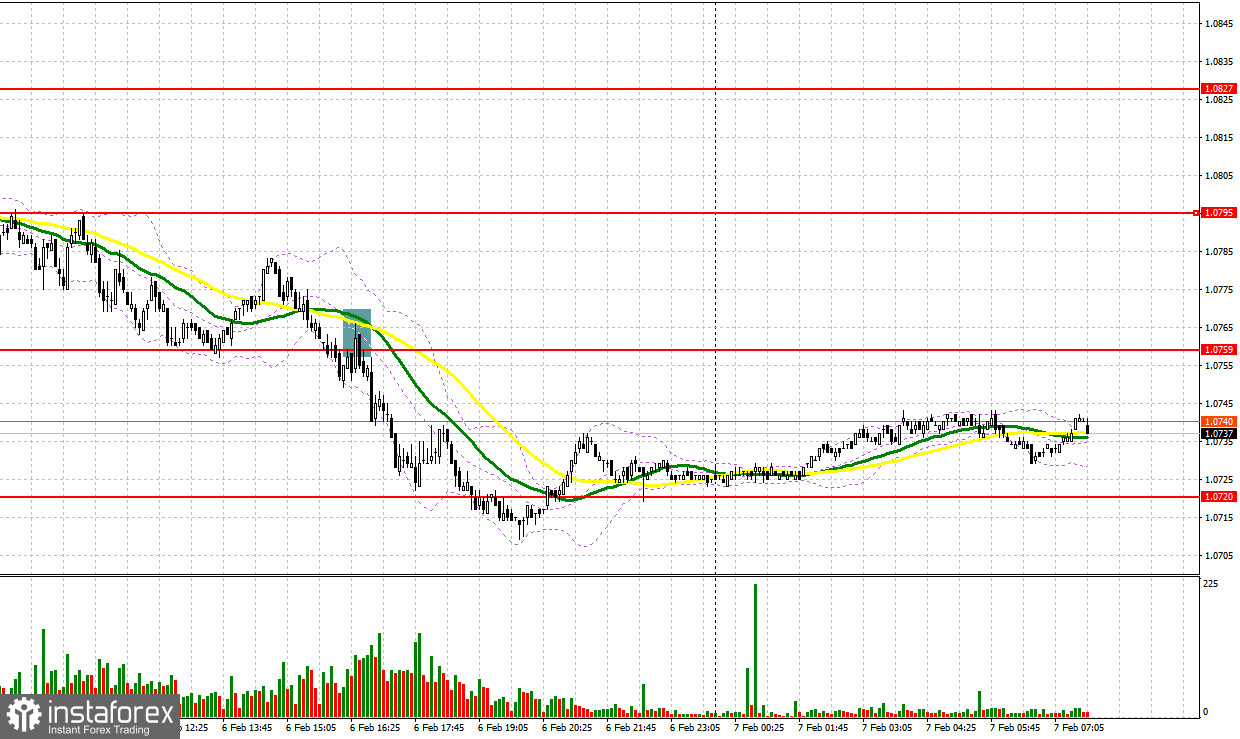

There was only one market entry signal yesterday. Let us have a look at the 5-minute chart and figure out what happened. A breakout and a upward retest of the support level of 1.0759 amid the lack of key fundamental data created an excellent sell signal, pushing the euro down by 40 pips to 1.0720.

When to open long positions on EUR/USD:

The euro continued to fall after Friday's strong US labor market data. It appears that even the hawkish policy of the Federal Reserve, which plans to keep the interest rate around 5.0% for quite a while, is not affecting the labor market. The lack of other data releases also pushed the euro even lower and created a new downtrend. Today there is nothing that can support EUR bulls much, so it is possible that the bearish trend will continue. Weak German manufacturing output and French trade balance data will further undermine the market participants' confidence in a quick economic recovery. Today's remarks by ECB executive board member Isabelle Schnabel's speech are unlikely to have an impact on the pair's direction. If EUR/USD declines, bulls will have to defend the closest support level of 1.0720, which was formed yesterday. I will open long positions after a false breakout of that area, targeting 1.0764. The moving averages in that area favor bearish traders. A breakout and a downward retest of that area will create an additional buy signal. From there, EUR/USD may jump to 1.0795, and if it breaks through that level as well, the pair may surge towards 1.0827, triggering the stop-loss orders of bears. I will take profits there. However, this scenario is unlikely today. If EUR/USD declines and bulls are idle at 1.0720 in the first half of the day, the euro's downward correction is likely to continue. A breakout below that level will trigger some stop-loss orders of bullish traders. In that situation, only a false breakout of 1.0687 will create a buy signal. New long positions can be opened immediately if EUR/USD bounces off 1.0653 or 1.0618, targeting an intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Bearish traders have no problems at this point. The MACD divergence may trouble them in the first half of the day, but a reversal currently seems unlikely. Short positions can be opened at 1.0764, if major market players are present in that area. It would be indicated by a false breakout of that level, which would create a sell signal targeting the intermediate support level of 1.0720. A false breakout and an upward retest of that level will create an additional sell signal and push EUR/USD to 1.0687, extending the downward correction. If the pair settles below that level amid weak eurozone data, it will then drop into the 1.0653 area. I will take profits there. If EUR/USD advances and bears are inactive at 1.0764, bullish traders will try to enter the market once again. In this situation, short positions should be opened only if the pair fails to settle above 1.0795. I will sell EUR/USD immediately if it bounces off 1.0827, targeting a downward correction of 30-35 pips.

