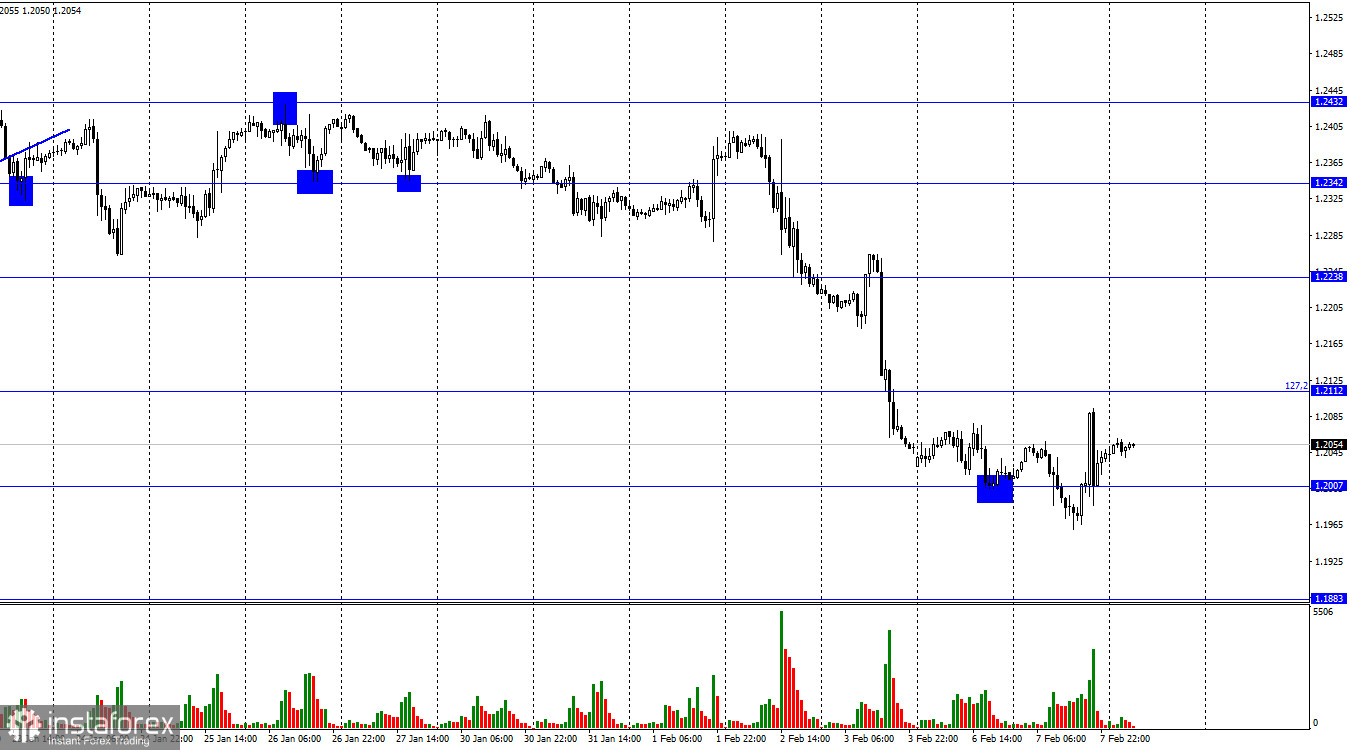

On Tuesday, the GBP/USD pair dropped below the 1.2007 level, according to the hourly chart. This was followed by a reversal in favor of the pound and a close above the 1.2007 level. At this time, the growth process can be carried out in the direction of the corrective level of 127.2% (1.2112). The beginning of a new fall to 1.2007 will benefit from the rebound of quotes from it, and closing above it will improve the likelihood of additional growth to the next level of 1.2238.

I'll discuss Jerome Powell's address from the previous evening in this article. I want to point out right away that traders' reactions to Powell's speech were unclear. The dollar initially declined, then quickly increased. It can be believed that traders were unable to reach a clear decision. Powell's major point was that the inflation rate in the United States wouldn't reach its target level until at least 2024. The general director of the Fed remarked that the economy is in excellent condition, employment levels are at all-time highs, and the most recent labor market statistics shocked everyone. Powell asserts that "disinflation has started, and it has started without affecting the labor market, which is extremely good." "We would certainly increase the rate more if the evidence persisted in being solid. The year 2023 will see a significant decline in inflation," said Powell in Washington. Powell's major point focused on the likelihood of a more significant increase in the interest rate. This is a "hawkish" notion that, in my opinion, will help the US dollar. The cycle of tightening PEPP in the US is now commonly thought to be coming to an end, although this may not be the case. The rate could increase to 6% if the labor market continues to be this strong, which would be advantageous for the US dollar. Today's schedule of FOMC member speakers can serve as confirmation of Powell's assertions. Or counter it.

