At the beginning of the previous week, Fed Chair Jerome Powell said that there was a need for more rate hikes. Meanwhile, ECB member Isabel Schnabel gave vague answers to questions about interest rates in an interview on Friday. Thus, we can see how the stance of the two regulators differs. That adds more pressure on the euro. At the same time, a predictable ECB is what investors need right now. Above all else, the market believes that the European regulator will be the first to cut rates this year. Therefore, the greenback goes up in price. Nevertheless, the dollar is significantly overbought. So, a correction in the market is needed. Given that the macroeconomic calendar is empty today, now is the perfect time for it. However, taking into account the rhetoric of the central banks, technical factors might not be enough for triggering a correction. Without macro statistics, the market will simply consolidate near the current levels.

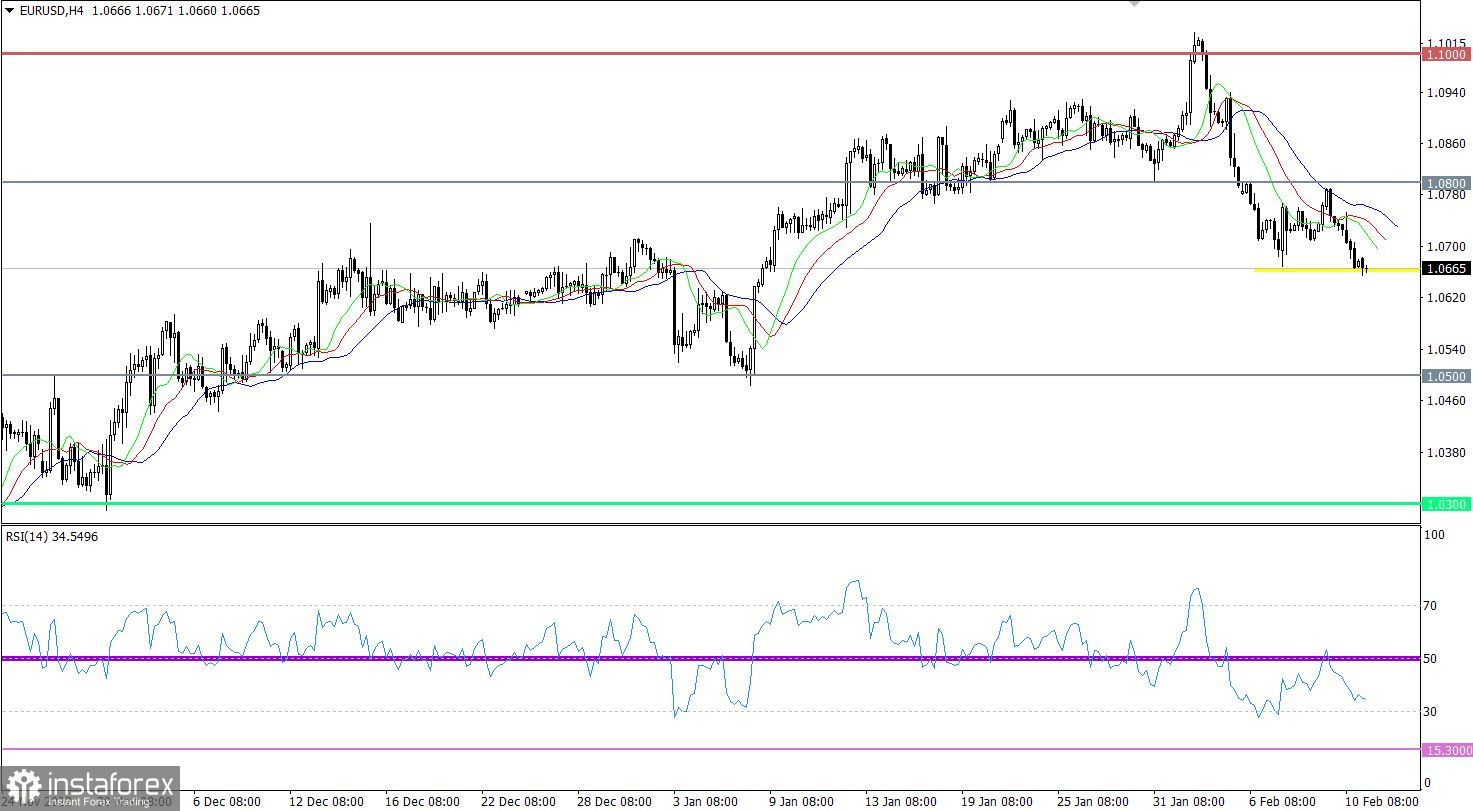

Moving down, EUR/USD hit a new low, and the corrective move went on from the high of the medium-term trend.

The RSI technical indicator is moving down between lines 30 and 50 in the 4-hour time frame, which indicates a corrective move. In the daily time frame, the RSI is near the levels of October last year, which reflects strong bearish sentiment in the market.

The Alligator's moving averages (MA) are headed down in the 1-hour, 4-hour, and daily time frames, signaling a corrective move from the high of the upward cycle.

Outlook

At this point, consolidation below 1.0650 in the 4-hour time frame at least could cause an increase in selling volumes, which in turn could prolong the corrective move.

Alternatively, if the downtrend cycle slows, the price may retrace and come to a standstill.

Based on complex indicator analysis, there is a sell signal for short-term and medium-term trading due to a correction continuation.