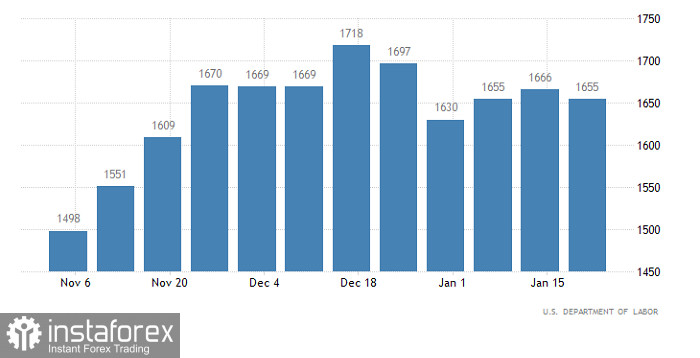

On Tuesday, Jerome Powell announced the necessity of higher interest rates amid the situation in the labor market. Traders should have priced in this information long ago. After a small pause, currency may try once again to show a local correction. The fact is that the US dollar is extremely overbought. Nevertheless, the hawkish stance of the Fed would still boost the greenback. Notably, before that, the recent market imbalances should be corrected. However, yesterday, some Fed officials repeated the main idea of Jerome Powell's speech, thus preventing a rebound. As result, the US dollar returned to its previous levels. It seems that investors have received some new information. At the moment, the US dollar has no reason to increase. Traders are searching for the factors that may spur a local bounce. Today, the US unemployment claims, which may increase by 11 thousand, could push the greenback lower. Notably, the number of first-time claims may advance by 6 thousand, whereas the number of continuing claims may rise by 5 thousand. Although the change is insignificant, it is enough to cause a decline in the greenback.

US Continuing Claims

The euro/dollar pair has been stagnant for the second day in a row. It is hovering within the range of 90 pips. This sideways movement points to the accumulation process. Once it ends, the market activity could surge.

On the four-hour chart, the RSI technical indicator is hovering in the lower area of 30/50, which points to the correctional movement. It is also necessary to compare the price changes and the indicator's movement on the smaller time frames, for example, on the one-hour chart. In this case, stagnation will be confirmed by the indicator's movement along the mid line 50. This points to the fact that signals on the four-hour chart are lagging.

On the one-hour chart, the Alligator's MAs have numerous intersections, which proves stagnation. On the four-hour and daily charts, we see a signal of the correctional movement from the high of the uptrend.

Outlook

Under the current conditions, the sideways movement is attracting speculators' attention. This may lead to an outgoing impulse, which may cause a technical signal of the end of the flat. In the event of this, the pair will start a new cycle.

In terms of the complex indicator analysis, we see that in short-term and intraday periods, indicators are signaling mixed opportunities because of the stagnation.