The EUR/USD currency pair was moving in multiple directions on Thursday, but the previous evening it left the side channel it had been in for the previous three weeks and started moving upward again. We purposefully did not take into account the outcomes of the Fed meeting in yesterday's article because they weren't relevant. Once more, the market's response to the conference is what we are most interested in, not its actual outcomes. Thus, it was sensible to hold off on looking at the new technical picture and comprehending how traders perceived the meeting's outcomes until Thursday or even Friday. It should be observed, looking a little farther forward, that they interpreted them in a manner that no one anticipated. First of all, the value of the euro has been rising for several consecutive months. It was able to add roughly 1200 points during this time with a single 250-point correction. We have constantly drawn traders' attention to this issue by criticizing the pair's unreasonably aggressive behavior. Simply put, after the global downward trend ended, we observed an inertial increase of a technical nature. The euro currency did not show such strong growth practically without a single correction since the fundamental background did not sustain it sufficiently.

The euro was rising on Wednesday night and into the early hours of Thursday. It has gained roughly 180 points over this time, and the price is back above the moving average line. As a result, the euro increased before the Fed meeting because there was no question that the rate of monetary policy tightening would slow to 0.25 percent. When this decision was made, the European currency then increased once more. It turns out that the market repeated the same incident, and the euro once again displayed an unwarranted increase. That is all there is to know about the market's response to international events. Whatever occurs, the euro continues to increase. This is somewhat accurate because the euro had been declining for the previous two years, but it had already adjusted to the downward trend by 50% in just a few months. Although the euro is growing too quickly, we still think it can.

The Fed met its objective in full.

Let's now analyze the outcomes of the Fed meeting. In a news conference, Jerome Powell threw out "hawkish" theses in all directions after the rate was increased by 0.25%. He emphasized that there is no longer any debate about a "short pause" in tightening monetary policy, the Fed is still having trouble controlling excessive inflation, and there is still no convincing evidence that the indicator is heading to 2%. The consumer price index is declining, but this may be because energy prices are declining globally. In many nations, the fundamental rates of inflation are not slowing down. Therefore, it is entirely legitimate for the Fed to want to keep tightening its monetary policy. Powell reaffirmed that maintaining price stability is the primary objective and underlined the outstanding status of the US labor market in addition to the good rate of inflation reduction. The unemployment rate is not rising, and monthly nonfarm payroll figures show that the economy has added 200,000 new jobs.

According to Powell, several additional rate increases of 0.25% were discussed at the meeting itself, following which there will be a "period of elevated rates" that is expected to endure through the end of this year. We think that Powell's arguments can be categorized as "hawkish" in almost every instance. Everyone at once started to believe that the Fed would only raise the rate once more after the most recent news on US inflation created a shock effect in the markets. This was incorrect, as we can see. Additionally, the Fed's decision to decrease the rate of tightening once more meant that it had to occur sooner rather than later, and the market has been preparing for it over the past few weeks. As a result, the foreign currency market's "absurdity" persists. Even in light of Powell's "hawkish" remarks, the euro is rising. Lagarde's speech and the ECB meeting both happened yesterday, but as is usual, we won't discuss them until after the market has finished processing and "digesting" the news.

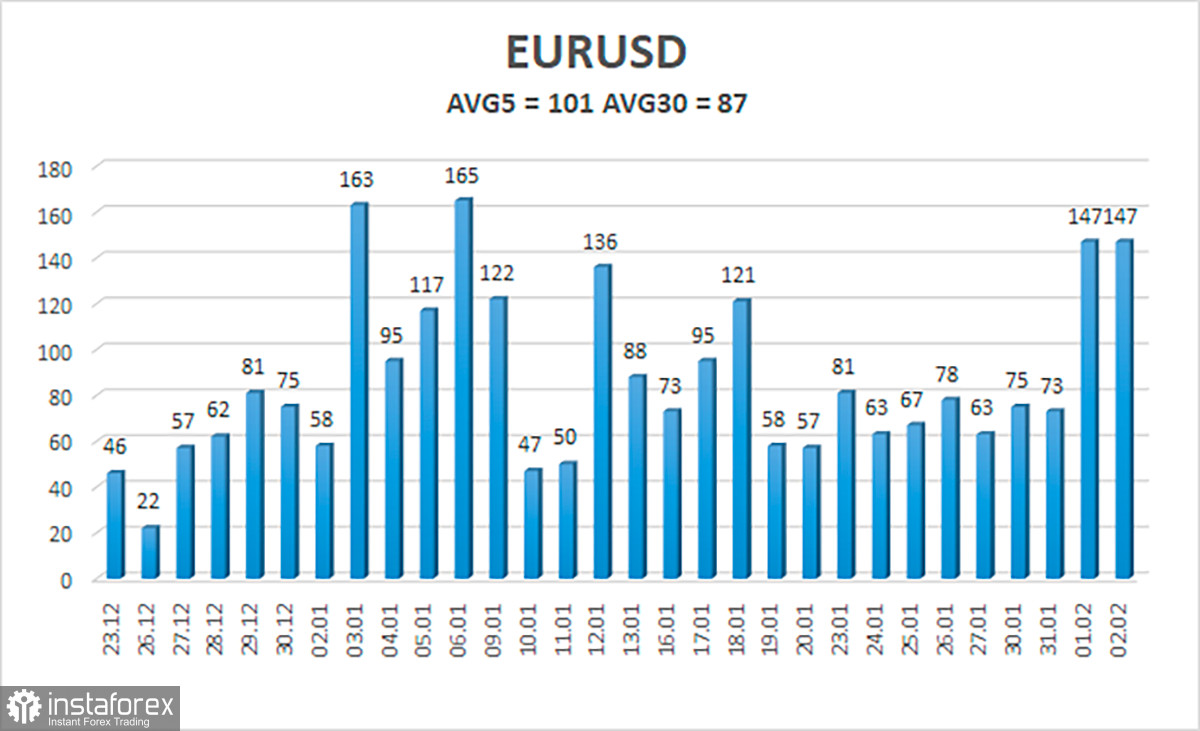

As of February 3, the euro/dollar currency pair's average volatility over the previous five trading days was 101 points, which is considered "high." So, on Friday, we anticipate the pair to move between 1.0809 and 1.1012. The Heiken Ashi indicator's return to the top will signal a possible continuation of the upward trend.

Nearest levels of support

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest levels of resistance

R1 – 1.0986

R2 – 1.1047

R3 – 1.1108

Trading Suggestions:

The EUR/USD pair is being adjusted but has moved back to the area above the moving average. At this point, if the price moves back above the moving average, we can take additional long positions with targets of 1.0986 and 1.1012. With targets of 1.0809 and 1.0742, short positions can be opened after the price is fixed below the moving average line.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

The short-term trend and the direction in which you should trade at this time are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.