When to open long positions on GBP/USD:

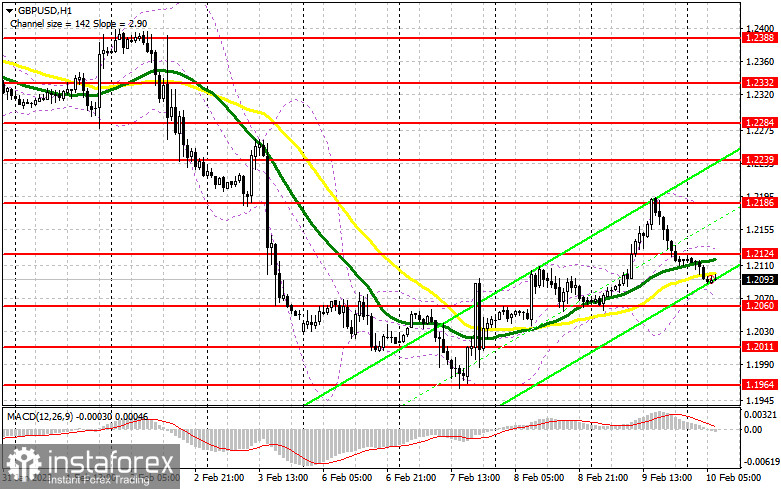

Parliamentary hearings on inflation convinced investors that the Bank of England would act aggressively only when necessary, which limited the pair's upside potential yesterday. Today, the UK will deliver its GDP data. The reading is forecast to decrease in December and show no growth in the 4th quarter. As a result, the pair could show weakness. Other reports coming out in the UK as well as the speech of a BoE MPC member will be of little interest to traders. If the pair goes down, I am going to keep an eye on the buyers only after a false breakout through 1.2060, a new support level formed yesterday. The pair may then go to 1.2124. GBP/USD may rise to the 1.2186 high only after a breakout and a downside retest of the range in the wake of upbeat macro data. In such a case, the target is seen at 1.2239 where I am going to lock in profits. If the bulls fail to protect 1.2060, the pressure on GBP/USD will increase. Therefore, long positions could be opened after a false breakout through support at 1.2011. It will also become possible to buy GBP/USD on a rebound from 1.1964, allowing a correction of 30 to 35 pips intraday.

When to open short positions on GBP/USD:

The bears may take the market under control at any time. That may happen if UK GDP comes in disappointing. However, before the fall, I'd like to see a false breakout through resistance at 1.2124. The level is in line with the bearish moving averages. GBP/USD may then plummet to 1.2060, protected by the bulls. If another BoE MPC member, namely Huw Pill, appears to be dovish, after a breakout and an upside retest of the 1.2060 mark, a sell signal will be made, targeting 1.2011. The most distant target stands at 1.1964 where I am going to lock in profits. If the price hits the target, we will see a bearish continuation. If GBP/USD goes up and there is no bullish activity at 1.2124, the bullish activity will increase. A false breakout through the 1.2186 resistance level will create a sell entry point. If there is no trading activity there as well, I am going to sell GBP/USD on a rebound from the 1.2239 high, allowing a bearish correction of 30 to 35 pips intraday.

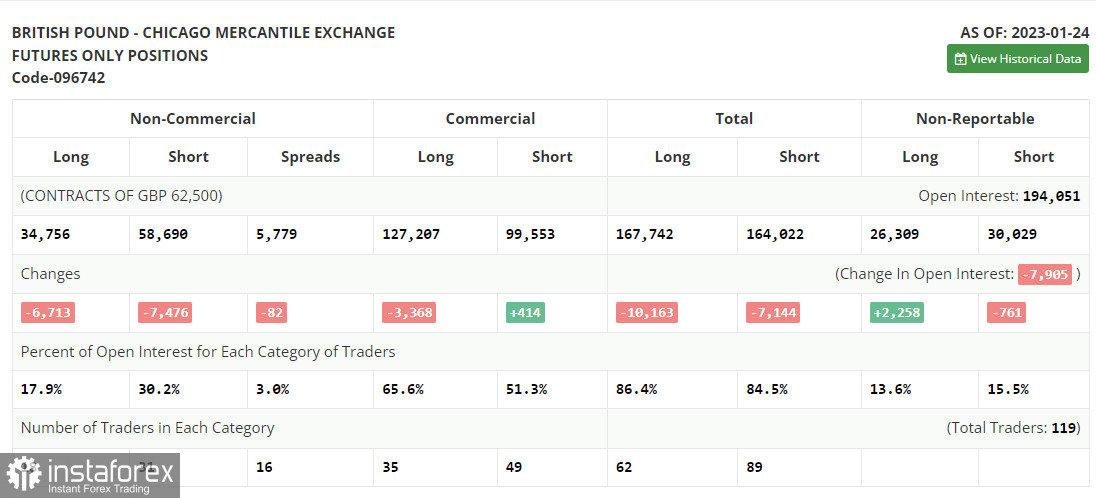

Commitments of Traders:

