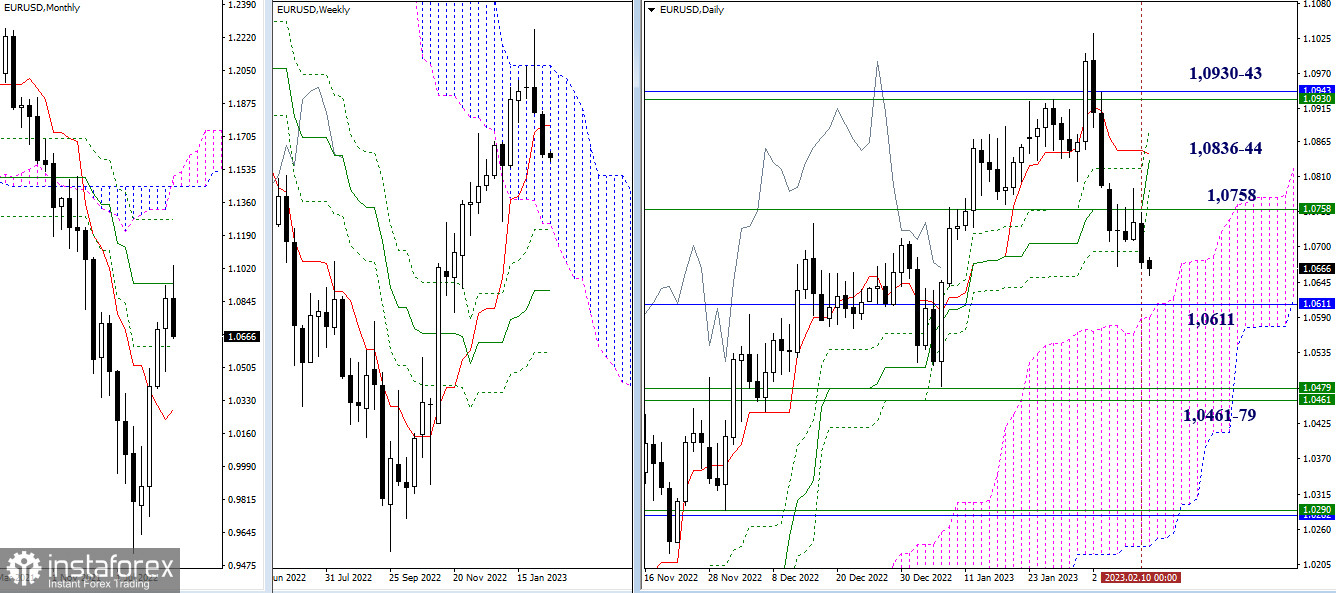

EUR/USD

Higher time frames

Last week ended with a bearish bias which was initiated by a rebound from the upper boundary of the weekly Ichimoku Cloud. The next downward target is found in the range between 1.0590 and 1.0611 (upper boundary of the daily Ichimoku Cloud + monthly level) and the levels of 1.0461-79 (lower boundary of the weekly Ichimoku Cloud + weekly Fibo Kijun). If bulls seize control over the market today, their main goal will be to overcome the levels that now act as resistance at 1.0758 (weekly short-term trend) – 1.0836-44 (daily cross) – 1.0930-43 (upper boundary of the weekly Ichimoku Cloud + monthly short-term trend).

