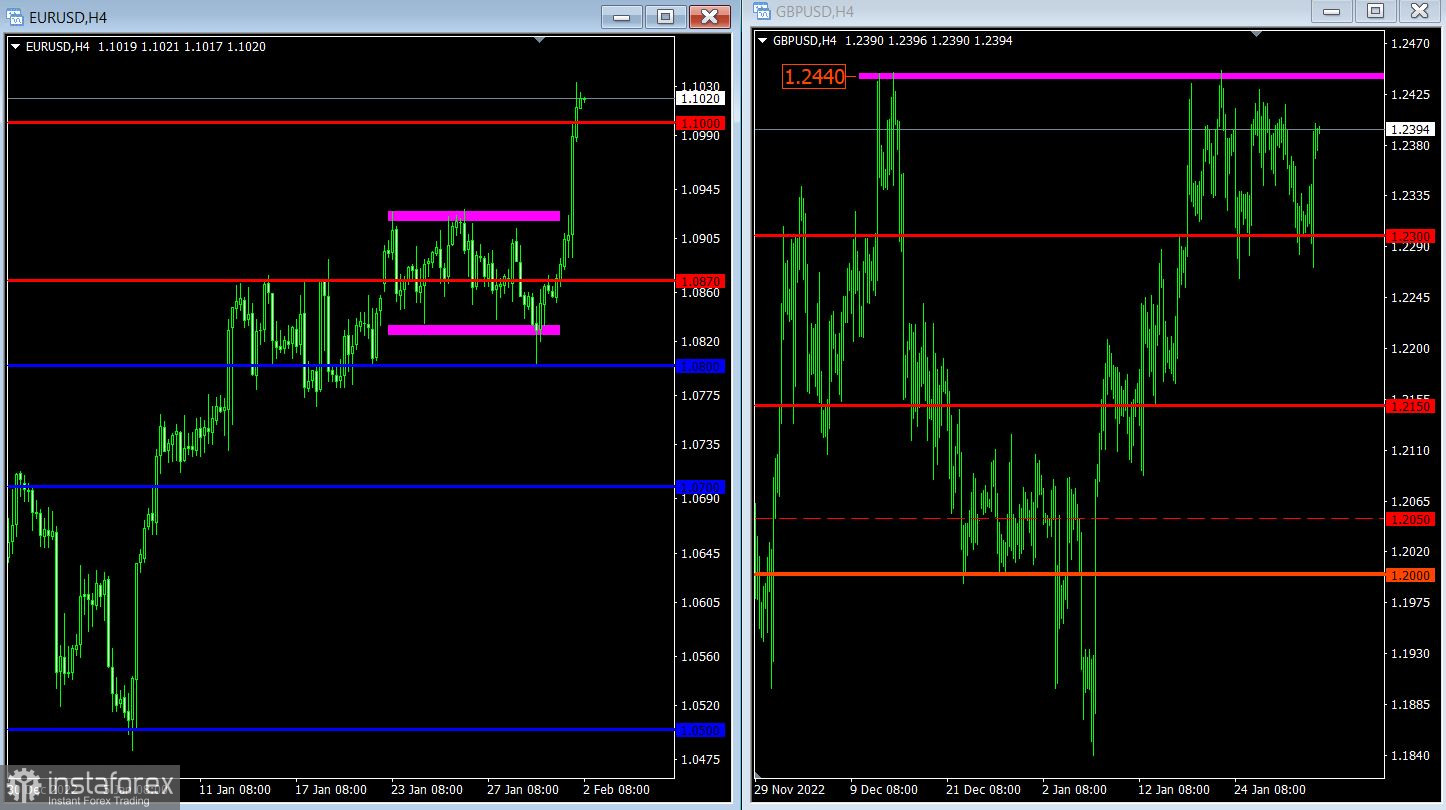

Euro jumped more than 150 points, thereby breaking the psychological level of 1.1000. This makes long positions overheated, which could lead to a pullback in the market.

In GBP/USD, there are no significant changes as the quote continues to move within the range of 1.2300/1.2440. Traders should closely monitor the behavior of the pair near the upper limit because that would signal whether there will be a rebound or a breakout.