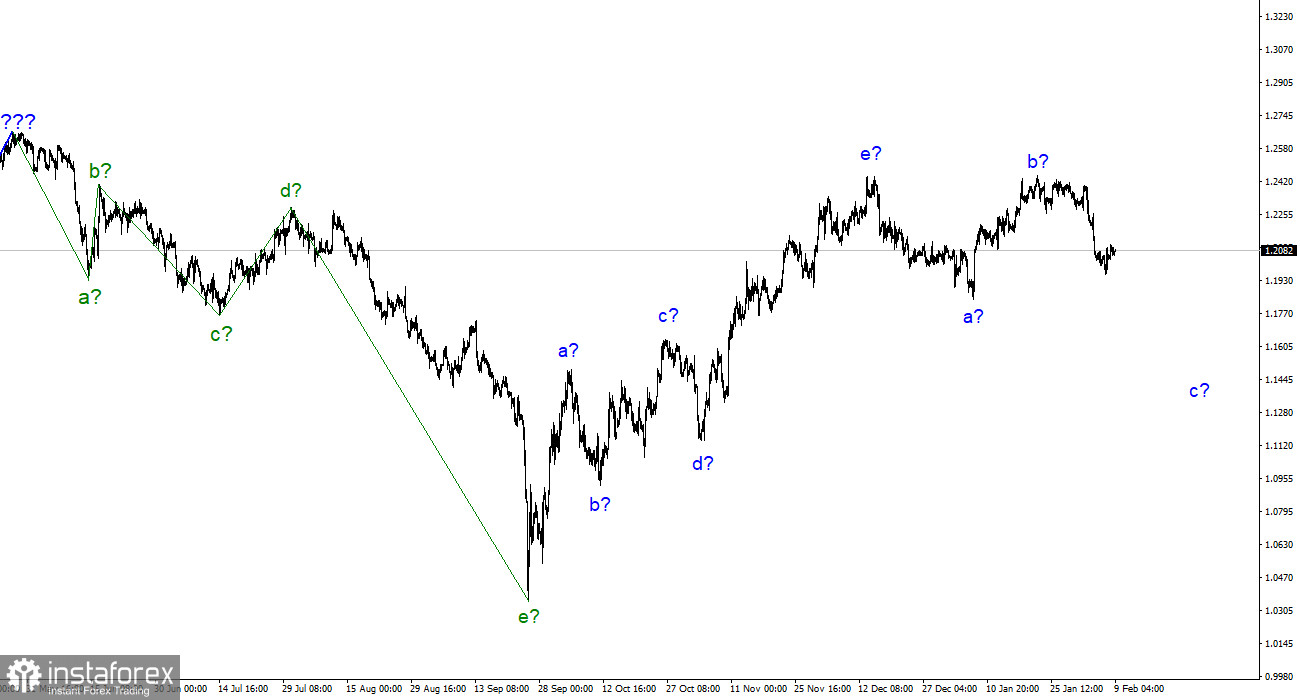

The wave analysis for the pound/dollar pair now appears very confusing but does not call for any clarifications. The wave patterns for the euro and the pound differ somewhat, but both point to a decrease. Our five-wave upward trend section has the form a-b-c-d-e and is most likely already finished. I anticipate that the downward section of the trend has started to take shape; it will at least have three waves. Wave B appeared to be unnecessarily long, but it did not cancel. As a result, last week, a wave could have started to form with a downward section of the trend, the targets of which are situated below wave a's low. The price would be at least 200–300 points less than it is at the moment. The entire downward section of the trend may even take a five-wave structure, in my opinion, and wave c may prove to be deeper than expected. But it's too early to discuss it at this time. The pair has been on the verge of restarting the development of an upward trend section for a while, and it wasn't until last week that it was able to start moving quotes away from the peaks reached with the help of the news background.

There should be less demand for the British pound.

On Wednesday, the pound/dollar exchange rate increased by 20 basis points. A corrective upward wave is not as necessary inside wave c, but there is still a weak retreat from the low that has already been reached. Since there were none inside wave a, I predict that the instrument will continue to drop without a significant upward pullback. There will be no background news today, but Friday will see the release of UK statistics, which may help the market make the appropriate choice. I continue to think that the British pound should drop another 200, 300, or 400 basis points to finish wave C and, with it, the correction phase of the trend. If the plans of market players have not changed by then, it will then be possible to discuss developing a new upward one.

