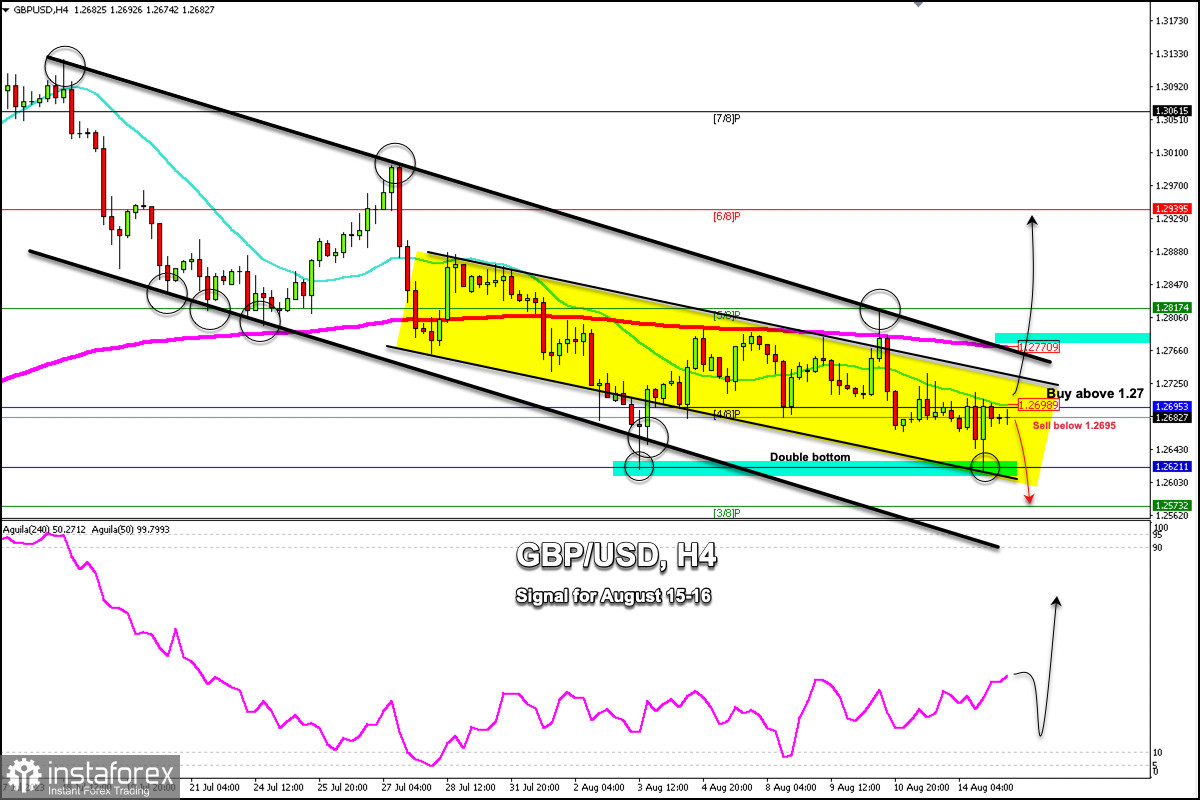

GBP/USD fell during the European session on Monday to as low as 1.2615. On the H4 chart, we see a recovery from the weekly lows and the instrument is now facing the resistance of the 21 SMA located at 1.2698.

Technically, we can see that the British pound formed a double bottom pattern around 1.2615. GBP/USD is expected to consolidate above the 4/8 Murray located at 1.2695.

If this scenario happens, then we could expect a bullish acceleration and the price could reach 1.2770. Above this level, we could expect GBP/USD to reach 6/8 Murray at 1.2939 and finally, the psychological level of 1.30.

On the other hand, strong support is located around 1.2615. As long as GBP/USD remains above this level, we could expect the British pound to recover. The key is to watch that it continues to trade and consolidates above 1.2770.

Investors are waiting for the data on the UK labor market and inflation data to be released in the coming days. These data could generate a strong movement in the GBP/USD pair and a break of the bearish channel is expected for a probable recovery.

On the contrary, in case the British pound falls below 4/8 Murray located at 1.2695, we expect a bearish movement and GBP/USD could reach 3/8 Murray located at 1.2573 and could even reach the bottom of the downtrend channel and the psychological level of 1.25.

In the next few hours, we expect the British pound to break the 1.2695 level. If so, it will be seen as a signal to buy with targets at 1.2770 and 1.2817. The Eagle indicator is giving a positive signal. However, any retracement will be seen as a signal to buy.