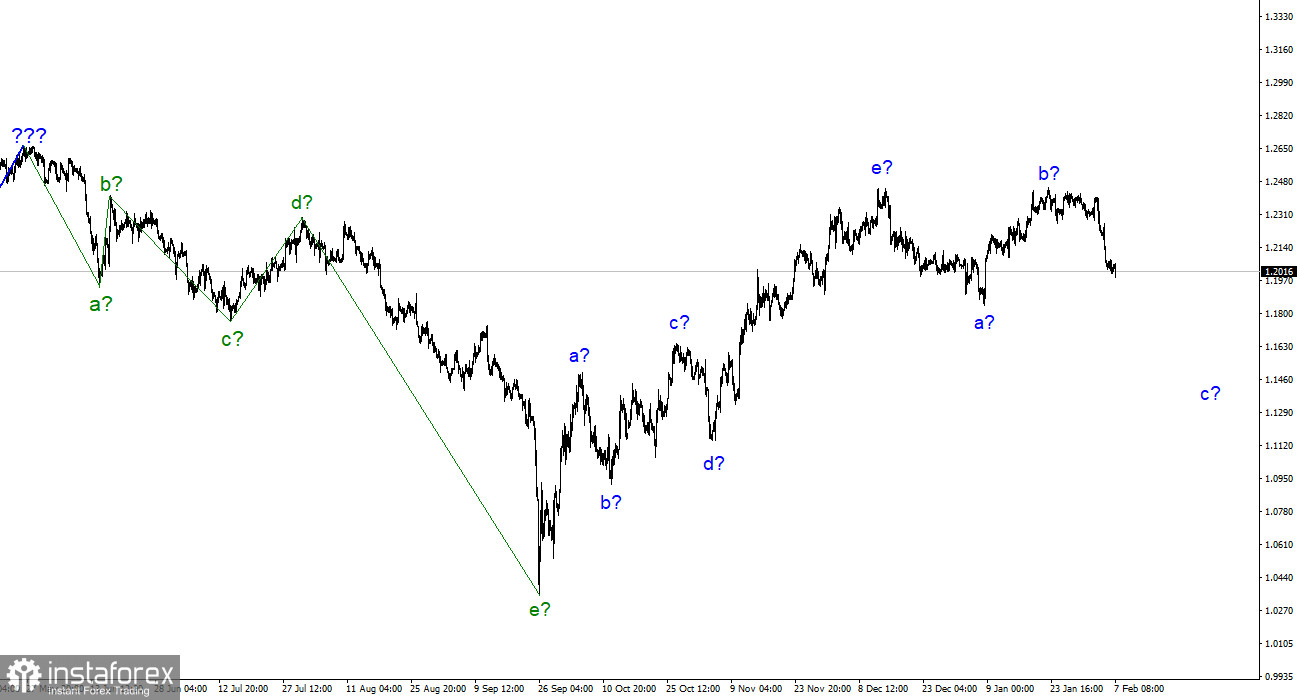

The wave pattern for the pound/dollar pair now appears very confusing but does not call for any clarifications. The wave patterns for the euro and the pound differ somewhat, but both point to a decrease. Our five-wave upward trend section has the letters a-b-c-d-e and is most likely already finished. I anticipate that the downward section of the trend has started to take shape; it will have at least three waves. Although Wave B appeared to be unnecessarily prolonged, it did not end. As a result, last week, a wave could have started to form with a downward component of the trend, the targets of which are situated below wave a's low. The price would be at least 200–300 points less than it is at the moment. The entire downward section of the trend may even take a five-wave structure, in my opinion, and wave c may prove to be deeper than expected. But it's too early to discuss it at this time. The pair has been on the verge of restarting the development of an upward trend section for a while, and it wasn't until last week that it was able to start moving quotes away from the peaks reached with the help of the news background.

Some FOMC members are particularly aggressive.

On Monday, the pound/dollar exchange rate fell by 20 basis points; today, it fell by an additional 35. Due to the results of meetings last week and the positive economic statistics released by the United States on Friday, the demand for the currency from the UK has been declining for four days in a row. A new week has started, though, and the market is actively searching for new information and factors. Neil Kashkari, president of the Federal Reserve Bank of Minneapolis, gave a speech yesterday in which he made several statements that could be considered "hawkish." He specifically mentioned that he believes the interest rate will increase to 5.4%. I should point out that the rate is currently 4.75% and that the majority of market players are anticipating one or two further increases of 25 basis points. Kashkari and other "hawks," like James Bullard, continue to be in a very difficult situation. I've already stated in other writings that I think it's necessary to increase the rate three more times by 25 basis points since US inflation is still too high compared to the target level. According to certain FOMC members, the first half of the year could witness a stronger tightening of monetary policy. This aspect will undoubtedly increase demand for US dollars.