According to Scotiabank analysts, the British pound must go above the area between 1.21 and 1.22 to see a new increase. The level of 1.2100, in other words. Although the pound was going below it, they also draw attention to the 1.2045 level as a point of support. I believe it is too soon to predict the development of the British pound. It is unlikely that this will come tomorrow and there is no good news background for it. The GDP report for the fourth quarter should only show a minimal increase of 0.1-0.2%. And this is the best-case scenario. The present inflation rate indicates that the Bank of England will need to maintain an aggressive, restrictive monetary policy for a considerable amount of time. The Bank of England raises interest rates frequently. Although it is yet unclear if the British regulator will be able to accomplish this mission, the rate should increase multiple times. If this is the case, there is no longer any need for the UK economy to increase. As a result, if the report is weaker than anticipated by the market, it can reduce demand for the pound, which is necessary for the current wave markup. I'm expecting the instrument to start declining again.

Conclusions in general

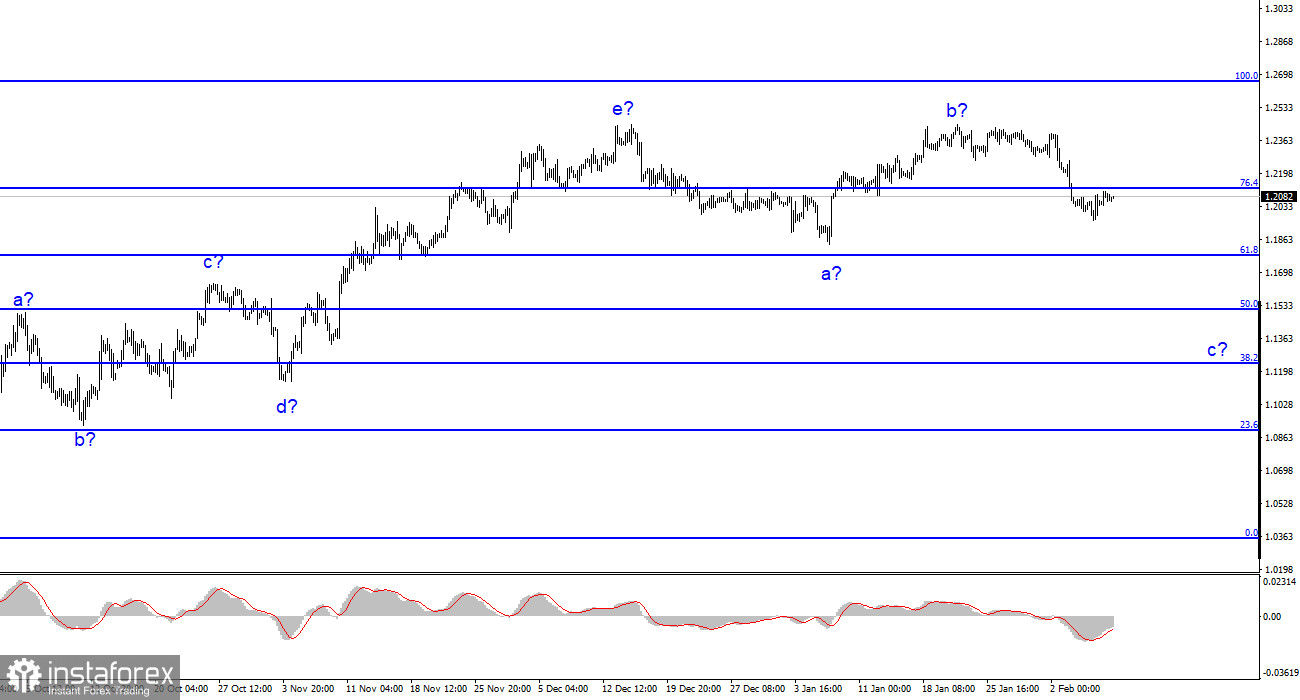

The development of a downward trend section is implied by the wave structure of the pound/dollar pair. Currently, sales with targets at the level of 1.1508, or 50.0% Fibonacci, might be taken into account. The peaks of waves e and b could be used to place a Stop Loss order. Wave C may be shorter in duration; everything now depends on the Fed and Bank of England's actions in March as well as economic data, particularly inflation data.

The image resembles that of the euro/dollar pair at higher wave scales, but there are still minor distinctions. The upward correction section of the trend has now been finished. If this presumption is true, then we must wait for the development of a downward section to continue for at least three waves with the possibility of a decrease in the area of figure 15.