Markets were so shaken up by the results of the Federal Reserve and European Central Bank meetings, as well as the US employment data for January, that they could not come to their senses for the entire week. A 25bp increase in the Fed Funds rate, a 50bp increase in the deposit rate, and speeches from central bankers were treated as dovish events, which sent stocks soaring. However, the harsh reality brought them back down to earth. The fall of the global risk appetite makes EURUSD feel out of place.

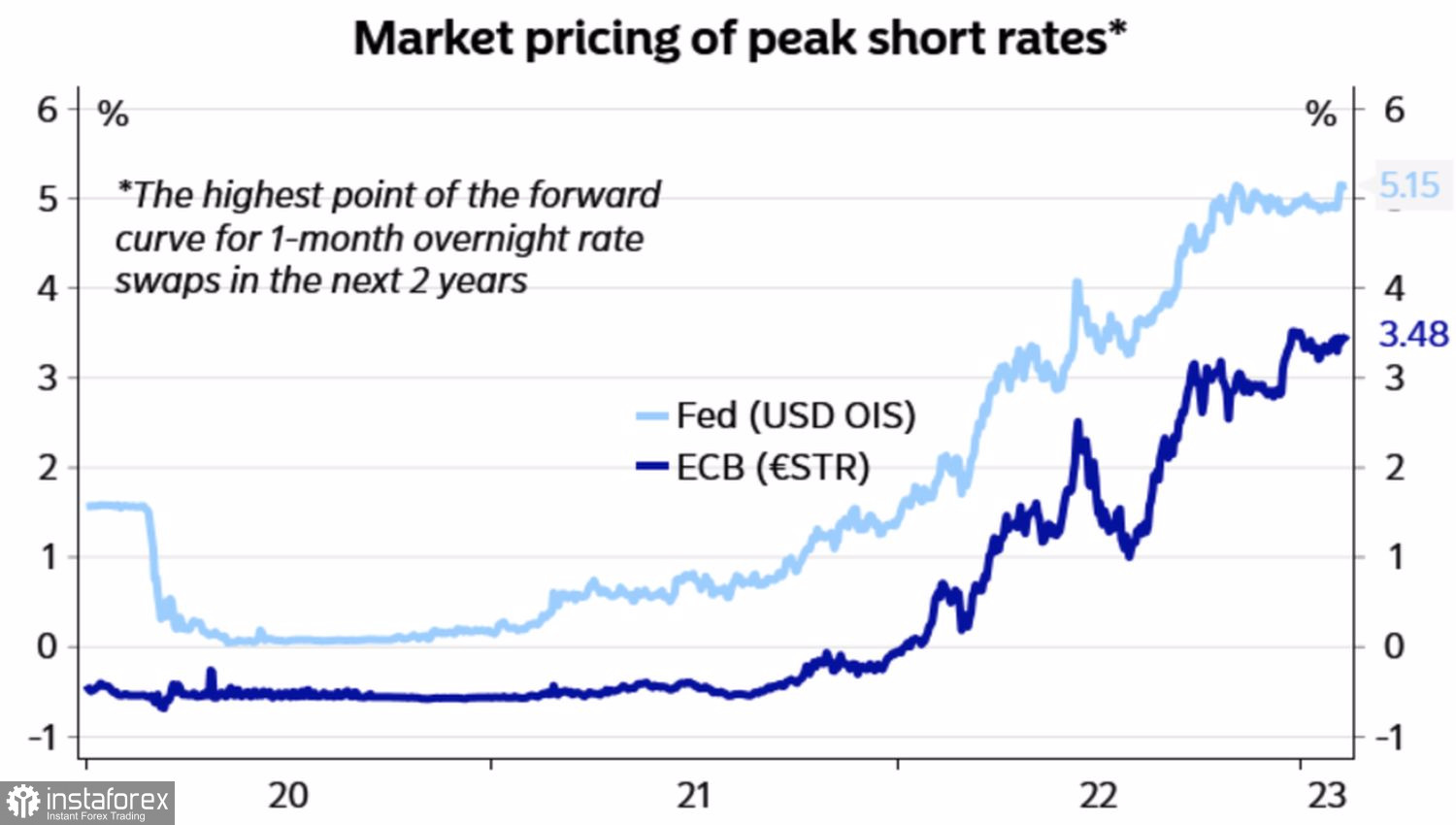

If we treat the US employment report with a certain degree of skepticism, referring to the fact that the data traditionally has a lot of noise in January, then in fact nothing has changed. Yes, the markets expect the rate to rise to 5.1% instead of 4.9%. But the ECB will still move faster. It intends to raise the cost of borrowing by 100 bps.

