The first days of February were on the dollar's side. Thanks to the strong Nonfarm, the dollar strengthened its position throughout the market, even against the euro. However, in the last few days, the downtrend clearly stalled for the EUR/USD pair: bears had to work really hard to gain points while the bulls regularly carried out counterattacks. As a result, the price is stuck in the 1.0650-1.0800 range, despite the dollar's dominant position.

To develop the downtrend, the bears need to go down to the base of the 6th figure, breaking the support level of 1.0650 (bottom line of the Bollinger Bands indicator on the D1 chart), while the bulls should at least climb above the target of 1.0760 (Kijun-sen line on the same chart) to open the way to the 8th figure area. The key news, which will be released this week, will trigger higher volatility in the pair. The only question is in whose favor this volatility will be.

Inflation in the U.S. will be in the spotlight

U.S. inflation will signify the week ahead. There will be three macroeconomic data to illustrate the dynamics of the inflationary process in America. In light of recent events, they could be crucial for the greenback, making it stronger or weaker across the board.

Let me remind you that the starting point of the dollar rally was the January Nonfarm payrolls, according to which more than half a million jobs were created in the U.S. last month. Almost all components of the report (except the payrolls) came out in the green zone, allowing Federal Reserve officials to tighten their rhetoric regarding further action on inflation. For instance, John Williams, one of the Fed's most influential officials, said last week that the U.S. labor market is in great shape, and this fact allows the central bank "to keep working on raising the rate" in order to lower inflation and restore price stability. Lisa Cook, a member of the Fed Board of Governors, came out with a similar message.

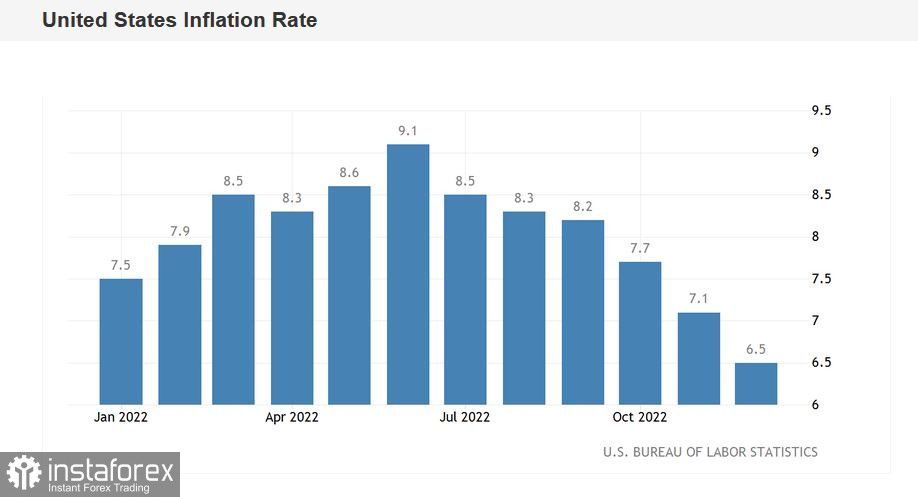

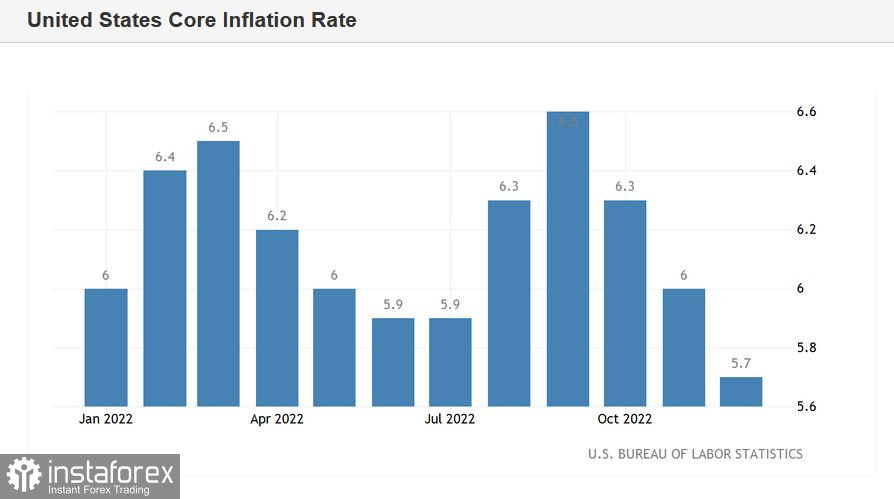

For his part, Fed Chairman Jerome Powell also recently complained that the Consumer Price Index (CPI) is declining at a rather slow pace. According to him, the inflation rate in the U.S. will slow down to the target level next year. In this context, he stated the need to keep raising the rate.

Remember that the markets are pricing in a nearly 100% chance the Fed raises its benchmark interest rate by 25 basis points at the March meeting. This fact is already taken into account in prices and already "won back" by traders. But further perspectives of monetary tightening are under question. For example, according to the CME FedWatch Tool, there is a 74% chance of a 25 bps rate hike in May, while 38% think that there will be another similar rate hike in June.

If the key inflation reports of the coming week come out in the green zone, hawkish expectations regarding the possible outcomes of the May and June meetings will increase significantly. This fact will provide significant support for the dollar.

CPI, PPI, import price index

There will be several important inflation reports in the U.S. this coming week. The most important one is the CPI, which will be released on Tuesday, February 14. According to preliminary forecasts, both the CPI and core CPI will reflect a slowdown in inflation in January. Thus, according to most experts, the CPI will come out at 6.2%. In this case, the indicator will demonstrate a downtrend for the seventh (!) straight month. However, in monthly terms the indicator may come out of the negative area, having risen to the mark of 0.5%. The market will pay special attention to the basic index, excluding food and energy prices. Here, too, the indicator is expected to fall - both in annual and monthly terms. In particular, in annual terms, the core CPI should reach 5.5%. In this case, a four-month consecutive decline will be recorded. Renewed growth in the core index will strengthen the greenback's position across the market.

The Producer Price Index (PPI) report will also be released on Thursday, February 16. This indicator may signal a change in inflationary trends. According to most experts, the PPI will fall to 5.4% y/y (down 7 months in a row) and the core index will fall to 4.9% (a consistent decline over the past 10 months). But then again, if this PPI comes out in the green, the dollar will get extra support.

Another inflation report is the import price index (Friday, February 17). And while this report is secondary, it may add to the fundamental picture. Moreover, analysts are predicting a sharp y/y decline to 1.8% after December's increase to 3.5%.

Conclusions

The aforementioned inflation reports could have a strong impact on the dollar, especially if they end up in the green zone, i.e. if the rate of decline in U.S. inflation slows down.

Amid strong Nonfarm, this will mean that the Fed will continue to raise rates quietly until at least mid-summer. This fundamental backdrop will allow the greenback to strengthen its position across the market. Bears will benefit from this situation: they can reach 1.0580 (upper limit of the Kumo cloud on the daily chart), and in the future, to the base of the 5th figure.