Analysis of positions and tips for trading GBP

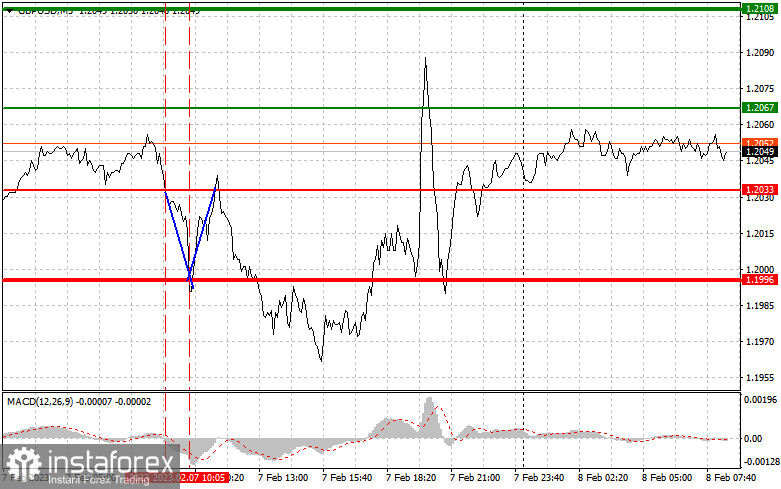

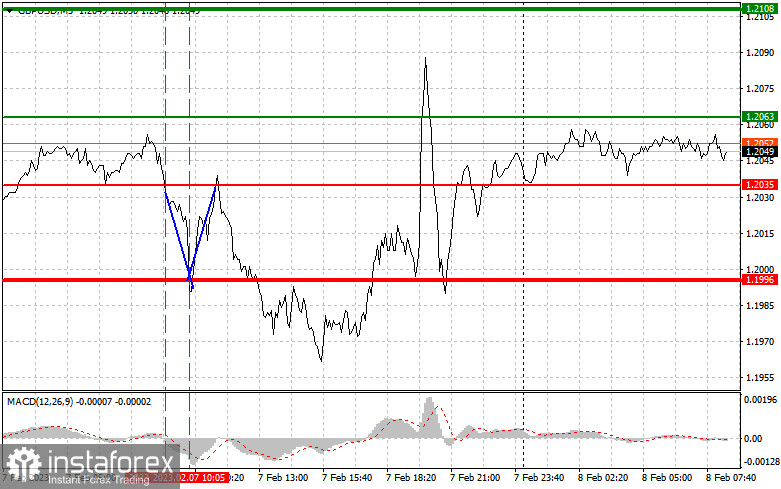

A test of 1.2033 occurred at a time when the MACD indicator had just started to move down from the zero level. It gave an excellent entry point into short positions. The pound sterling halted its decline at 1.1996. Hence, it dropped by 30 pips. In my yesterday analysis, I stressed that it would be wise to open long positions at a bounce from 1.1996. The pound sterling rose by 30 pips from this level. There were no entry points in the afternoon.

The Halifax House Price Index as well as the speech of BoE Deputy Governor for Markets and Banking Sir David Ramsden did not affect the market sentiment yesterday. Today, the economic calendar for the US is completely empty. It means that the pound sterling is likely to get stuck in the sideways channel. It may try to rise above a weekly high. In the afternoon, the US will reveal its wholesale inventories report. What is more, such Fed policymakers as John Williams, Michael S. Barr, and Christopher Waller will make speeches. The tone of their comments is likely to be hawkish. They could advocate for further rate hikes. Jerome Powell also admitted that the regulator could stick to aggressive tightening in his speech yesterday. If so, it could facilitate a rally of the US dollar.

Buy signal

Scenario No.1: we could buy GBP if the price reaches 1.2063 plotted by the green line on the chart with the target at 1.2108 (thicker green line on the chart). I would recommend leaving the market at 1.2108 and then selling the pound sterling in the opposite direction, bearing in mind a 30-35 pip downward move from the market entry point. The pound sterling could rise only if large sellers do not enter the market at yesterday's intraday high. Important! Before opening long positions, make sure that MACD is above the zero mark and it has just started to climb from it.

Scenario No.2: it is also possible to buy the pound sterling today if the price approaches 1.2035. At this moment the MACD indicator should be in the oversold area. It could limit the downward potential of the pair. It may also trigger an upward reversal of the market. The pair is expected to grow to the opposite levels of 1.2063 and 1.2108.

Sell signal

Scenario No.1: We could sell the pound sterling if the price hits 1.2035 plotted by the red line on the chart. If so, there might be a sharp decline. The 1.1996 level could serve as the target where I recommend leaving the market and buying the pound sterling in the opposite direction, bearing in mind a 20-25 pip upward move. The pressure on the pair could rerun only due to hawkish speeches of Fed policymakers. Important! Before opening short positions, make sure that MACD is below the zero line and it has just started to decline from it.

Scenario No.2: it is also possible to sell the pound sterling today if the price decreases to 1.2063. At this moment, the MACD indicator should be in the overbought area, which will limit the upward potential of the pair. It could also lead to a downward reversal of the market. The pair is projected to slide down to the opposite levels of 1.2035 and 1.1996.

What's on the chart

The thin green line is the key level at which you can place long positions in the GBP/USD pair.

The thick green line is the target price as the price is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the GBP/USD pair.

The thick red line is the target price as the price is unlikely to move below this level.

MACD line. When entering the market, it is important to adjust trading decisions to the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid trading during sharp fluctuations in market quotes. If you decide to trade during the news release, always place Stop Loss orders to minimize losses. Without placing Stop Loss orders, you can lose your entire deposit very quickly, especially if you do not use money management and trade large volumes.

Remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation will inevitably lead to losses for an intraday trader.