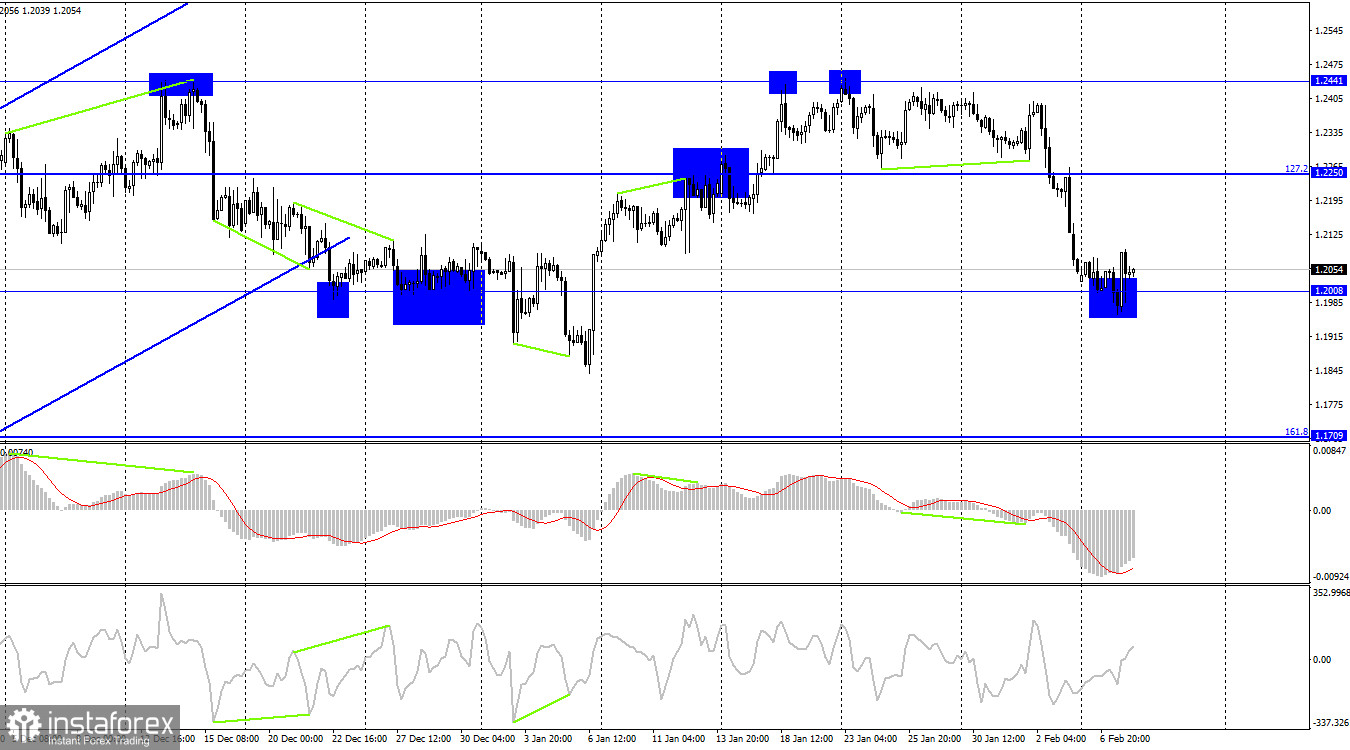

The pair dropped to a level of 1.2008 on the 4-hour chart. Although it is unlikely to be strong, the rebound of prices from this level favored the British pound and signaled the start of development in the direction of the level of 127.2% (1.2250). The likelihood of a further decline in the direction of the next corrective level of 161.8% (1.1709) will rise if the pair's rate is closed at 1.2008. Emerging divergences are currently undetectable by any indication.