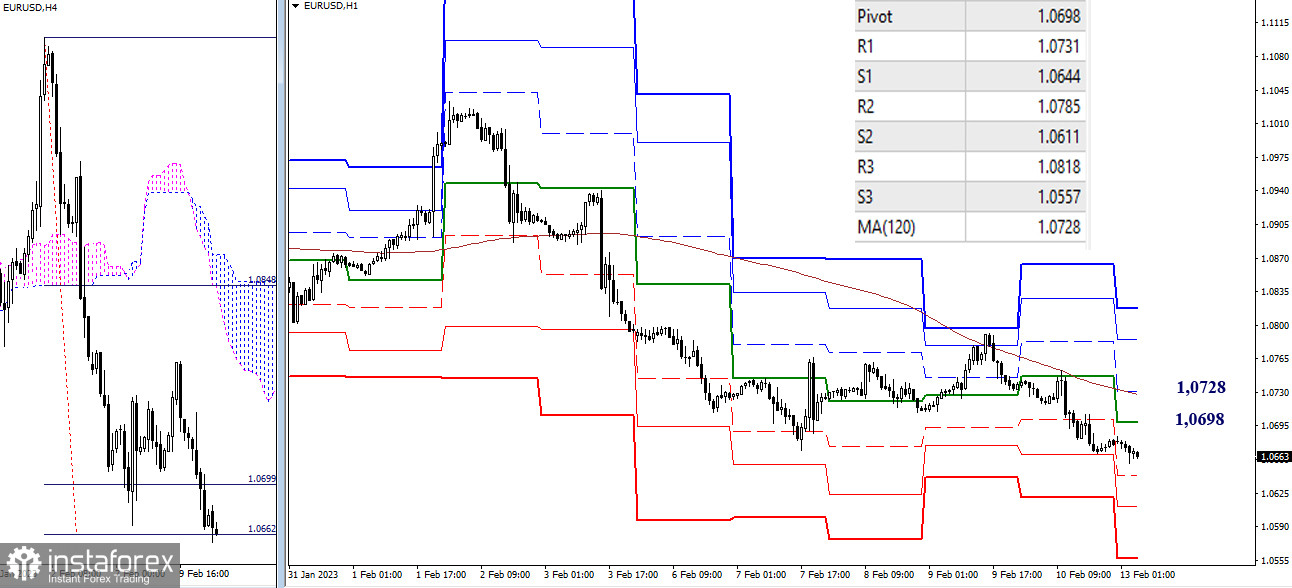

H4 – H1

In the meantime, bears prevail on lower time frames. Today, they have fully tested the breakout target of the H4 cloud at 1.0662. The price may stay in the range for some time. If the sellers manage to break below the target on H4, they will head for the support formed by the standard daily pivot levels of 1.0644 – 1.0611 – 1.0557. In case an upward correction starts, bulls will face the key levels on lower time frames. Their successful attempts to overcome these levels may change the market balance. Today, the key levels are found at 1.0698 (central daily pivot level) and 1.0728 (weekly long-term trend). A firm hold above this range and a reversal of the moving average will affect the market balance, creating conditions for stronger bullish sentiment. The levels of 1.0785 and 1.0818 serve as daily upward targets (standard daily pivot levels).

