The GBP/USD currency pair increased as well, though far less significant than the EUR/USD pair. Additionally, this situation ought to have caused traders to pause. Why is the euro strengthening faster than the pound, even though the Fed meeting affects both currencies equally? After all, the currency with the lowest volatility is the euro. We know the answer to this one: the pound has recently been trading at least somewhat logically and reasonably, so I could not afford to demonstrate an increase in response to Powell's "hawkish" words. The results of the Bank of England meeting, which we shall discuss below, caused the pair to start falling as early as Thursday. The pair then left the side channel where it had stayed for three weeks as a result of what we perceived as a movement up and down. As we predicted, the market "in advance" worked out the outcomes of both meetings. It was widely known that the BA would increase rates by 0.5% and the Fed by 0.25%. But there was still violence in response to what happened on Wednesday and Thursday.

The outcomes of the BA meeting can be described as paradoxical at the same time. For instance, the rate rose by 0.5%, which was the most "hawkish" course of action. As a result of this choice, the pound can increase. Forecasts for economic growth in 2023 and 2024 have also been upgraded. According to the regulator, the GDP will contract by 0.6% this year and even less in 2024. The GDP will only decrease by a maximum of 1% overall. Instead of eight, as predicted in November, the British economy will be in a recession for five quarters, and inflation has already risen. All of these are supportive aspects for the pound, but there were also disadvantages.

The Bank of England hinted that the tightening pace might slow down.

As previously stated, the UK economy is not something that can be sacrificed by the Bank of England. The regulator has not yet informed the markets that it is prepared to raise the rate "until the bitter end" because of the widespread worries about a protracted recession. There would have been various signals of a prospective slowing in the rate of tightening in BA's accompanying statement. Given that the regulator anticipates a decline in inflation in the upcoming months due to dropping energy prices, it is likely to occur already at the March meeting. In theory, this is what we anticipated in the previous month. The regulator simply cannot raise the BA rate to at least 5-6% at the current level of inflation (over 10% at a rate of 3.5%), since doing so would require further downward revision of its economic growth estimates. Meanwhile, there is optimism that decreasing energy costs would "reach" the UK and cause inflation to decline by at least a few percentage points. It will increase to 4.75–5% by the middle of the year, and if inflation does not show a considerable decline, the "period of high rates" in the UK will simply last longer than in the USA. There will also be numerous additional rate rises of 0.25%.

As long as the economy doesn't suffer too much, we also think London can accept 3-4% inflation in the upcoming years. All of this indicates that the pound is losing its primary source of support, according to which the BA should have increased interest rates in 2023 more strongly and swiftly than the Fed. It should be emphasized that 2 of the monetary committee's nine members once more voted "against" tightening. The pound may decrease significantly if there were at least one more of them. And now we must wait for the market to "digest" the information completely before moving on to today's topic: non-farm payrolls in the United States. Although the pound is not in the best of moods when these statistics are released, non-farms may continue to slow down, which might lead to a decline in the US dollar today.

