The EUR/USD pair tries to build a bullish correction, but the current price dynamics look unusual. Fundamentals do not seem encouraging for bullish sentiment.

Shaky ground for growth

The latest German consumer price index reflected the slowdown in inflation in Germany, thereby, confirming the pan-European trends. This fact allows the European Central Bank to soften its rhetoric regarding further prospects for tightening monetary policy. At the same time, Fed officials continue to be hawkish: Jerome Powell, Lisa Cook and John Williams, who spoke this week, effectively denied rumors that the US central bank may end the current cycle of monetary tightening ahead of schedule.

In other words, the current fundamental picture is not conducive to the development of an uptrend. The current upward pullback of EUR/USD is more technical in nature, amid the decline in the US dollar index. Meanwhile, Thursday's economic calendar was virtually empty. The German inflation data was the only significant report of the day. According to most currency strategists, the overall decline of the U.S. currency is due to improved risk appetite in the markets. However, as a rule, such "unreasonable" price fluctuations are short-lived. Therefore, you should be cautious with long positions on EUR/USD because the price is rising on very shaky grounds.

German inflation in red

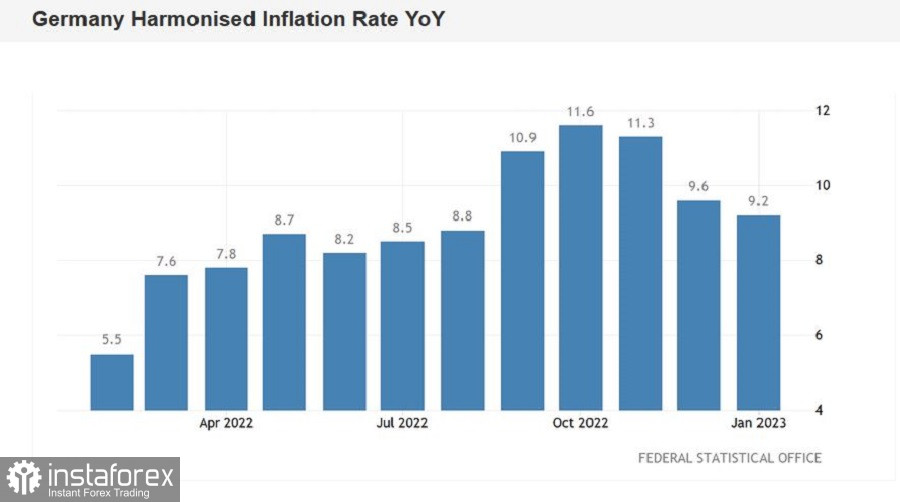

In general, the German inflation report was surprising: almost all components of the report came out in the red zone. In annual terms, the overall consumer price index continued its downtrend in January, falling to 8.7% (with a forecast of a decline to 8.9%). By comparison, the peak of 10.4% was recorded in October. But a downtrend has been recorded since November 2022. The harmonized consumer price index also showed a rather weak result, both in monthly (0.5% against the forecast of 1.2%) and annual terms (9.2% against the forecast of 10.0%).

Back in December, the German authorities paid the gas bills to the majority of German households. But it was a one-time payment, therefore, consumer energy bills rose again last month (ie, in January, the Germans again paid in full for gas supplies). This factor affected the overall CPI on a monthly basis (in January it rose by 1.0% against a growth forecast of 0.9%), while all other components of the report came out in the red zone, reflecting the slowdown in inflation in the country.

As a rule, the German report is published the day before the release of the pan-European inflation report, but this time the date had to be postponed due to problems that emerged during the change in the method of calculating the German data. At the same time, Germany accounts for about a quarter of all price data used to calculate inflation in the eurozone.

What does the German report say?

The slowdown of German inflation is another alarm bell for the bulls. Let me remind you that the consumer price index in the euro area fell to 8.5% (with the forecasted decline to 9.0%), registering a downtrend for the fourth straight month. At the same time, the core index is still at 5.2% (it peaked in December). The pan-European release was published the day before the ECB meeting in February, so it is obvious that the head of the central bank was voicing her position already taking into account the released figures. ECB President Christine Lagarde blatantly announced a 50-point rate hike in March but also questioned further steps towards a tightening of monetary policy.

The German report may strengthen the position of representatives of the "dovish wing" of the ECB.

At the same time, Fed officials continue to voice hawkish rhetoric. In particular, John Williams, head of the New York Fed, said that the U.S. labor market is "very strong," but the Fed has a lot more work to do to bring inflation down. He suggested that service prices are likely to remain elevated - and if this prediction holds true, the central bank will need higher rates. Another Fed official, Lisa Cook, said that "even though inflation has shown signs of moderation, the economy is still running too hot." She also noted the fact that the labor market is in good shape, adding that the Fed is now focused on restoring price stability.

These messages came amid Fed Chairman Jerome Powell's recent comments that inflation in the US may not slow to the target until 2024.

These hawkish signals changed market assessments on the prospects for further tightening of the monetary policy. Thus, according to the CME FedWatch Tool, the probability of a 25-point Fed rate hike in March is 93%, in May (also 25 points) - 68%, in June - 33%.

Conclusions

Fed officials are still voicing concerns about inflation, even though key inflation indicators are consistently falling. Against this backdrop, hawkish expectations about the Fed's future actions are gradually rising.

At the same time, the ECB "guaranteed" only a 50-point rate hike in March. But things are uncertain right now given the slowdown of inflation in Germany.

Thus, the current fundamental background does not contribute to the development of the uptrend: the current correctional growth is probably limited by resistance level 1.0830 (average line of the indicator Bollinger Bands on the daily chart). If the upward momentum fades, it would be better to consider short positions with 1.0680 as the target (the bottom line of the Bollinger Bands indicator on the same chart).