***

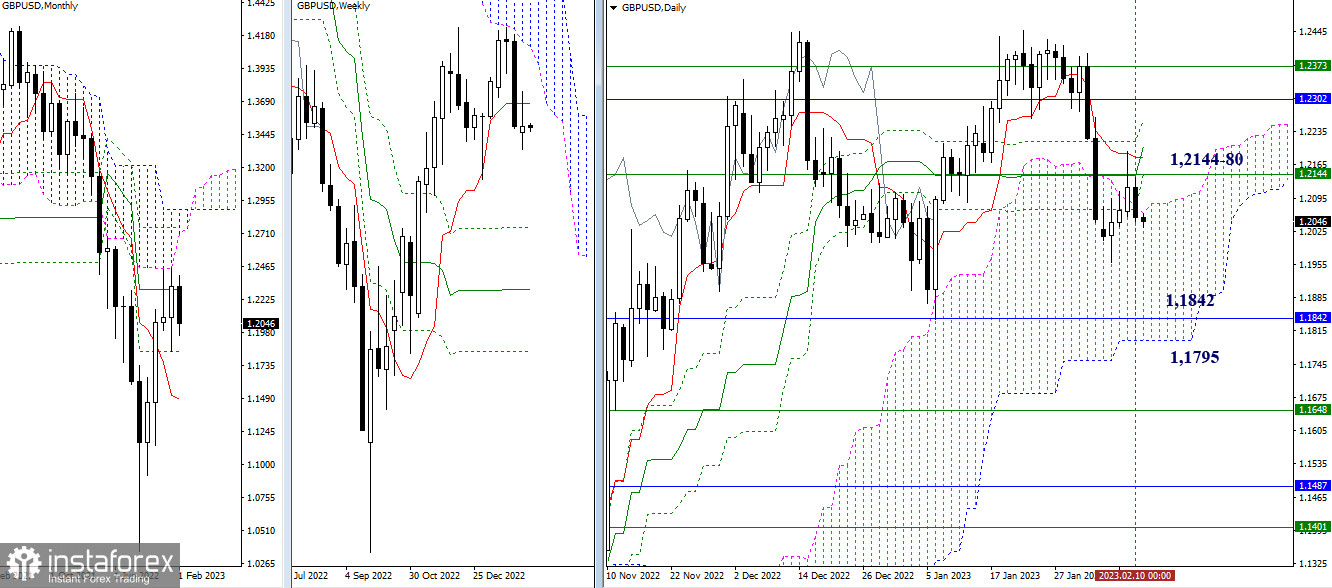

GBP/USD

Higher time frames

The candlestick formed last week looks rather uncertain. Bears failed to outperform their rivals who retested the broken levels. If the sellers manage to retest the low of 1.1960 this week and extend the decline, their main target will lie in the support area of 1.1842 – 1.1795 (monthly level + lower boundary of the daily Ichimoku Cloud). If the buyers maintain control of the situation and manage to bring the pair back to the already tested resistance area of 1.2144 – 1.2180 – 1.2203, the pair may get stuck in the consolidation phase. Bulls may also increase their presence in the market.

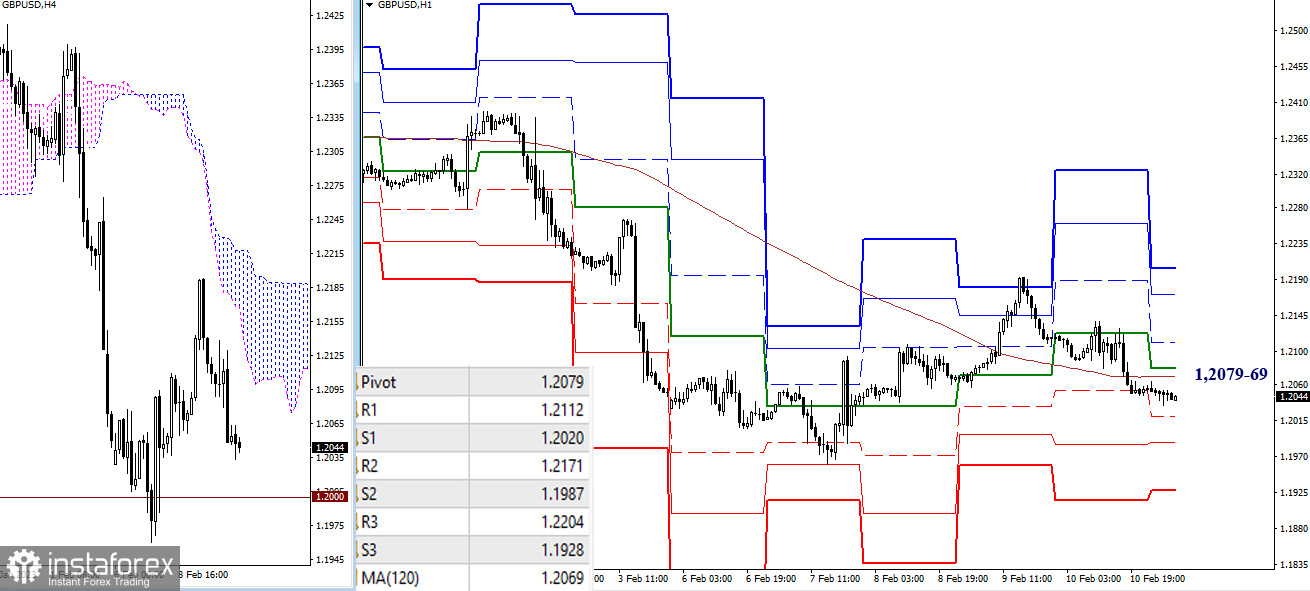

H4 – H1

On lower time frames, bears have seized control of the pair but failed to meet the following conditions to preserve their dominance. So their goals for today remain the same. To develop a deeper decline, the sellers need to break below the psychological level of 1.2000 and pass the low of 1.1960. As for the bulls, their main task is to regain control of the 1.2069-79 area (central daily pivot level + weekly long-term trend). In case of a continued uptrend, the main focus should be on the intraday resistance area of 1.2112 – 1.2171 – 1.2204.

***

Technical analysis is based on:

Higher time frames – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower time frames – H1: Pivot Points (standard) + 120-day Moving Average (weekly long-term trend)