Fed Chairman Jerome Powell said on Tuesday that interest rates had to be raised further because of the situation in the labor market. This should have led to a further increase in dollar; however, there was no growth as the currency is heavily overbought. Movement was seen only after Fed representatives repeated the words of Powell.

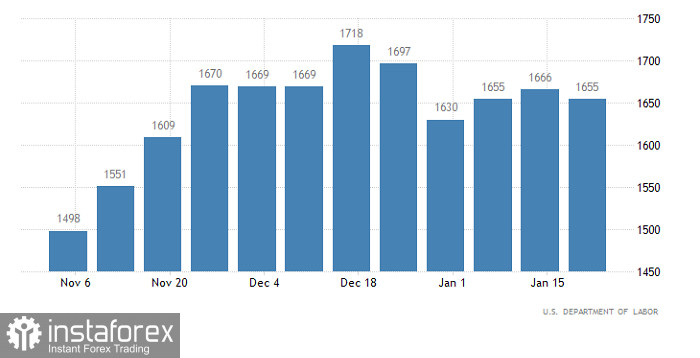

Dollar returned to where it was at the opening of the trading session, so technically, there was no price increase. Most likely, a local bounce will occur when the US releases its weekly data on jobless claims, which should grow by 11,000. Although this change is extremely insignificant, it is enough reason for market players to ramp up dollar purchases.

Jobless claims (United States):

EUR/USD is in a sideways trend, but market signals indicate that it will change soon. This means that there will be a breakout, so traders should closely monitor the behavior of the pair.

In GBP/USD, there was a rebound, but activity is not much, so it is likely that traders will see a sideways trend. Staying above 1.2100 will keep a bullish momentum, while a return below 1.2050 will jump-start a bearish trend.