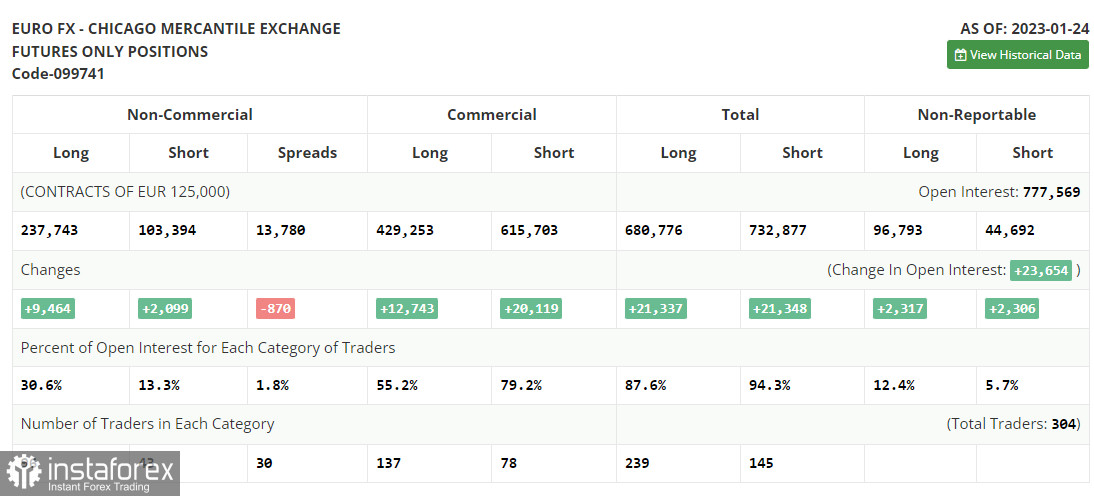

Commitment of Traders (COT) report:

The Commitment of Traders (COT) report for January 24 indicated that both long and short positions increased. It is obvious that traders continued to build up their long positions after speeches of the European Central Bank representatives last week, expecting the European regulator to maintain its aggressive policy. They also bet on a less aggressive Federal Reserve, which may cut the pace of rate hikes for the second time in a row. The recent weak fundamental data on the US economy, particularly falling retail sales and softening inflationary pressures suggest that now is a good time to slow down. Further Fed monetary tightening could hurt the economy even more. Central bank policy meetings will be held this week, which will determine the pair's future trajectory. The COT report showed that long non-commercial positions rose by 9,464 to 237,743, while short non-commercial positions jumped by 2,099 to 103,394. At the end of the week, total non-commercial net positioning was up by 134,349 versus 126,984. All this suggests that investors are confident that the euro will continue to rise, but are waiting for more clarity from central banks on interest rates. The weekly closing price rose to 1.0919 vs. 1.0833.

Indicators' signals:

Moving averages

Trading is carried out below the 30 and 50-days moving averages, which indicates that the euro is likely to decline further.

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD increases, the upper boundary of the indicator at 1.0764 will serve as a resistance. If the pair declines, 1.0715 will provide support.

Description of indicators

Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart. Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart. MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9 Bollinger Bands (Bollinger Bands). Period 20 Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements. Long non-commercial positions represent the total long open position of non-commercial traders. Short non-commercial positions represent the total short open position of non-commercial traders. Total non-commercial net position is the difference between the short and long positions of non-commercial traders.