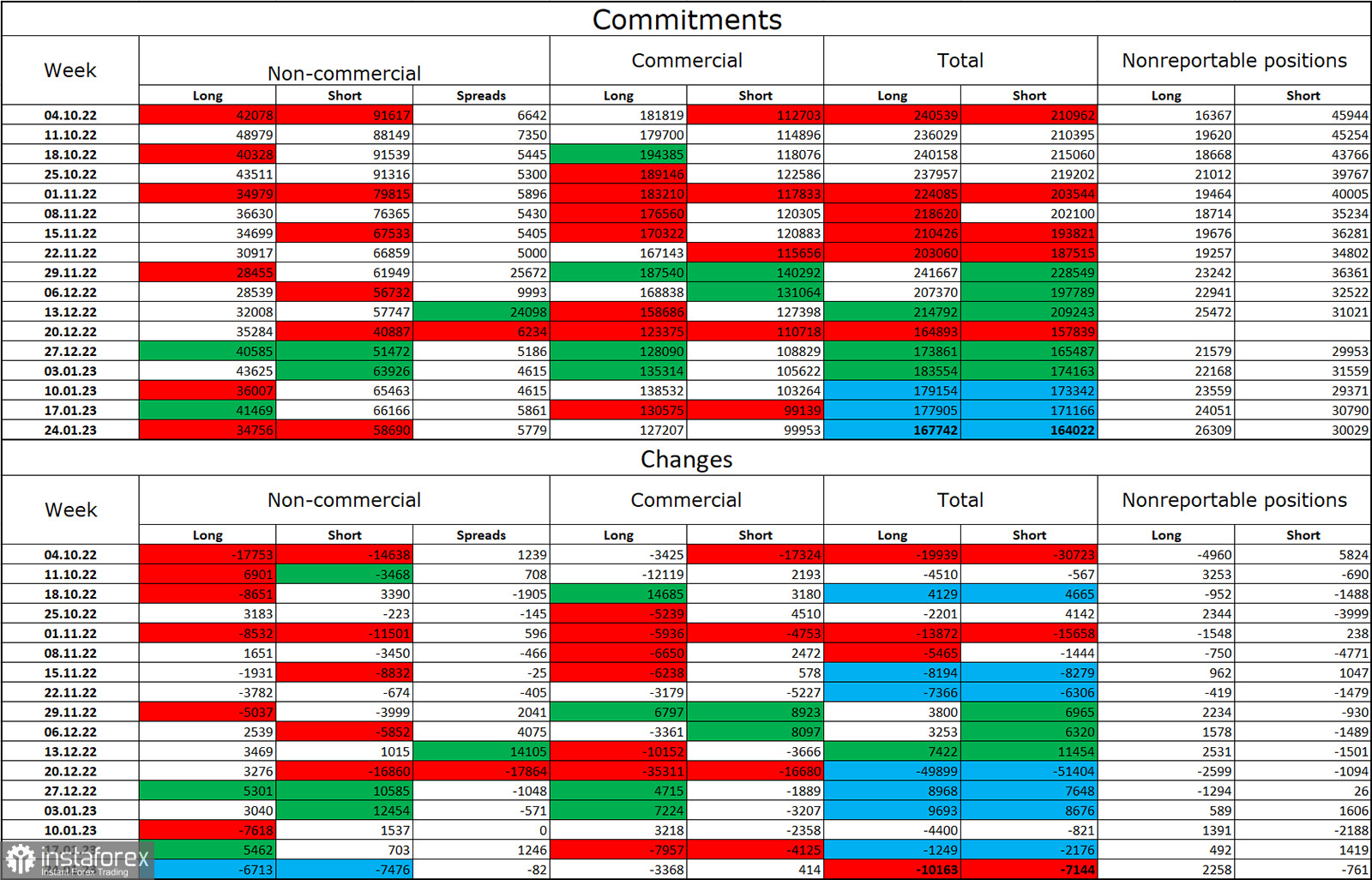

Report on Commitments of Traders (COT):

In comparison to the previous reporting week, the sentiment among traders in the "non-commercial" category has grown less "bearish." The number of long contracts held by investors dropped by 6,713 units, while the number of short contracts dropped by 7,476. The major players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. The situation has shifted in favor of the British pound over the last few months, but today the number of long and short positions in the hands of speculators is nearly doubled once more. As a result, the outlook for the pound has once again declined, but it is not eager to decline and is instead concentrating on the euro. An escape from the three-month upward channel was visible on the 4-hour chart, and this development may have stopped the pound's growth.

United States and United Kingdom news calendars:

There is not a single interesting event scheduled for Wednesday in either the UK or US economic calendars. Today's traders won't be affected by the information background's sentiment.

Forecast for GBP/USD and trading advice:

When quotes on the hourly chart were fixed below the level of 1.2238, I suggested selling the pound with targets of 1.2112 and 1.2007. Both targets have been met. With a target of 1.1883, new sales closed at a lower rate than 1.2007. On the 4-hour chart, purchases of the pair are possible when it rises over the level of 1.2008, with the first target being 1.2112.