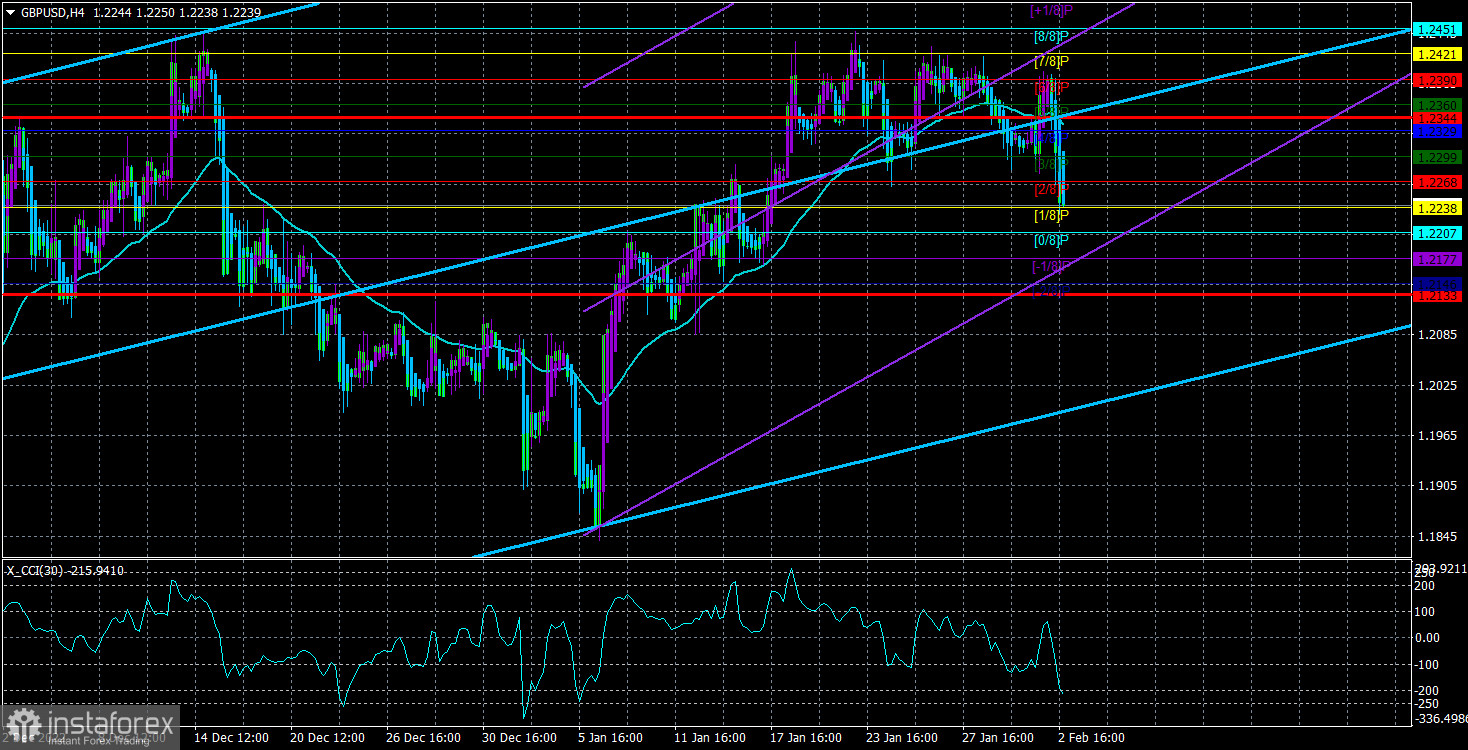

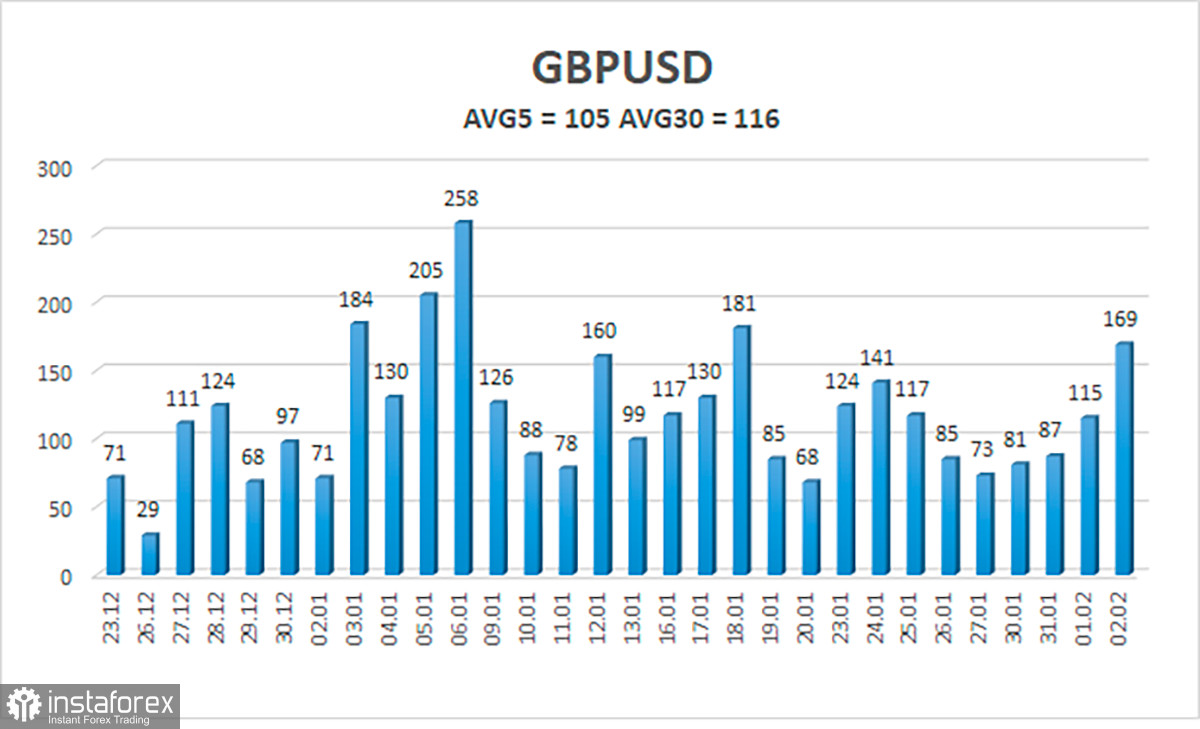

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 105 points. This number is the "average" for the dollar/pound exchange rate. Thus, we anticipate movement inside the channel on Friday, February 3, limited by the levels of 1.2133 and 1.2344. A round of upward corrective is indicated by the Heiken Ashi indicator's upward reversal.

Nearest levels of support

S1 – 1.2238

S2 – 1.2207

S3 – 1.2177

Nearest levels of resistance

R1 – 1.2268

R2 – 1.2299

R3 – 1.2329

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair is situated below the moving average. Therefore, until the Heiken Ashi indicator turns up, it is still possible to hold short positions with targets of 1.2207 and 1.2146. If the price is stable above the moving average line, you can start trading long with targets of 1.2421 and 1.2451.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

The short-term trend and the direction in which you should trade at this time are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator enters into the overbought (above +250) or oversold (below -250) zones.