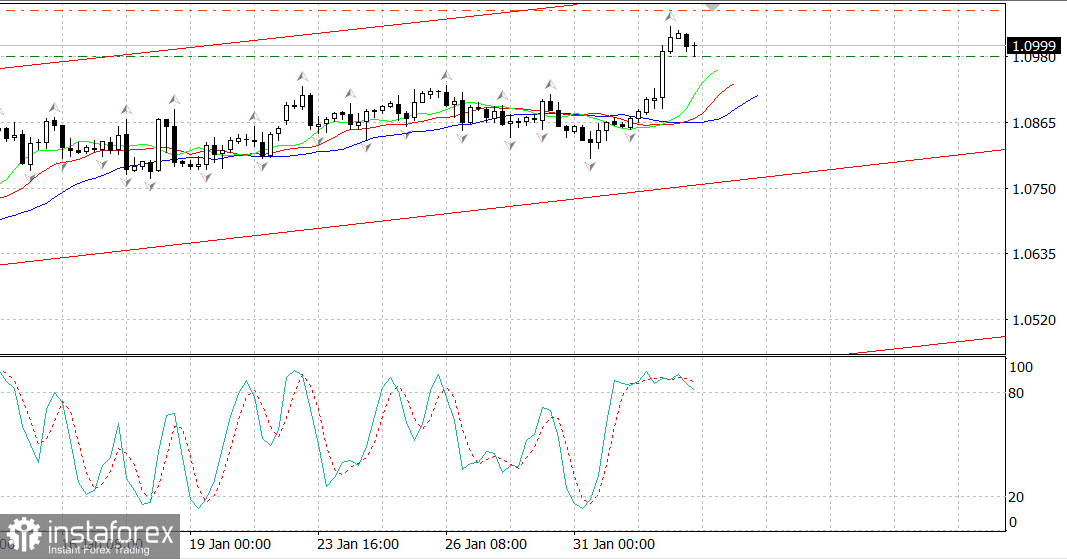

EURUSD just after the European Central Bank meeting

The Governing Council will continue on course to significantly raise interest rates at a sustained pace and keep them at restrictive levels to ensure that inflation returns to its medium-term target of 2% in time. Accordingly, the Governing Council decided to raise the ECB's three key rates by 50 basis points and expects to raise them further. In view of the underlying inflationary pressures, the Governing Council intends to raise interest rates by another 50 basis points at its next monetary policy meeting in March, after which it will assess the subsequent direction of its monetary policy.

This is a strong move to tighten ECB policy and indirectly strengthen the euro.

As a reminder, the Fed raised its rate by +0.5%.

Nevertheless, I don't see much prospects for the euro's growth from the current levels of 1.1020 and above.

In my opinion, now is a good time to gradually sell in anticipation of a strong pullback to 1.0500.