The evolution of the Fed's and ECB's expected rate ceilings

FOMC officials say they will likely have to do more than expected, but the rhetoric of their ECB counterparts is no less hawkish. On the contrary, statements that borrowing costs will rise by 50 bps not only in March but also in May look very aggressive. The eurozone is still looking good, China is opening, so why wouldn't EURUSD go back to rallying? Citigroup thinks it will. If the Fed does not raise the rate to 6%, the euro will rise to 1.14-1.15 within a few months, so the current pullback provides a great opportunity for long positions.

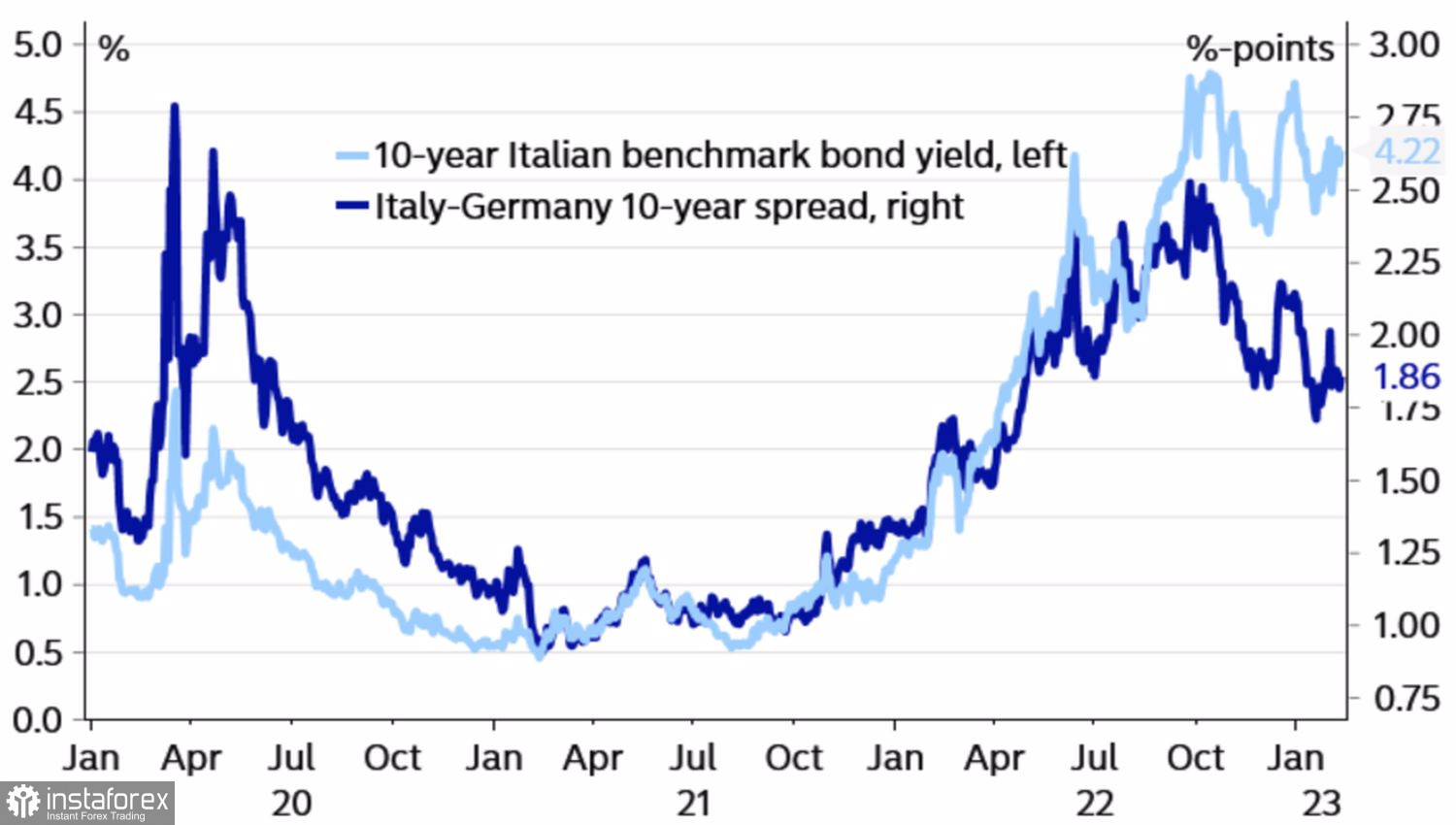

However, in my opinion, we should not forget that the regional currency has its vulnerabilities. In particular, it is still unclear if the eurozone economy can withstand the cycle of aggressive monetary tightening by the ECB. Won't problematic countries, in terms of debt burden, have problems? Won't the spreads between Italian and German bond yields widen, eventually forcing the ECB to switch from being decisive to cautious.