The COT report for January 24 logged a plunge in both long and short positions. However, this drop was within the limits, especially if taking into account the problems the UK is now facing. Its government has to deal with strikes for fair pay and fight against stubborn inflation at the same time. Nevertheless, all eyes are now on the upcoming meetings of the US Fed and the Bank of England. The American regulator is expected to adopt a less aggressive stance on monetary policy. Meanwhile, its British counterpart is likely to stay aggressive and raise the interest rate by 0.5%. In this light, the pound sterling may strengthen unless something extraordinary happens. According to the latest COT report, short non-commercial positions decreased by 7,476 to 58,690, and long non-commercial positions fell by 6,713 to 34,756. As a result, the non-commercial net position came in at -23,934 versus -24,697 a week ago. These are insignificant changes. Therefore, they are unlikely to affect market sentiment. That is why it is important to monitor macroeconomic reports in the UK and the BoE's rate decisions. The weekly closing price rose to 1.2350 from 1.2290.

Indicator signals:

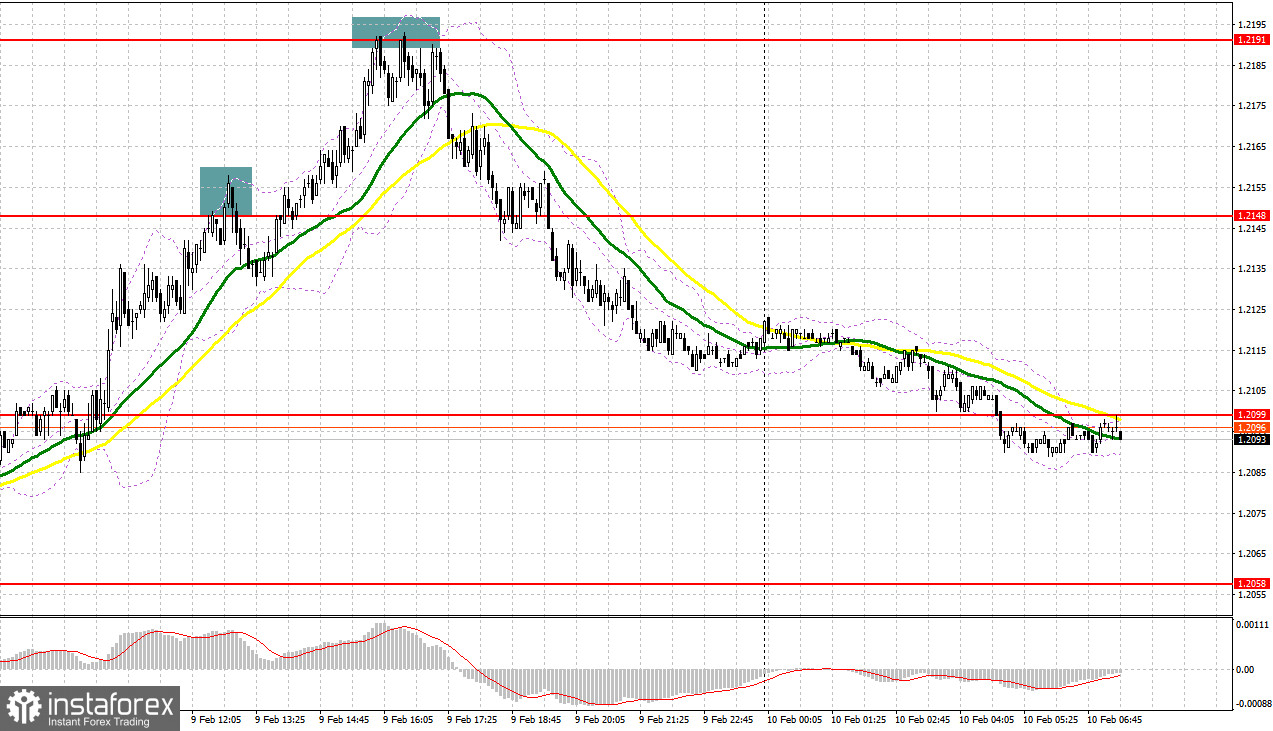

Moving averages

Trading is carried out below the 30-day and 50-day moving averages, indicating the bears' attempt to build a downward correction.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Resistance is seen at 1.2186, in line with the upper band. Support stands at 1.2060, in line with the lower band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.