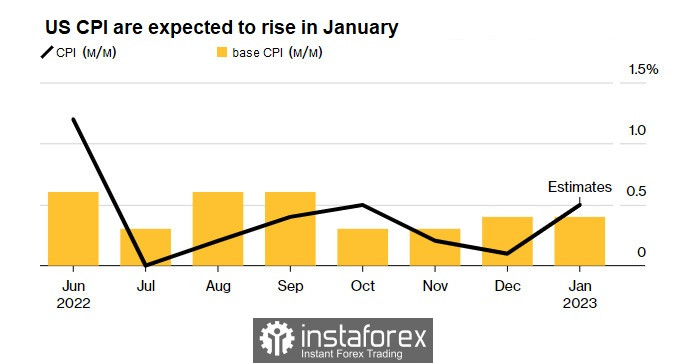

Dollar is likely to resume its upward spiral after the US releases its latest data on prices. The expected growth rate will certainly cause discomfort not only on consumers, but also on the Federal Reserve, which is looking to make more progress on inflation. Although the yearly rate is sure to slow, January's index is forecast to rise by 0.5% partly due to higher petrol prices. This will be the biggest increase in three months. As for core inflation, which better reflects the real picture, a rise of 0.4% is expected.

All this is in line with the Fed's view that although inflation is slowing from its four-decade high, further interest rate hikes will be needed to ensure that price pressures are extinguished. Officials will also keep an eye on rising costs of basic services to gauge the impact of the still-tight labor market on inflation.

Actually, it was the labor market that sparked the heated debate last week about the need for further rate hikes as the supply-demand imbalance is still quite high. That strengthened dollar by the end of the week.

In terms of estimates compared to last year, the underlying consumer price index is expected to rise by 5.5%, which would be the smallest yearly increase since the end of 2021. The central bank target is 2%, so there is still a long way to go.

The constant price pressure explains why many Americans are unhappy with their personal finances. According to a recent Gallup poll, 50% of respondents describe their personal financial situation as worse than a year ago.

However, there is good news for consumers and Fed Chairman Jerome Powell as prices for major categories of goods have fallen in each of the last three months of 2022. "We expect the monthly change in the consumer price index in January to cushion the three-month trend of disinflation. Rising gasoline prices, slowing commodity inflation and a still-steady rise in services prices should boost all indices. This should increase expectations that the Fed will have to raise rates further - to a higher maximum than the current price levels implied," Morgan Stanley said.

Among the upcoming US economic reports this week are the retail sales and industrial production data for January. Figures showing a healthy rise in car purchases will boost overall retail sales, indicating robust consumer spending.

The presidents of the Fed's regional banks will also speak this week. Statements are expected from Laurie Logan, Patrick Harker, John Williams, James Bullard, Loretta Mester and Thomas Barkin.

Talking about the forex market, pressure in EUR/USD remains high, so to stop the bear market, buyers need to show themselves above 1.0650 as that will spur a rise to 1.0690, 1.0720 and 1.0760. If they fail, the quote will fall further to 1.0600 and 1.0565.

In GBP/USD, the bulls have practically lost all the advantage they had at the end of last week, so to regain control, they need to climb above 1.2070. Only the breakdown of this resistance will prompt a rise to 1.2130 and 1.2180. But if the bears gain control of 1.2015, the pair will go back to 1.1960.