Dynamics of the differential between Italian and German bond yields

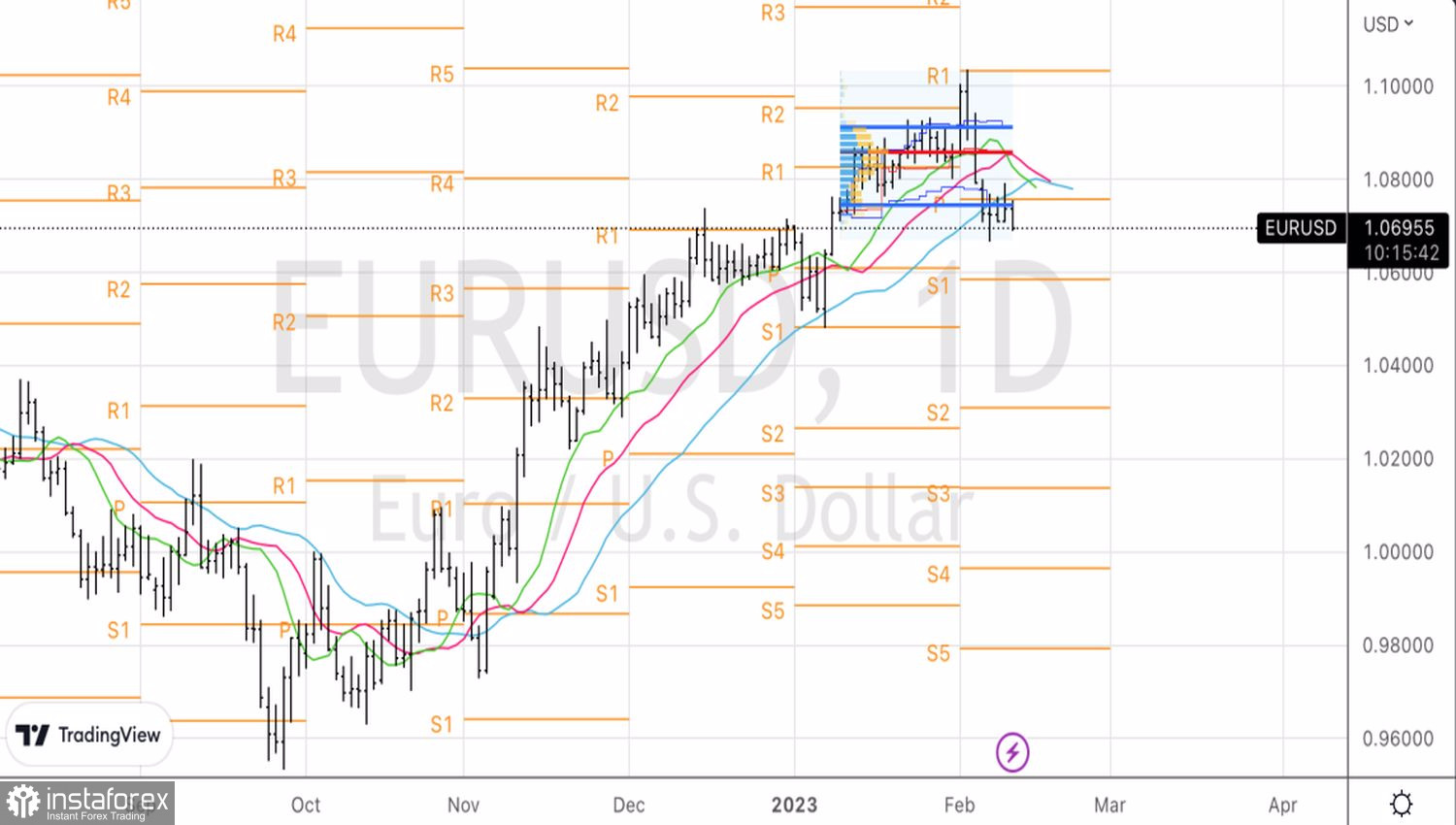

A strong jobs report and hawkish rhetoric from FOMC members, which is now being listened to rather than ignored, has returned investors' interest in the US dollar. The U.S. dollar no longer looks like a whipping boy as it did in October and January. I don't think it will be easy for the EURUSD pair to return to a rally. Most likely, we are looking forward to a long consolidation. And in such conditions the most important thing is to define its borders correctly. The U.S. inflation report for January will surely provide a clue. For now the pair is stagnant.

Technically, the bulls' inability to return to the limits of the fair value range of 1.075-1.091 and to rise above the blue moving average indicates their weakness. Formed on the previous recommendations from 1.0745 it makes sense to increase short positions. At the same time, falling below 1.067 will strengthen the risks of hitting 1.06.