Neil Kashkari added that he was astonished by the most recent labor market data and had not anticipated such a high figure. He stated that the labor market is not currently being strongly impacted by the Fed's actions. The head of the Federal Reserve Bank of Minneapolis stated, "I would like to see more evidence that we are confidently going towards the target rate level before we refuse to raise it." Additionally, he stated that the services sector is still stable, most likely alluding to the strong ISM services sector index, which increased to 55.2 points in January. Kashkari argues that we haven't made enough progress to declare victory over inflation.

Conclusions in general

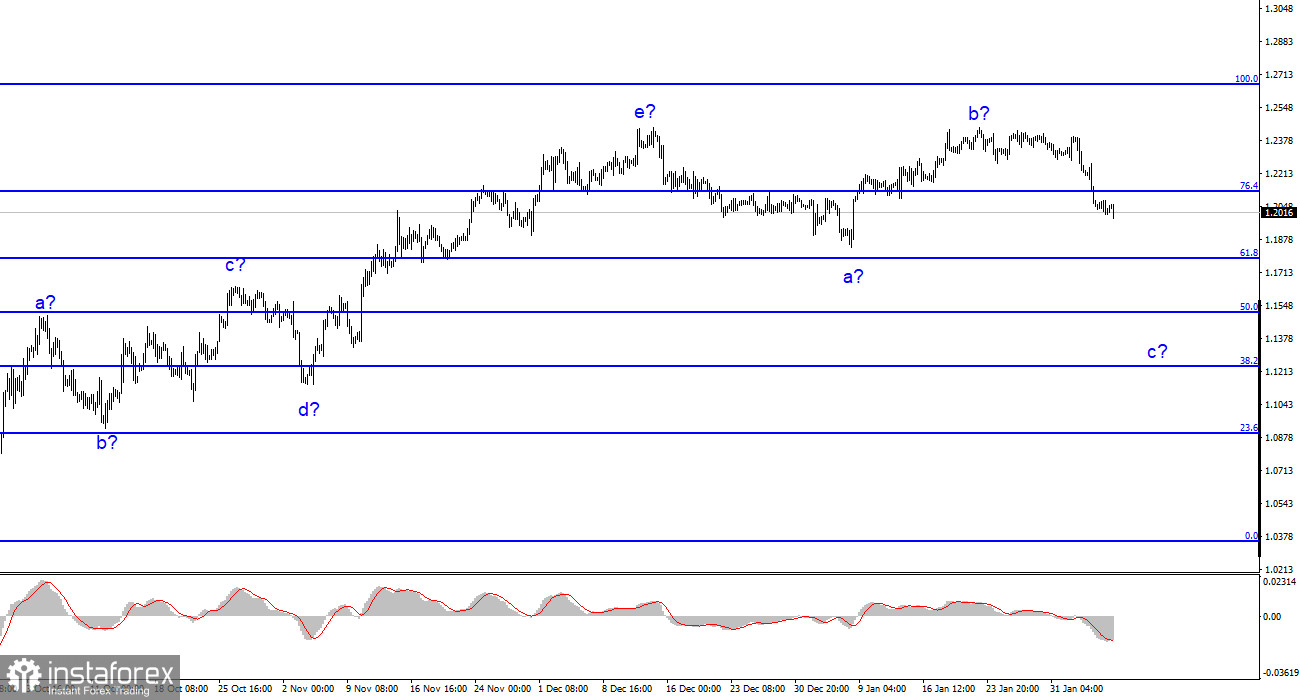

The development of a downward trend section is implied by the wave structure of the pound/dollar pair. Currently, it is possible to think of sales with targets near the level of 1.1508, which corresponds to 50.0% of the Fibonacci. The peaks of waves e and b could be used to place a Stop Loss order. Everything now depends on the decisions made by the Fed and the Bank of England in March, as well as on economic indicators, particularly those related to inflation. Wave c may take on a less protracted form.

The image resembles that of the euro/dollar pair at higher wave scales, but there are still minor distinctions. The upward correction section of the trend has now been finished. If this presumption is true, then we must wait for the development of a downward section to continue for at least three waves with the possibility of a decrease in the area of figure 15.