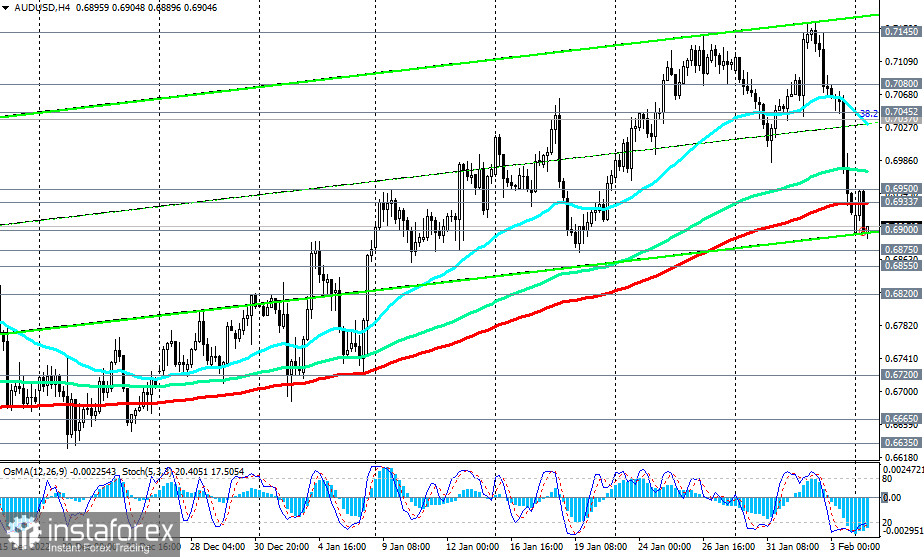

A strong report from the U.S. Department of Labor last Friday contributed to the sharp strengthening of the U.S. dollar. Its DXY index gained 2%, while all major currencies fell in pairs with the USD. In particular, this applies to the AUD/USD pair, which has fallen by 3% over the past two trading days. Today, its decline continued, and the price reached the important medium-term support level 0.6900 (50 EMA on the weekly chart).

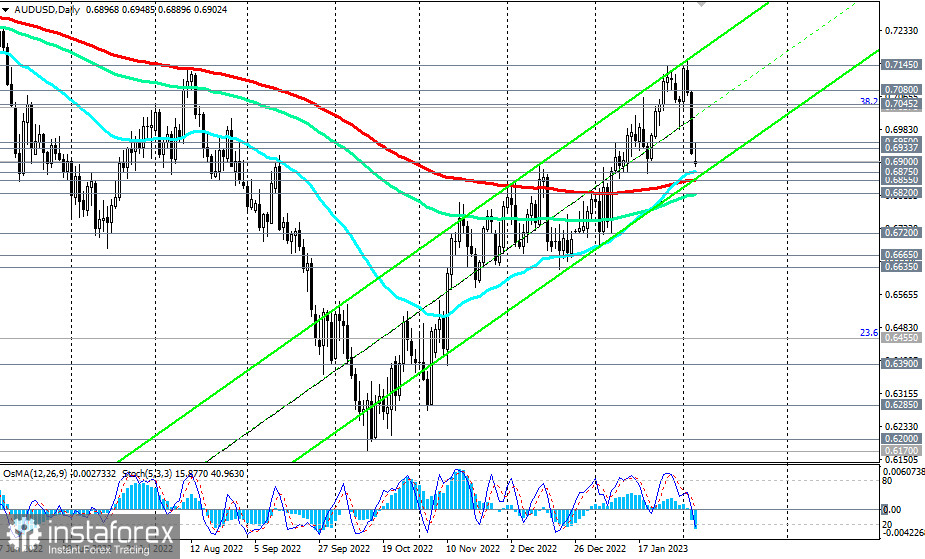

The strong bearish momentum is still pushing the pair down towards important support levels 0.6875 (50 EMA on the daily chart), 0.6855 (200 EMA on the daily chart).

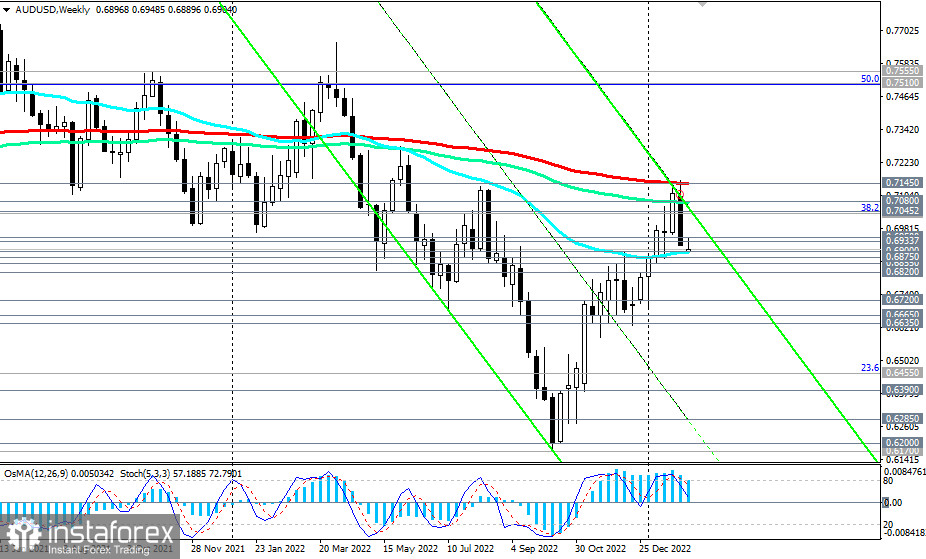

Technical indicators OsMA and Stochastic on the daily and weekly AUD/USD charts also signal the possibility of further decline.

In case of breakdown of the important support level 0.6820 (144 EMA on the daily chart), AUD/USD will return to the global downward trend zone.

In an alternative scenario, the first signal for the resumption of long positions may be a breakdown of the resistance levels 0.6934 (200 EMA on the 4-hour chart), 0.6950 (the recent local high).

The breakdown of the key long-term resistance level 0.7145 (200 EMA on the weekly chart) and the local 7-month high at 0.7157 will confirm the return of AUD/USD to the long-term bull market zone.

Support levels: 0.6900, 0.6875, 0.6855, 0.6820, 0.6720, 0.6700, 0.6665, 0.6635

Resistance levels: 0.6934, 0.6950, 0.7000, 0.7037, 0.7045, 0.7080, 0.71 57

Trading scenarios

Sell Stop 0.6880. Stop-Loss 0.6960. Take-Profit 0.6875, 0.6855, 0.6820, 0.6720, 0.6700, 0.6665, 0.6635

Buy Stop 0.6960. Stop-Loss 0.6880. Take-Profit 0.7000, 0.7037, 0.7045, 0.7080, 0.7157